|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

Aveanna Healthcare AVAH is scheduled to report third-quarter 2025 resultson Nov. 6, before the opening bell. In the last reported quarter, the company’s earnings per share (EPS) of 18 centssurpassed the Zacks Consensus Estimate by 350%.

Let us check out the factors that might have shaped AVAH’s performance prior to the announcement, along with the preliminary third-quarter results.

Aveanna’s preliminary third-quarter results point to another period of healthy execution, supported by strong demand trends and continued operating discipline. Management expects revenues of $616-$624 million, reflecting 21.0%-22.6% year-over-year growth. This suggests that improved reimbursement rates and stronger care-hour delivery continued to lift top-line performance.

Net income is estimated to be in the range of $11-$15 million, representing approximately 126%-135% growth from the prior-year period. Adjusted EBITDA is projected to be in the range of $77-$81 million, up about 61%–69% year over year, indicating sustained margin support. While these figures remain subject to final accounting review, the early indicators show that Aveanna is maintaining growth and profitability trajectory seen earlier in the year.

Aveanna Healthcare Holdings Inc. price-eps-surprise | Aveanna Healthcare Holdings Inc. Quote

Rate Initiatives and Preferred-Payer Expansion

AVAH’s third-quarter earnings are likely to have benefited from continued traction in reimbursement improvements and the scaling of preferred-payer relationships. The company previously demonstrated that enhanced rates can meaningfully support revenue quality, and this momentum may have carried into the third quarter as more states adopt higher Medicaid rates and value-based frameworks.

The expansion of preferred payers beyond the existing base is also likely to have driven improved pricing mix and contributed to steadier revenue per hour. If payer negotiations continued progressing, especially across Private Duty Services, this might have supported stronger top-line performance and margin stability in the third quarter.

Capacity Gains and Higher Care-Hour Delivery

AVAH’s third-quarter earnings are also likely to have been supported by ongoing improvements in caregiver recruitment and retention, helping convert strong demand into more care hours delivered. The company previously experienced healthy labor momentum, and sustained execution in filling harder-to-cover shifts or bringing new geographies online might have unlocked additional volume in the third quarter. Better alignment between reimbursement rates and caregiver compensation could have further enabled staffing expansion, allowing AVAH to serve more medically complex patients and widen its service delivery footprint. As a result, higher care-hour throughput and better schedule utilization are likely to have played a meaningful role in driving sequential revenue growth in the to-be-reported quarter.

Margin Support and Improved Cash-Generation Profile

AVAH’s third-quarter earnings are likely to have benefited from incremental operating leverage following solid margin performance earlier in the year. With adjusted EBITDA reaching $88.4 million at a 15% margin in the second quarter and gross margin improving to 35.8%, third-quarter results may have carried forward some of these efficiencies even as timing-related tailwinds eased.

Continued discipline around labor cost pass-throughs, a richer mix from preferred-payer arrangements and operational efficiencies are likely to have supported steady EBITDA performance in the third quarter. In addition, a year-to-date free cash flow base of roughly $36.9 million exiting the second quarter is likely to have positioned AVAH well to continue generating healthy cash in the third quarter, helped by margin consistency and disciplined working capital management.

For third-quarter 2025, the Zacks Consensus Estimate for EPS is pegged at 8 cents, implying an improvement of 300% from the prior-year quarter’s reported figure.

Per our proven model, the combination of a positive Earnings ESPand a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat. That is not the case here, as you will see below.

Earnings ESP:TerrAscendhas an Earnings ESP of 0.00%. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank:The company currently sports a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

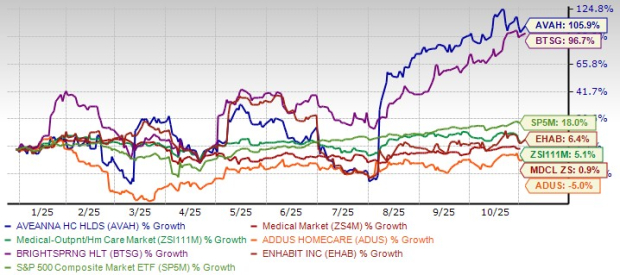

In the year-to-date period, AVAH’s shares have gained 105.9%, outperforming the Medical Outpatient and Home Healthcare Market’s 5.1% growth as well as the Medical Market’s 0.9% gain. AVAH has also surpassed the S&P 500 Composite’s 18% increase.

Year-to-Date Price Comparison

AVAH shares have outperformed its key peers like BrightSpring Health Services BTSG, Enhabit Inc. EHAB and Addus HomeCare ADUS in the year-to-date period. AVAH has led the group with a strong gain of 105.9% in the year-to-date period, followed by BTSG, which is up about 96.7%. EHAB has posted modest growth of 6.4%, while ADUS has declined by about 5% over the same period.

From a valuation perspective, AVAH trades at roughly 0.8X forward 12-month price-to-sales, positioning it below several home-care peers. BTSG is lower at about 0.44X, while EHAB is even cheaper at approximately 0.38X. In comparison, ADUS commands at a higher multiple of about 1.5X, reflecting a premium valuation compared to the group.

AVAH’s long-term outlook appears increasingly durable as management lifted its full-year guidance to more than $2.3 billion in revenues and over $270 million in adjusted EBITDA. This reflects confidence that improved reimbursement trends, expanding preferred-payer partnerships and a more efficient operating model can continue to scale across core markets. The company has already demonstrated meaningful profitability gains, offering clearer line-of-sight toward full-year objectives. These upgraded expectations signal structural growth tailwinds rather than one-off boosts, reinforcing stronger long-term earnings visibility as the business continues to execute.

Segment dynamics also support a favorable long-term setup. Private Duty Services remains the primary growth engine, supported by rising demand for in-home care and expanding state coverage. Home Health & Hospice is positioned to benefit from greater adoption of episodic and value-based models that reward higher-quality outcomes, while the Medical Solutions segment provides a stable, specialized revenue stream that deepens payer alignment. Combined, this balanced mix allows AVAH to serve multiple patient populations and payment structures, reducing concentration risk and widening the growth runway. On top of this, a supportive industry backdrop with states continuing to shifting care into lower-cost home settings and demographic trends drive sustained demand from medically fragile children and aging adults.

The company’s cash-generation profile adds further visibility to the long-term investment case. The improving liquidity position gives AVAH flexibility to reinvest in attractive markets, pursue targeted acquisitions and strengthen its balance sheet over time. With reimbursement tailwinds, scaling preferred-payer penetration, demographic demand support and consistent operating cash flow, AVAH appears well positioned to compound revenue and earnings as operational leverage deepens and its care-delivery footprint expands.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 11 hours |

Stock Market Leaders, Top-Performing IPOs Tend To Share This Common Trait

BTSG

Investor's Business Daily

|

| Feb-18 | |

| Feb-18 | |

| Feb-17 | |

| Feb-13 |

IPO Stock Of The Week: Health Care Leader BrightSpring Eyes New Buy Point

BTSG

Investor's Business Daily

|

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-11 | |

| Feb-09 | |

| Feb-09 | |

| Feb-05 | |

| Feb-03 | |

| Jan-30 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite