|

|

|

|

|||||

|

|

MP Materials MP is scheduled to announce its third-quarter 2025 results on Nov. 6, after market close.

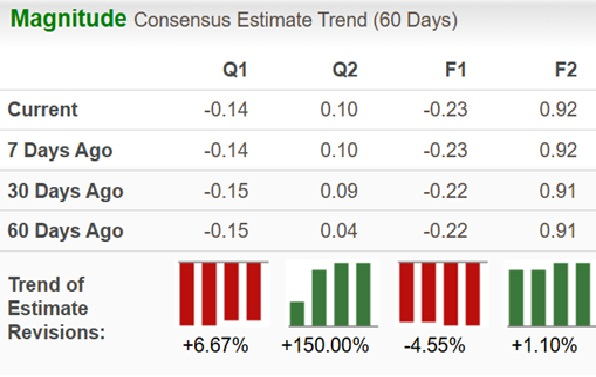

The consensus estimate for MP’s third-quarter revenues is $53.14 million, indicating a 15.56% decline from the year-ago quarter. The Zacks Consensus Estimate for earnings is pegged at a loss of 14 cents per share.

The estimate has moved down from a loss of 15 cents to the current loss of 14 cents over the past 60 days. MP Materials reported a loss of 12 cents per share in the year-ago quarter.

MP Materials’ earnings missed the Zacks Consensus Estimates in two of the trailing four quarters, matched in one quarter and surpassed the same in one quarter. The company has a trailing four-quarter negative earnings surprise of 1.39%, on average.

Our proven model predicts an earnings beat for MP Materials this time. This is because the stock has the right combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold), which increases the chances of an earnings beat.

Earnings ESP: MP has an Earnings ESP of +8.77%. You can uncover the best stocks before they are reported with our Earnings ESP Filter.

Zacks Rank: The company currently carries a Zacks Rank of 3. You can see the complete list of today’s Zacks #1 Rank stocks here.

MP Materials has been demonstrating strong growth in rare earth production, with back-to-back record quarterly performances so far this year. Production of neodymium and praseodymium (NdPr) reached 597 metric tons in the second quarter, a 119% surge from the year-ago quarter. This even outscored MP Materials’ previous record NdPr production of 563 metric tons in the first quarter.

Rare Earth Oxide (REO) production increased 45% to 13,145 metric tons in the second quarter, marking the second-highest quarter in the company’s history. This was driven by higher recoveries from the continued implementation of Upstream 60K optimizations. MP Materials had reported REO production of 12,213 metric tons in the first quarter of 2025.

We expect this momentum to have continued in the third quarter, with higher NdPr production and sales volumes. This, along with higher NdPr prices, is expected to have boosted the Materials segment’s revenues. However, with MP Materials ramping up its midstream operations, much of the REO output is being diverted to the production of separated rare earth products rather than being sold as concentrate.

The Magnetics segment made its first metal deliveries in March and the ramp-up at the segment is expected to have contributed to revenues in the quarter.

In April, MP Materials halted rare earth concentrate shipments to China in response to Chinese tariffs and export controls, cutting off a revenue stream. Considering that this sale accounted for approximately 50% of the company’s revenues in the first quarter of 2025, this is expected to have been a headwind to its revenue performance during the third quarter as well.

MP Materials has experienced a significant jump in its cost of sales over the past few quarters. Producing separated products is more costly than producing rare earth concentrates due to the additional processing required. These additional costs pertain to chemical reagents, employee labor, maintenance expenses and consumables. The increase in MP Material’s costs also reflects the production of magnetic precursor products. Selling, general and administrative expenses have also increased due to higher employee headcount to support downstream expansion.

All these factors are anticipated to have led to a loss in the quarter.

Energy Fuels UUUU reported a loss of seven cents per share in third-quarter 2025, in line with the year-ago quarter and beating the Zacks Consensus Estimate of a loss of eight cents. Energy Fuels’ revenues were reported at $17.7 million, surpassing the consensus estimate of $10 million. Energy Fuels had reported revenues of $4 million in the year-ago quarter.

Lynas Rare Earths Limited LYSDY recently reported first-quarter fiscal 2026 results (ended Sept. 30, 2025). Lynas achieved NdPr production of 2,003 tons, exceeding the 2,000-ton mark for the first time. Total REO production was at 3,993 tons. Total REO sales volume was 3,691 tons, up from 2,828 tons in the prior quarter, including record NdPr sales. Lynas’s revenues grew 66% year over year to AUD$200.2 million (around $130 million).

MP Materials shares have skyrocketed 269.7% so far this year compared with the industry’s 27.6% growth. In comparison, the Zacks Basic Materials sector has gained 8.3%, while the S&P 500 has risen 5.7% in the same period.

MP Materials has also outpaced Energy Fuels and Lynas Rare Earths Limited, which have gained 247% and 126.1% year to date, respectively.

MP is trading at a forward 12-month price/sales multiple of 16.58X, a significant premium to the industry’s 1.45X. It has a Value Score of F.

Energy Fuels and Lynas are trading at price-to-sales ratios of 34.49X and 14.48X, respectively.

MP Materials is the United States’ only fully integrated rare earth producer with capabilities spanning the entire supply chain, from mining and processing to advanced metallization and magnet manufacturing. The company recently secured a multibillion-dollar investment package and long-term commitments from the Department of Defense (DOD), which will enable it to expand its production capacity and play a pivotal role in reducing the United States’ reliance on foreign sources, particularly China.

The company is making investments to boost its production capacity. Also, the DoD deal offers price and revenue stability in the long run. Investors holding MP shares should continue to do so to benefit from the solid long-term fundamentals of rare earth products. However, given its premium valuation and the expected loss in the quarter, prospective investors can wait for a better entry point.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 7 hours | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite