|

|

|

|

|||||

|

|

Wheaton Precious Metals (WPM) is scheduled to report third-quarter 2025 results on Nov. 6, after market close.

The Zacks Consensus Estimate for Wheaton Precious Metals’ third-quarter sales is pegged at $470.4 million, indicating 52.5% growth from the prior-year quarter’s reported figure.

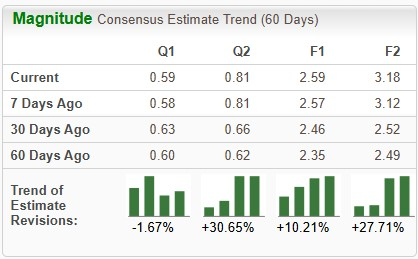

The consensus mark for WPM’s earnings is pegged at 59 cents per share, indicating year-over-year growth of 73.5%. Earnings estimates have moved down 1.7% in the past 60 days.

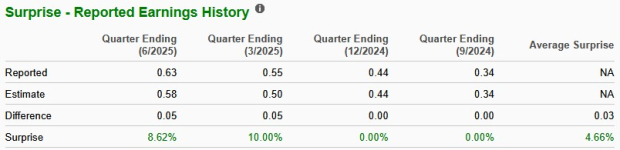

Wheaton Precious Metals’ earnings have outpaced the consensus estimate in two of the trailing four quarters while matching twice, the average surprise being 4.7%.

Our model does not predict an earnings beat for Wheaton Precious Metals this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat. That is not the case here, as you can see below.

You can uncover the best stocks before they are reported with our Earnings ESP Filter.

Earnings ESP: Wheaton Precious Metal has an Earnings ESP of -1.14%.

Zacks Rank: WPM currently carries a Zacks Rank of 3.

Wheaton Precious Metals projects an attributable production of 600,000-670,000 gold equivalent ounces (GEOs) for 2025. The mid-point of the range indicates a 10% year-over-year increase in production. This outlook reflects higher attributable production from Antamina, the start-up of several development projects (Blackwater, Goose, Mineral Park and Platreef) and a stable forecast for Salobo production. The company continues to forecast production from Mineral Park, Goose, Platreef and Aljustrel for the second half of 2025. This is expected to have been partially offset by lower production from Penasquito and Constancia.

Our model projects WPM’s total attributable production of 162,298 GEOs for the third quarter of 2025, indicating a 13.7% year-over-year increase. The production figure includes attributable gold production of 94,165 ounces of gold (an 8.5% year-over-year increase).

After a record-breaking fourth-quarter 2024, production levels at Salobo have been stable in the first quarter of 2025. It is expected to have been consistent year over year in the third quarter of 2025, with higher throughput levels, attributable to the Salobo III expansion project, anticipated to have been offset by lower gold grades. Our model projects an 11.5% year-over-year increase for the third quarter, attributable to gold production at 69,877 ounces.

Gold production at Sudbury is expected to be 31.8% higher year over year at 4,734 ounces. At Constancia, attributable gold production is projected to be 53.7% lower at 4,979.5 ounces due to decreased gold grades.

Our model projects WPM’s third-quarter gold sales volume of 93,965 ounces, indicating 24.1% year-over-year growth. Gold realized prices are expected to be $2,929 per ounce, suggesting a 17.6% year-over-year rise.

The company’s third-quarter 2025 total gold sales are projected at $275 million, implying a 46% year-over-year rise. Gold sales are expected to have contributed 60.3% to WPM’s total sales.

Our model projects 5.69 million ounces of total attributable silver production (up 25.4% year over year). A 49.3% year-over-year increase at Antamina and a 12.1% rise at Penasquito are expected to offset the 10.5% decline in Constancia.

Wheaton Precious Metals’ silver sales volume is expected to be 5.52 million ounces. Silver realized prices are expected to be $31.89 per ounce, suggesting 7.4% year-over-year growth. This is likely to lead to silver sales of $176 million, indicating a 52.9% year-over-year rise. Silver sales are expected to contribute 38.6% to the total sales.

Attributable production of palladium is projected at 1,643 ounces (down 59.3% year over year) while production for cobalt is expected at 360 thousand pounds (down 9.4%). Other metals’ production is projected at 2,469 GEOs for the third quarter.

Our model projects Wheaton Precious Metals to sell 159,520 GEOs in the third quarter, 30.5% higher than the prior-year quarter’s actual. Overall, the company’s third-quarter results are expected to reflect the gains of higher gold and silver prices.

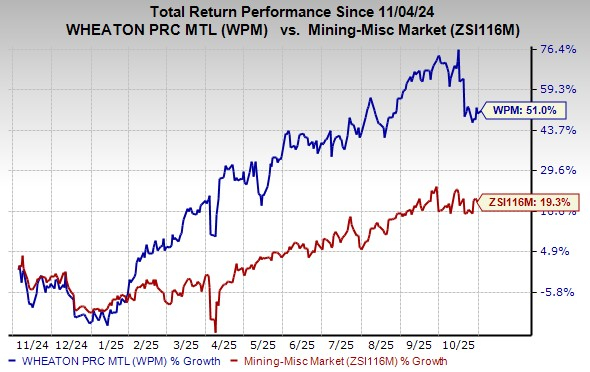

Shares of Wheaton Precious Metals have soared 51% over the past year compared with the industry's 19.3% growth.

Here are some stocks with the right combination of elements to post an earnings beat in their upcoming releases.

Barrick Mining Corporation (B), scheduled to release third-quarter 2025 earnings on Nov. 10, has an Earnings ESP of +3.06% and a Zacks Rank of 3 at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Barrick Mining’s earnings for the third quarter of 2025 is pegged at 57 cents per share, indicating a surge of 83.9% from the year-ago quarter’s reported figure. Barrick Mining has a trailing four-quarter average earnings surprise of 6.7%.

CF Industries (CF), slated to release third-quarter 2025 earnings on Nov. 5, has an Earnings ESP of +10.05% and carries a Zacks Rank of 3 at present.

The Zacks Consensus Estimate for CF Industries’ third-quarter earnings is pegged at $1.91 per share. The estimate indicates a 23% year-over-year increase. CF Industries has a trailing four-quarter average earnings surprise of 25.3%.

USA Rare Earth, Inc. (USAR), slated to release third-quarter 2025 earnings on Nov. 6, currently has an Earnings ESP of +81.82% and a Zacks Rank of 3.

The Zacks Consensus Estimate for USA Rare Earth’ loss for the third quarter is pegged at 6 cents per share. The company reported a loss of 10 cents in the year-ago quarter. USA Rare Earth has a trailing four-quarter average earnings surprise of 38.5%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 6 hours | |

| 10 hours | |

| 13 hours |

Rare Earth Stocks Warm Up As Oxide Prices Climb; REalloys To Start Trading

USAR +8.52%

Investor's Business Daily

|

| 14 hours |

Rare Earth Stock REalloys To Start Trading As Oxide Prices Climb

USAR +8.52%

Investor's Business Daily

|

| Feb-23 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite