|

|

|

|

|||||

|

|

Financial technology provider Broadridge (NYSE:BR) announced better-than-expected revenue in Q3 CY2025, with sales up 11.7% year on year to $1.59 billion. On top of that, next quarter’s revenue guidance ($1.68 billion at the midpoint) was surprisingly good and 4.4% above what analysts were expecting. Its non-GAAP profit of $1.51 per share was 21.2% above analysts’ consensus estimates.

Is now the time to buy Broadridge? Find out by accessing our full research report, it’s free for active Edge members.

Processing over $10 trillion in equity and fixed income trades daily and managing proxy voting for over 800 million equity positions, Broadridge Financial Solutions (NYSE:BR) provides technology-driven solutions that power investing, governance, and communications for banks, broker-dealers, asset managers, and public companies.

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years.

With $7.06 billion in revenue over the past 12 months, Broadridge is one of the larger companies in the business services industry and benefits from a well-known brand that influences purchasing decisions.

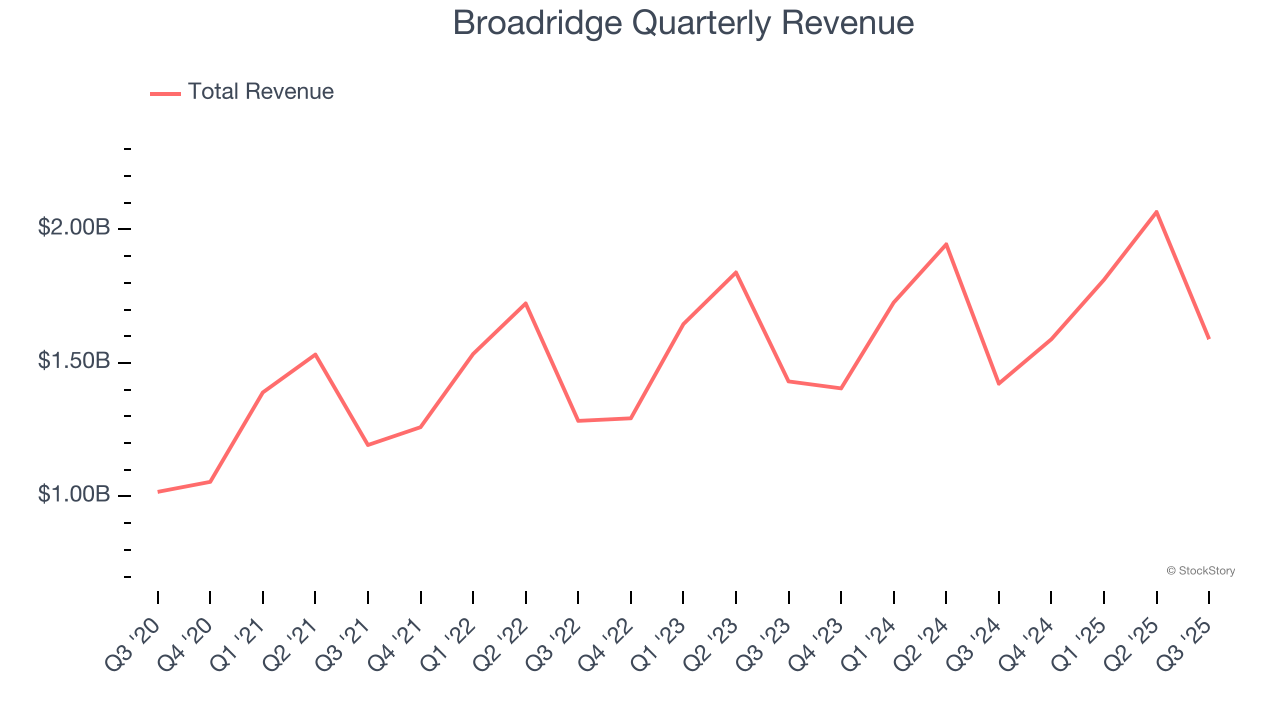

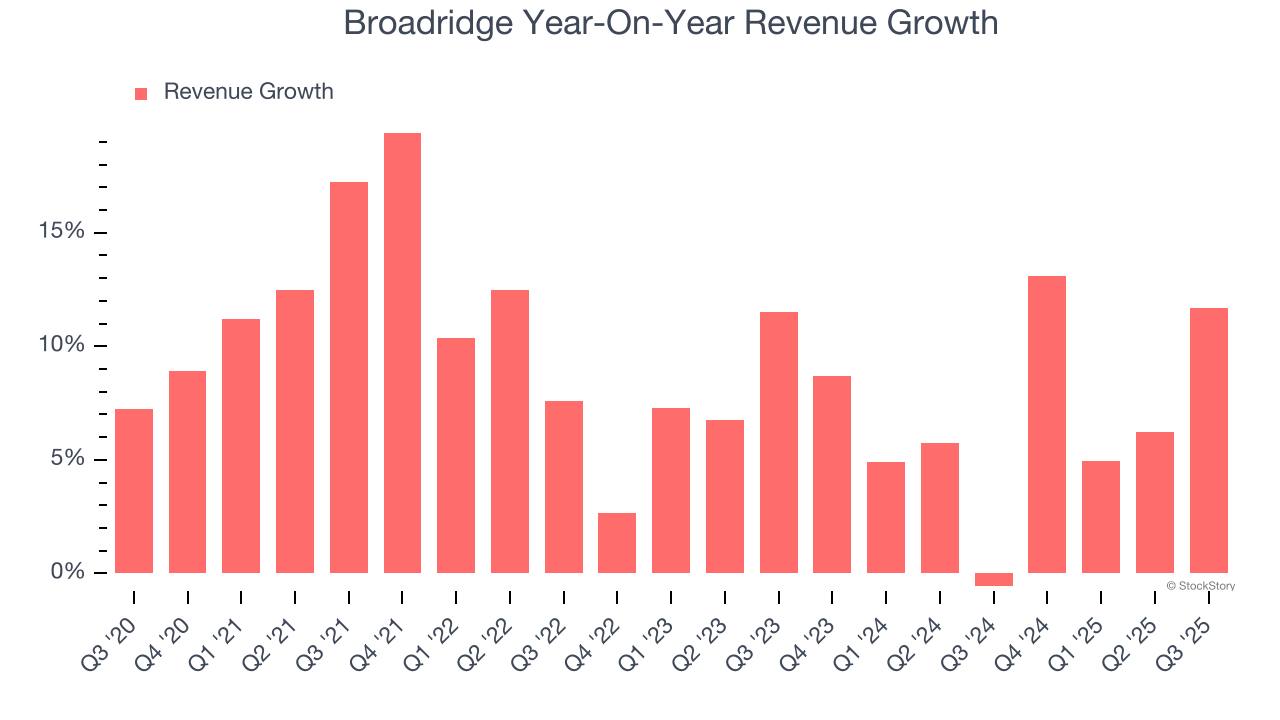

As you can see below, Broadridge’s 8.9% annualized revenue growth over the last five years was solid. This is an encouraging starting point for our analysis because it shows Broadridge’s demand was higher than many business services companies.

Long-term growth is the most important, but within business services, a half-decade historical view may miss new innovations or demand cycles. Broadridge’s annualized revenue growth of 6.6% over the last two years is below its five-year trend, but we still think the results were respectable.

This quarter, Broadridge reported year-on-year revenue growth of 11.7%, and its $1.59 billion of revenue exceeded Wall Street’s estimates by 3.4%. Company management is currently guiding for a 6% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 3.5% over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and suggests its products and services will see some demand headwinds. At least the company is tracking well in other measures of financial health.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Broadridge has been an efficient company over the last five years. It was one of the more profitable businesses in the business services sector, boasting an average operating margin of 15.3%.

Looking at the trend in its profitability, Broadridge’s operating margin rose by 4 percentage points over the last five years, as its sales growth gave it operating leverage.

This quarter, Broadridge generated an operating margin profit margin of 11.9%, up 2.4 percentage points year on year. This increase was a welcome development and shows it was more efficient.

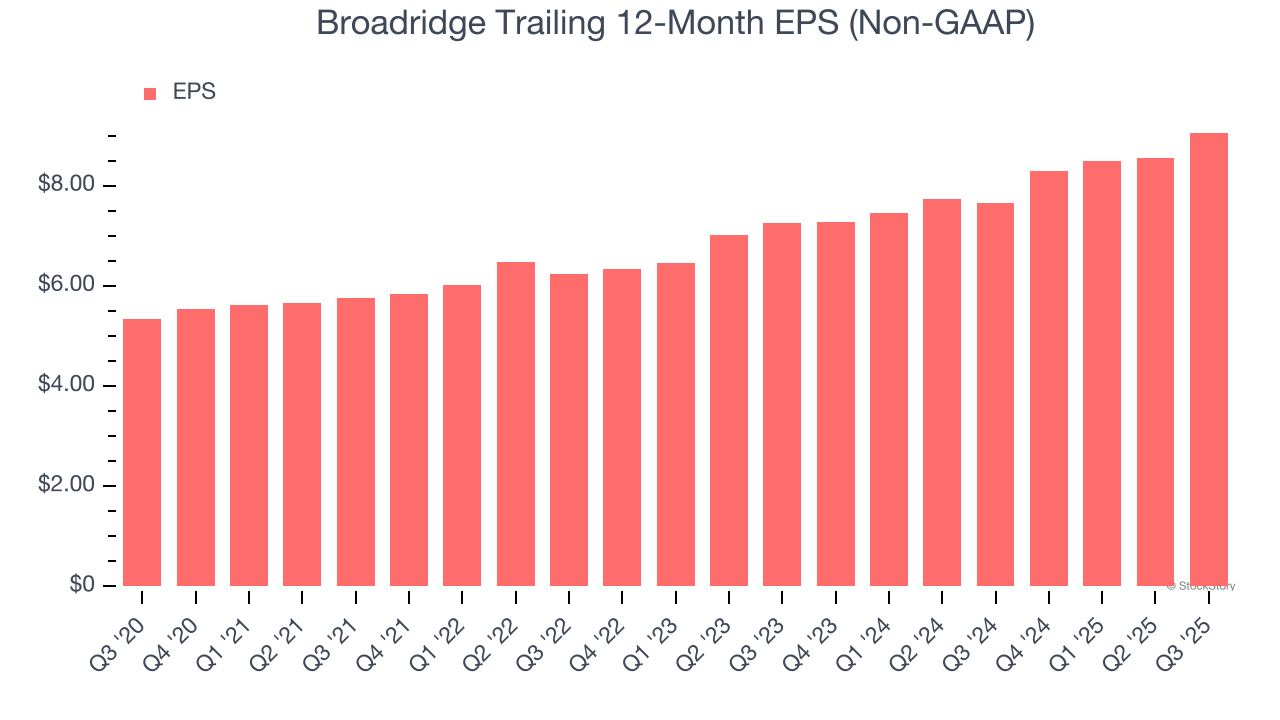

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Broadridge’s EPS grew at a remarkable 11.2% compounded annual growth rate over the last five years, higher than its 8.9% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

We can take a deeper look into Broadridge’s earnings quality to better understand the drivers of its performance. As we mentioned earlier, Broadridge’s operating margin expanded by 4 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its higher earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Broadridge, its two-year annual EPS growth of 11.7% is similar to its five-year trend, implying stable earnings power.

In Q3, Broadridge reported adjusted EPS of $1.51, up from $1 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Broadridge’s full-year EPS of $9.06 to grow 4.6%.

It was good to see Broadridge beat analysts’ EPS expectations this quarter. We were also glad its revenue guidance for next quarter trumped Wall Street’s estimates. Zooming out, we think this was a good print with some key areas of upside. The stock remained flat at $221.18 immediately following the results.

Big picture, is Broadridge a buy here and now? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.

| Mar-10 | |

| Mar-09 | |

| Mar-06 | |

| Mar-06 | |

| Mar-05 | |

| Mar-05 | |

| Mar-05 | |

| Mar-04 | |

| Mar-04 | |

| Mar-04 | |

| Feb-27 | |

| Feb-26 | |

| Feb-25 | |

| Feb-24 | |

| Feb-23 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about Finviz Elite