|

|

|

|

|||||

|

|

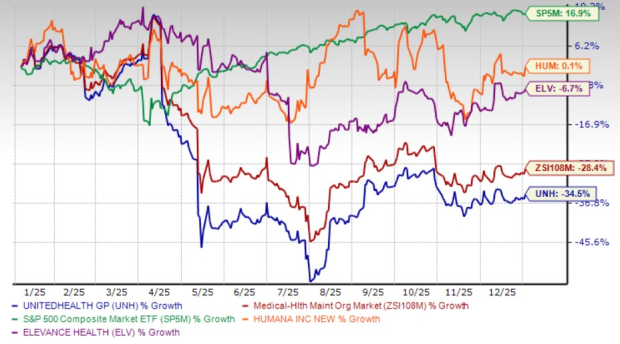

Shares of UnitedHealth Group Incorporated UNH have had a brutal year. The stock has fallen 34.5% over the past year, lagging the industry’s 28.4% decline and standing in sharp contrast to the S&P 500 Index’s 16.9% growth. Persistent cost pressures, rising utilization, regulatory scrutiny and mounting policy uncertainty weighed heavily on sentiment. Multiple earnings misses and downward profit revisions only added fuel to the selloff.

The underperformance looks even starker when stacked against peers. Humana Inc. HUM eked out a modest 0.1% gain during the same period, while Elevance Health, Inc. ELV declined a comparatively restrained 6.7%. Investors have clearly punished UnitedHealth more severely, reflecting concerns that its challenges may prove deeper and more structural.

Despite the gloom, there are signs that confidence is returning at the top. Former CEO Stephen J. Hemsley rejoined the company in May 2025, a move widely viewed as an attempt to steady the ship. Shortly after returning, Hemsley purchased more than $25 million worth of UnitedHealth stock, a strong signal that management believes the worst may be behind it.

Another notable vote of confidence came from Berkshire Hathaway Inc. BRK.B, which disclosed a $1.57 billion investment in UnitedHealth, acquiring more than 5 million shares. While neither development guarantees a turnaround, both suggest long-term investors see value emerging after the sharp correction.

The key question now is whether that optimism will be validated when UnitedHealth reports fourth-quarter earnings and issues its 2026 outlook on Jan. 27, 2026.

The Zacks Consensus Estimate indicates fourth-quarter earnings of $2.09 per share, a steep 69.3% decline from the prior-year period. Revenue, however, is expected to rise 12.7% year over year to $113.64 billion, underscoring that the pressure is squarely on profitability rather than growth. The company missed earnings estimates in two of the last four quarters, beating in the other two, with an average earnings surprise of negative 2.3%, reinforcing investor skepticism heading into the report.

UnitedHealth Group Incorporated price-consensus-eps-surprise-chart | UnitedHealth Group Incorporated Quote

For full-year 2025, the consensus estimate for earnings is pegged at $16.30 per share, implying a sharp 41.1% year-over-year decline. Revenues, by contrast, are projected to grow 11.9% to $448.03 billion. Importantly, earnings estimates have remained stable over the past month, suggesting that downside expectations may already be baked in.

Looking ahead, analysts expect some improvement. The consensus estimate for 2026 earnings stands at $17.60 per share, reflecting nearly 8% growth. Revenues are projected to rise 2.2% to $458.04 billion, though estimate revisions remain mixed.

Investors should pay close attention to medical care ratio (MCR) trends, enrollment dynamics and operating margins in the upcoming release. Guidance for 2026 will likely be the biggest catalyst. Results that fall short of expectations could trigger another wave of selling, while even modest beats may stabilize the stock. A clear improvement narrative paired with confident 2026 guidance could reignite bullish momentum.

MCR has been a major pain point. The ratio climbed from 82% in 2022 to 83.2% in 2023, surged to 85.5% in 2024 and reached 89.9% in the third quarter of 2025. Higher MCR leaves less premium revenue after claims. Our model projects full-year 2025 MCR at 89.1%, rising further to 91.1% in 2026.

Membership trends also matter. Medical membership growth marginally slowed from 2.1% in 2022 to 2% in 2023 before declining 3.9% in 2024. For full-year 2025, membership is expected to rebound 1.9%. Growth in 2026 remains uncertain, particularly in Medicare Advantage, though commercial fee-based businesses should continue expanding and support margins.

Adjusted net margins highlight the stress. After hovering near 6.5% from 2022 through 2024, margins fell sharply to 6%, 3.3% and 2.3% in the first three quarters of 2025. Full-year 2025 margins are projected at 3.3%, with stabilization expected in 2026.

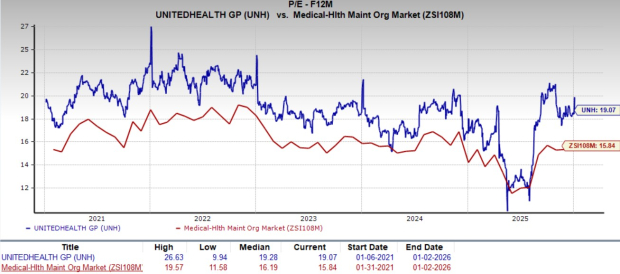

Valuation adds nuance to the debate. UnitedHealth trades at a forward P/E of 19.07X, slightly below its five-year median of 19.28X but above the industry average of 15.84X. Humana commands a richer 21.62X multiple, while Elevance trades at a discounted 13.13X.

Shares remain below the average analyst price target of $394.91, implying roughly 19% upside. However, the wide target range, from $280 to $440, reflects sharply divided views on risk. For investors, fourth-quarter earnings may decide whether UnitedHealth is a value opportunity or a value trap.

UnitedHealth’s sharp pullback has undeniably improved its risk-reward profile, but the investment case is still incomplete. Cost pressures remain elevated, margins are fragile, and visibility into 2026 profitability hinges on upcoming guidance. With medical care ratios still climbing and earnings expectations reset lower, investors have little margin for disappointment in the fourth-quarter report.

While insider buying and long-term institutional interest add credibility to the recovery narrative, near-term execution risk remains high. Given these crosscurrents, the prudent move is to stay on the sidelines until earnings provide clearer evidence that cost trends are stabilizing and margins are bottoming. UnitedHealth currently carries a Zacks Rank #3 (Hold), suggesting investors should wait for confirmation rather than buy ahead of results. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 6 hours | |

| 7 hours | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-25 | |

| Feb-25 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite