|

|

|

|

|||||

|

|

Subscribers to Chart of the Week received this commentary on Sunday, November 2.

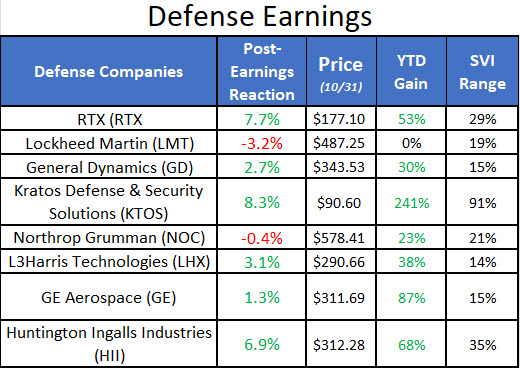

We’re more than halfway through earnings season, yet there’s only one sector out there that’s wrapped up its quarterly reports. Large cap defense contractors have stepped in and out of the earnings confessional, and the results – and long-term conclusions -- are worth unpacking.

Remember the two B’s when talking defense stocks: backlogs and budget. Backlogs signal future revenue potential and long-term stability. Think of it like knowing you have your best players locked up on long-term contracts, the excitement about the team increases, right? All of these companies reported backlogs at or near record-high levels.

Budgets matter and are as apolitical as they come. The total US national defense budget for fiscal year (FY) 2024 was $874 billion. The proposed budget for FY 2026 is over $1 trillion, with the Department of Defense requesting $1.01 trillion. There’s plenty of money to go around.

Unfortunately, it’s a good time to be a defense contractor. You’ve got the Russia-Ukraine conflict slogging on, a shaky ceasefire with Israel and Hamas, persistently icy tensions between China and Taiwan, and a Trump administration content with missile strikes on Venezuelan boats.

It’s no surprise that every name on this table below reported an earnings beat, and all of the War 4 RTX Corp (NYSE:RTX), Lockheed Martin Corp (NYSE:LMT), Northrop Grumman Corp (NYSE:NOC), General Dynamics Corp(NYSE:GD) hiked their full-year outlooks.

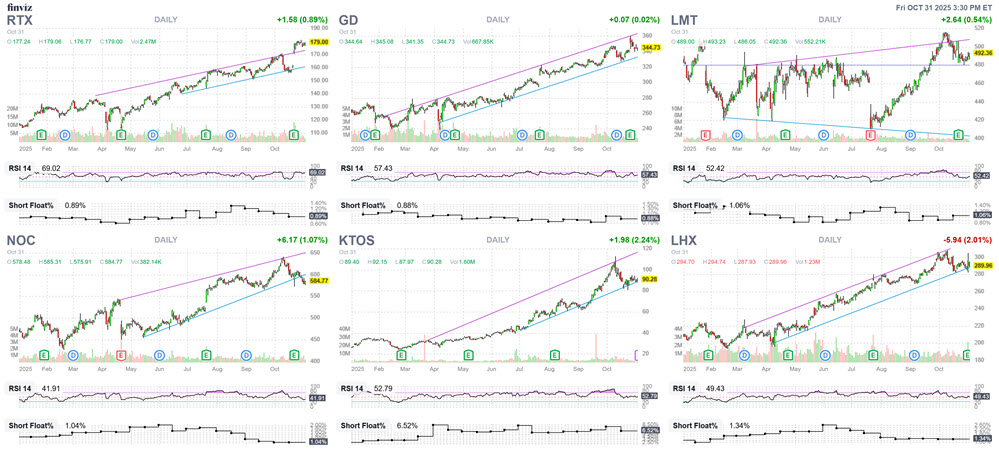

Blue chip LMT battling its year-to-date breakeven is interesting, especially as the rest of the sector soars. It’s also interesting that 14 of the 22 brokerages covering the stock maintain “hold” or worse ratings. With the U.S. Golden Dome project looming in 2026, will analysts suddenly change their tune?

Fellow Dow name RTX is consolidating below record highs, a move that’s resulted in new highs in the past.

GD, L3Harris Technologies Inc (NYSE:LHX), and Kratos Defense and Security Solutions Inc (NASDAQ:KTOS) are all on similar paths, with the latter two testing their respective bottom rails. NOC has fallen out of that same uptrend channel.

If you’re looking for exciting contrarian potential, keep moving. Ain’t nobody betting against these guys. Short squeeze potential is nonexistent with these established giants save for KTOS. Plus, there are no 14-Day relative strength indexes (RSI) in overbought or oversold territory.

With quarterly reports out of the way, post-earnings volatility crushes have options premium affordably priced, save for KTOS.

Huntington Ingalls Industries Inc (NYSE:HII) — the largest shipbuilder in the U.S. — gapped higher by nearly 7% on Thursday after a top-line beat and has that same price action as its larger peers. Yet eight of 11 analysts are on the sidelines with “hold” or “sell” ratings. Considering HII’s 12-month price target of $313.59 is a 1.4% discount to its current perch, overdue bull notes could keep the wind at the equity’s back.

Options traders are bearish on two names; GE, and NOC. Their respective 10-day put/call volume ratio of 1.05 and 1.07 at the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX) rank in the 76th and 85th percentile of their annual ranges.

Honeywell’s spinoff of its specialty materials business occurred on Thursday, with the separation of its automation and aerospace arms on track for completion by the second half of 2026.

Factor in the encouraging backlogs across the board, and the U.S’ eagerness to spend on weapons, and there’s a lot to like about defense stocks going forward. But: if everyone is outperforming and has favorable technical setups, then who do you target?

It may feel like a cop out after this deep dive, but the iShares U.S. Aerospace & Defense ETF (ITA) and Global X Defense Tech ETF (SHLD) are up 70% and 82% year to date, respectively, and have exposure to all of the names outlined below.

Sometimes, when an entire sector looks great, and the differences between the players are semantics, you choose them all.

Pretty boring stuff, right? Buy and hold defense stocks through thick and thin? If you’re craving that sweet volatile price action, the outsized moves, let’s talk drones, or unmanned aerial vehicles (UAVs), or electric vertical take-off and landing aircraft (eVTOLs).

Drone demand is a multi-billion opportunity, valued at $15 billion in 2025 and projected to reach $29.8 billion by 2030.

For industry standard AeroVironment Inc (NASDAQ:AVAV) the shares are 10% off their Oct. 9 record high of $417.86, forming a flag pattern above their 30-day moving average. The drone maker won’t report earnings until Dec. 3, has 7% of its total available float sold short, and a buildup of options traders targeting puts.

Drones are the speculative side of defense stocks right now. Northrop and Kratos have invested considerable amounts of cheddar in their aeronautics systems, but if you want to take a big swing on some heavily-shorted names, specialists like AVAV, Joby Aviation (JOBY), Draganfly (DPRO), Red Cat Holdings (RCAT), Archer Aviation (ACHR), ZenaTech (ZENA), and EHang Holdings (EH) are all worth familiarizing with.

But that’s a deeper dive for another time.

Click Here to view the rest on Schaeffer’s Substack!

| 3 hours | |

| 3 hours | |

| 3 hours | |

| 5 hours | |

| Feb-14 | |

| Feb-14 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite