|

|

|

|

|||||

|

|

Health insurance company Humana (NYSE:HUM) reported revenue ahead of Wall Streets expectations in Q3 CY2025, with sales up 11.4% year on year to $32.65 billion. The company expects the full year’s revenue to be around $128 billion, close to analysts’ estimates. Its GAAP profit of $1.62 per share was 43.4% below analysts’ consensus estimates.

Is now the time to buy Humana? Find out by accessing our full research report, it’s free for active Edge members.

With over 80% of its revenue derived from federal government contracts, Humana (NYSE:HUM) provides health insurance plans and healthcare services to approximately 17 million members, with a strong focus on Medicare Advantage plans for seniors.

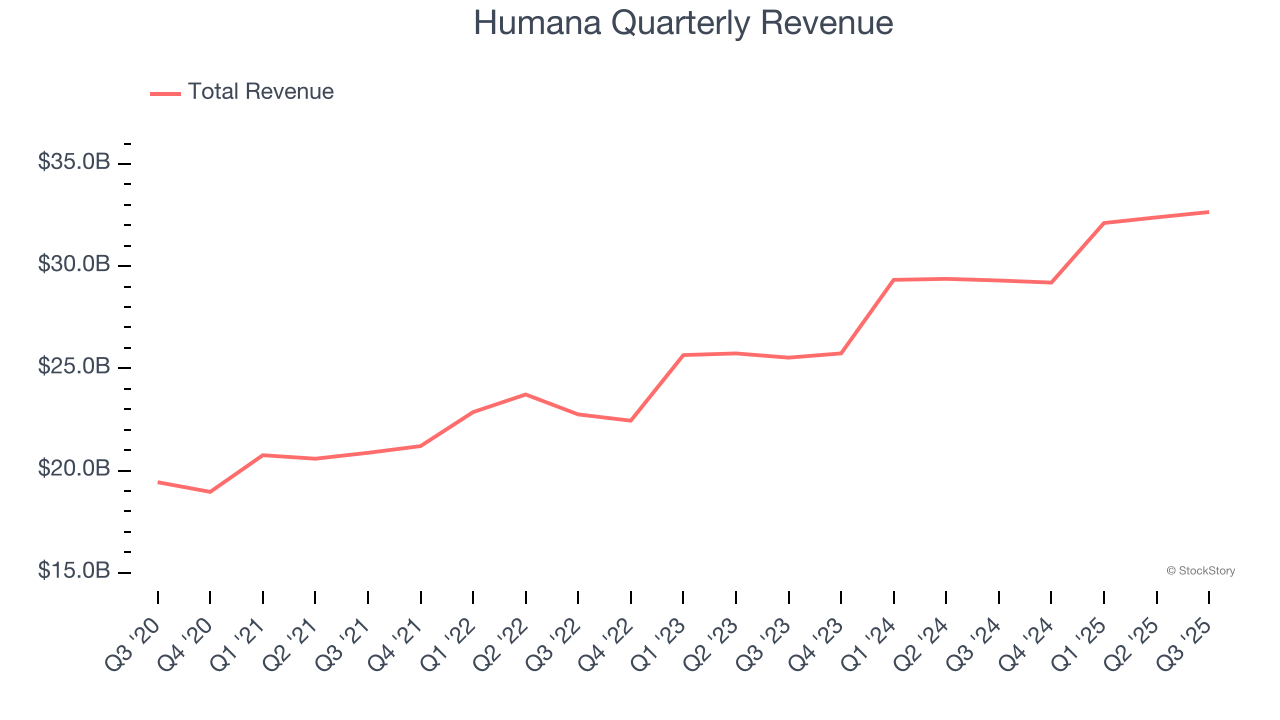

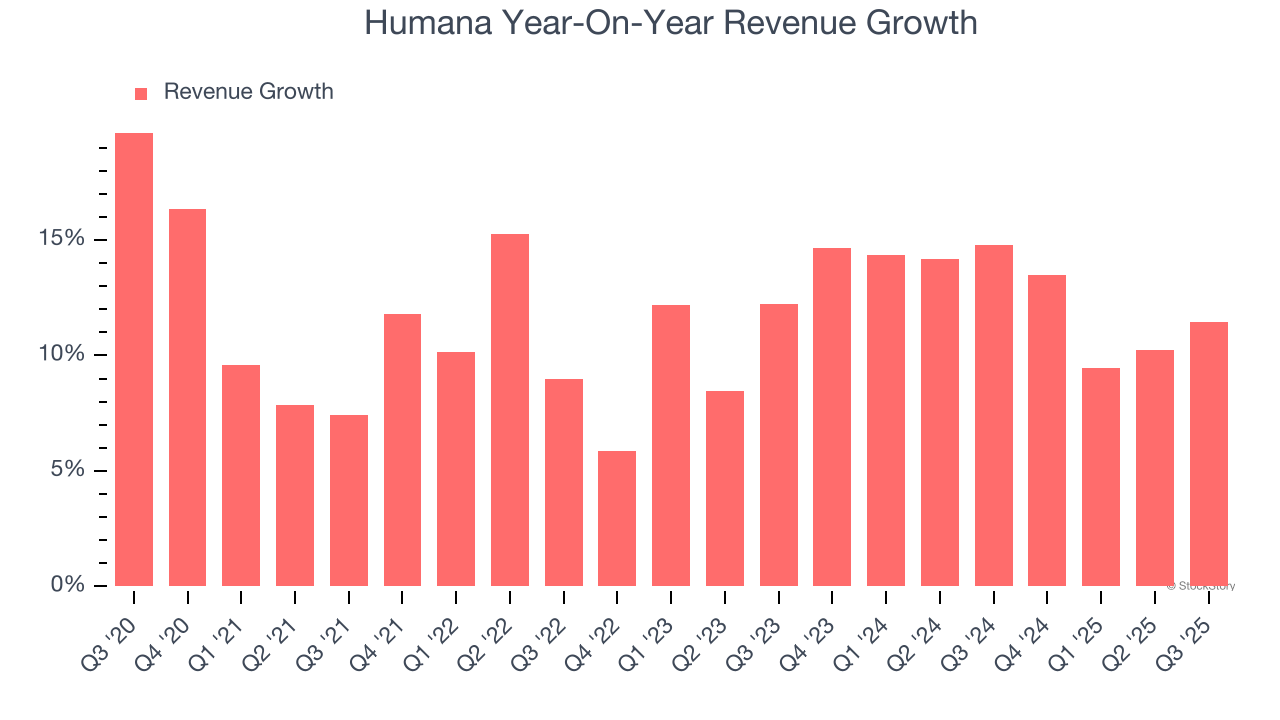

Reviewing a company’s long-term sales performance reveals insights into its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Luckily, Humana’s sales grew at a decent 11.4% compounded annual growth rate over the last five years. Its growth was slightly above the average healthcare company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within healthcare, a half-decade historical view may miss recent innovations or disruptive industry trends. Humana’s annualized revenue growth of 12.8% over the last two years is above its five-year trend, suggesting its demand recently accelerated.

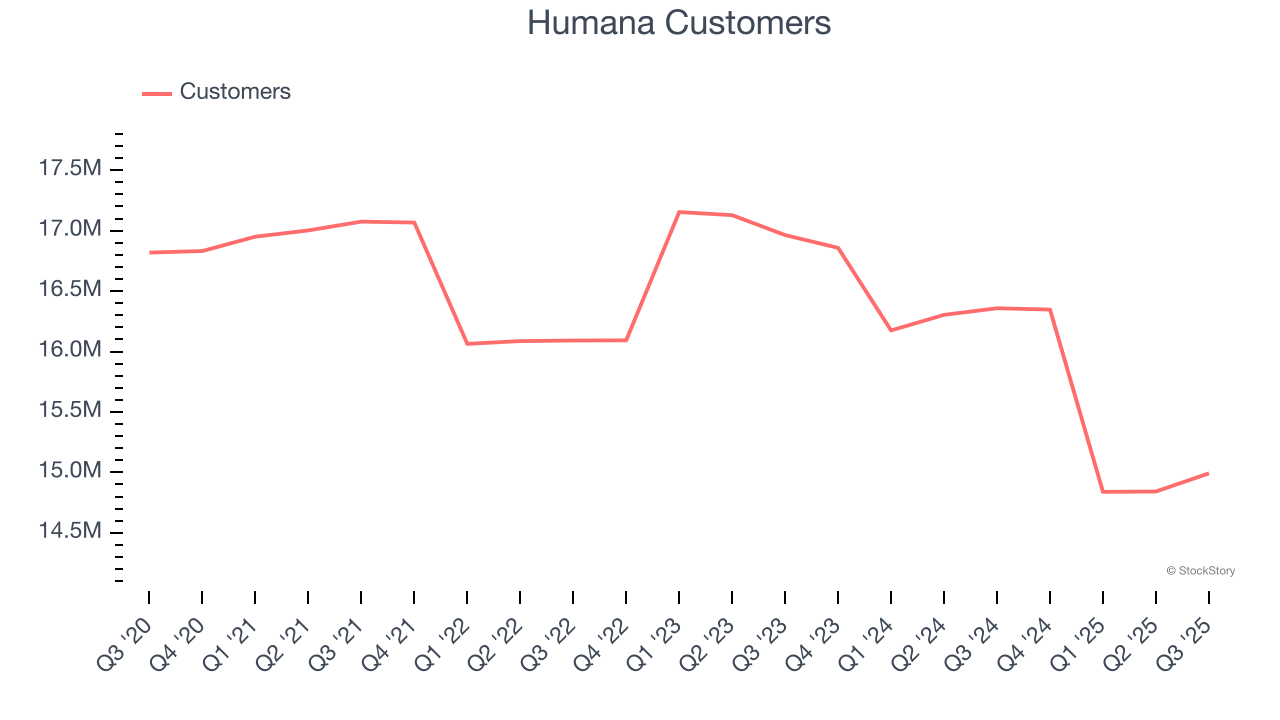

We can dig further into the company’s revenue dynamics by analyzing its number of customers, which reached 14.99 million in the latest quarter. Over the last two years, Humana’s customer base averaged 4.7% year-on-year declines. Because this number is lower than its revenue growth, we can see the average customer spent more money each year on the company’s products and services.

This quarter, Humana reported year-on-year revenue growth of 11.4%, and its $32.65 billion of revenue exceeded Wall Street’s estimates by 2.1%.

Looking ahead, sell-side analysts expect revenue to grow 6.7% over the next 12 months, a deceleration versus the last two years. We still think its growth trajectory is satisfactory given its scale and suggests the market is baking in success for its products and services.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

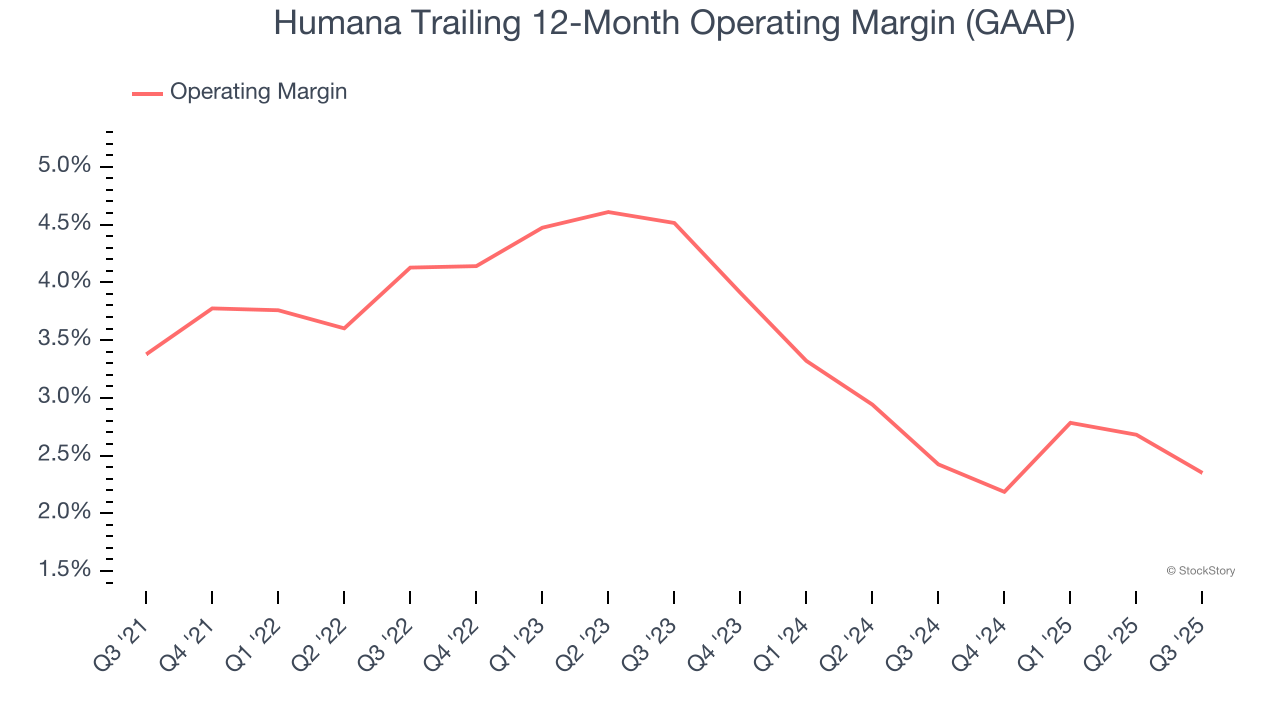

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Humana was profitable over the last five years but held back by its large cost base. Its average operating margin of 3.3% was weak for a healthcare business.

Looking at the trend in its profitability, Humana’s operating margin decreased by 1 percentage points over the last five years. This performance was caused by more recent speed bumps as the company’s margin fell by 2.2 percentage points on a two-year basis. We still like Humana but would like to see it make some adjustments.

This quarter, Humana generated an operating margin profit margin of 1.2%, down 1.3 percentage points year on year. This reduction is quite minuscule and indicates the company’s overall cost structure has been relatively stable.

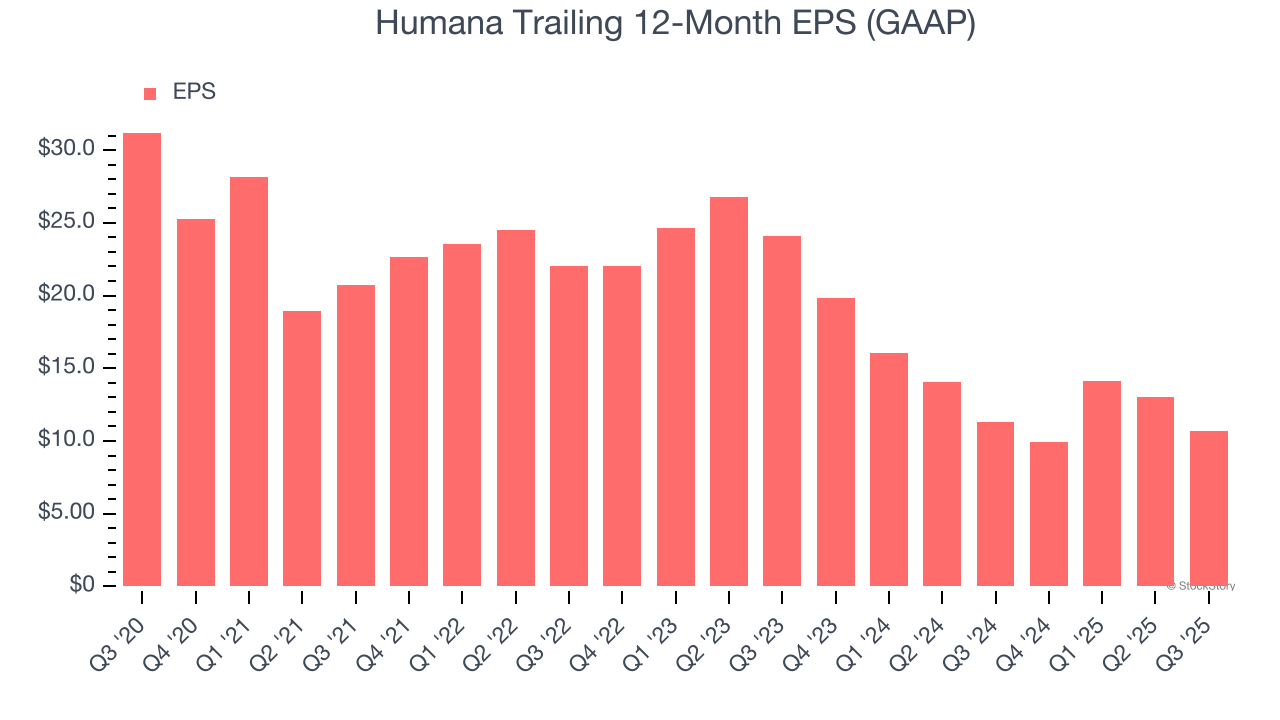

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Sadly for Humana, its EPS declined by 19.3% annually over the last five years while its revenue grew by 11.4%. This tells us the company became less profitable on a per-share basis as it expanded due to non-fundamental factors such as interest expenses and taxes.

Diving into the nuances of Humana’s earnings can give us a better understanding of its performance. As we mentioned earlier, Humana’s operating margin declined by 1 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its lower earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q3, Humana reported EPS of $1.62, down from $3.97 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street expects Humana’s full-year EPS of $10.66 to grow 28.1%.

It was encouraging to see Humana beat analysts’ revenue expectations this quarter. On the other hand, its EPS missed and its customer base fell slightly short of Wall Street’s estimates. Overall, this was a softer quarter. The stock remained flat at $281.87 immediately following the results.

Humana underperformed this quarter, but does that create an opportunity to invest right now? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.

| Feb-13 | |

| Feb-13 | |

| Feb-12 | |

| Feb-12 | |

| Feb-11 | |

| Feb-11 | |

| Feb-11 | |

| Feb-11 | |

| Feb-11 | |

| Feb-11 | |

| Feb-11 | |

| Feb-11 | |

| Feb-11 | |

| Feb-11 | |

| Feb-11 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite