|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

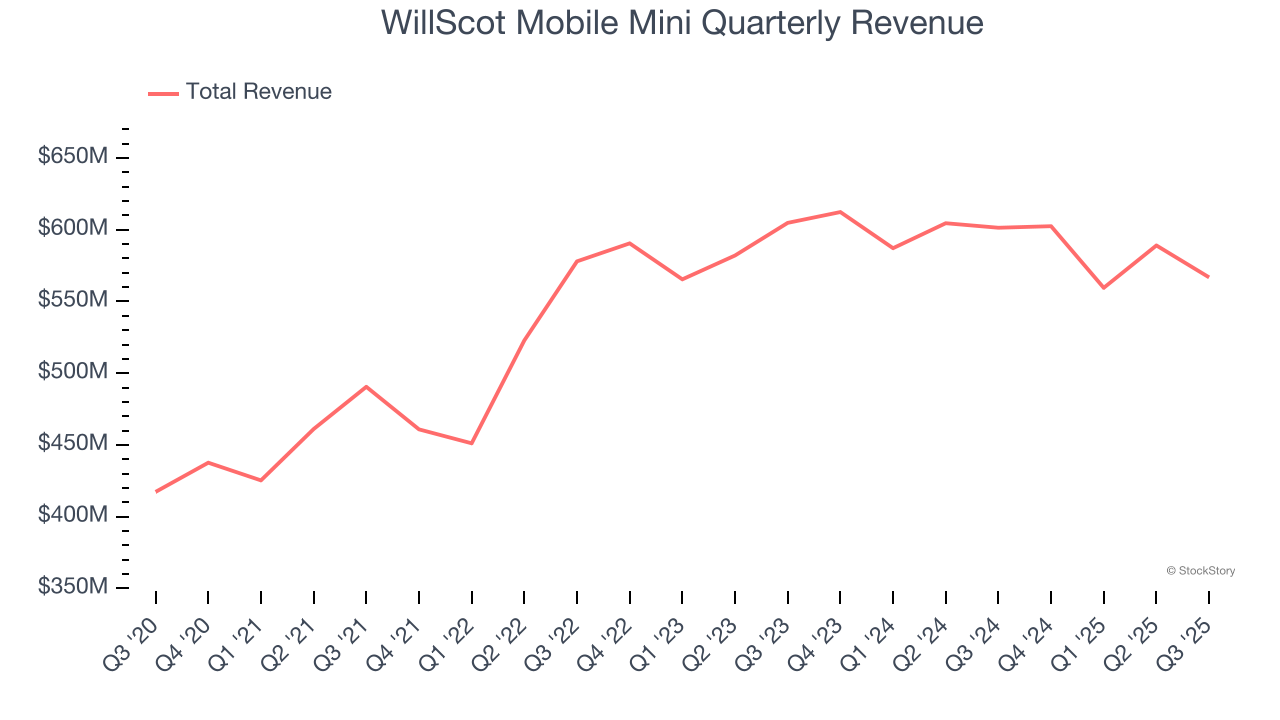

Temporary space provider WillScot (NASDAQ:WSC) fell short of the markets revenue expectations in Q3 CY2025, with sales falling 5.8% year on year to $566.8 million. Next quarter’s revenue guidance of $545 million underwhelmed, coming in 6.6% below analysts’ estimates. Its non-GAAP profit of $0.30 per share was 3.9% above analysts’ consensus estimates.

Is now the time to buy WillScot Mobile Mini? Find out by accessing our full research report, it’s free for active Edge members.

Brad Soultz, Chief Executive Officer of WillScot, commented, “Our third quarter 2025 financial results were mixed. We delivered strong cash flow, and the team remains focused on executing the growth and operational excellence initiatives we outlined in March at our 2025 Investor Day. Our customer service team made significant progress improving our collections processes where we are realizing meaningful improvements in customer satisfaction and steady improvements in days sales outstanding, as well as a temporary increase in accounts receivable write-offs. Leasing revenues excluding write-offs were stable sequentially, with favorable rate and mix offsetting year-over-year volume headwinds. With that impact of increased write-offs largely confined to 2025, we are focused on the areas in our portfolio where we believe strong demand and our differentiated products and services will drive growth into 2026, particularly in Enterprise Accounts and more differentiated service offerings. With ongoing uncertainty around the market trajectory, we remain agile in terms of controlling what we can control, specifically adjusting our cost structure and implementing our operating improvement initiatives to maintain our free cash flow and return profile. I want to thank our entire team for its steadfast dedication and hard-work which are the cornerstones to providing value to our customers and shareholders.”

Originally focusing on mobile offices for construction sites, WillScot (NASDAQ:WSC) provides ready-to-use temporary spaces, largely for longer-term lease.

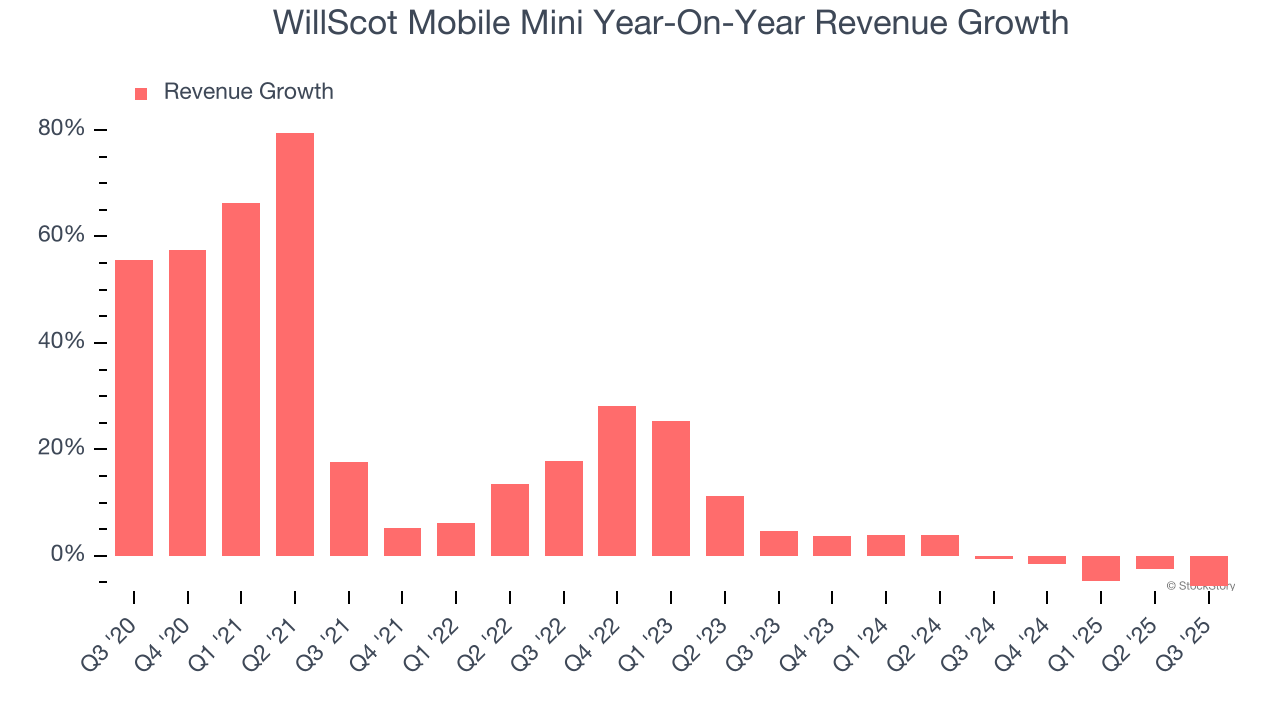

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Over the last five years, WillScot Mobile Mini grew its sales at an exceptional 13.9% compounded annual growth rate. Its growth beat the average industrials company and shows its offerings resonate with customers.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. WillScot Mobile Mini’s recent performance shows its demand has slowed significantly as its revenue was flat over the last two years.

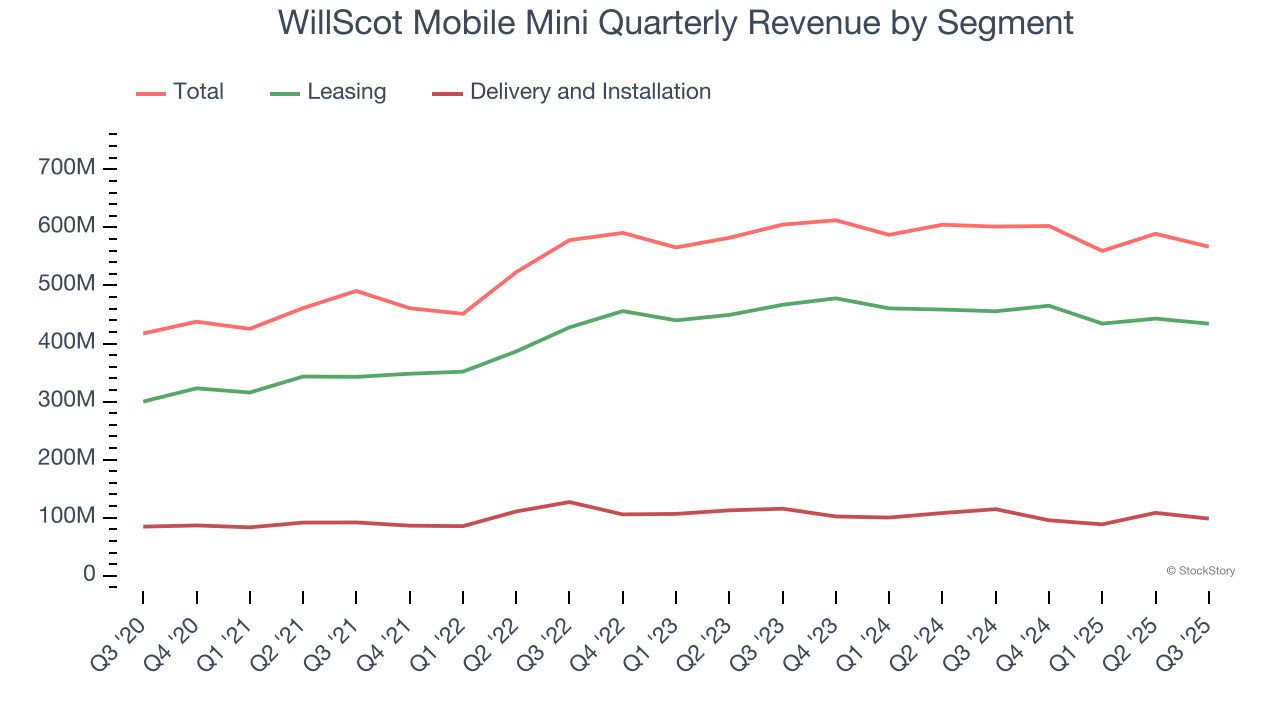

WillScot Mobile Mini also breaks out the revenue for its most important segments, Leasing and Delivery and Installation, which are 76.6% and 17.4% of revenue. Over the last two years, WillScot Mobile Mini’s Leasing revenue (recurring) was flat while its Delivery and Installation revenue (non-recurring) averaged 5.8% year-on-year declines.

This quarter, WillScot Mobile Mini missed Wall Street’s estimates and reported a rather uninspiring 5.8% year-on-year revenue decline, generating $566.8 million of revenue. Company management is currently guiding for a 9.5% year-on-year decline in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 1.3% over the next 12 months. While this projection indicates its newer products and services will catalyze better top-line performance, it is still below average for the sector.

The 1999 book Gorilla Game predicted Microsoft and Apple would dominate tech before it happened. Its thesis? Identify the platform winners early. Today, enterprise software companies embedding generative AI are becoming the new gorillas. a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

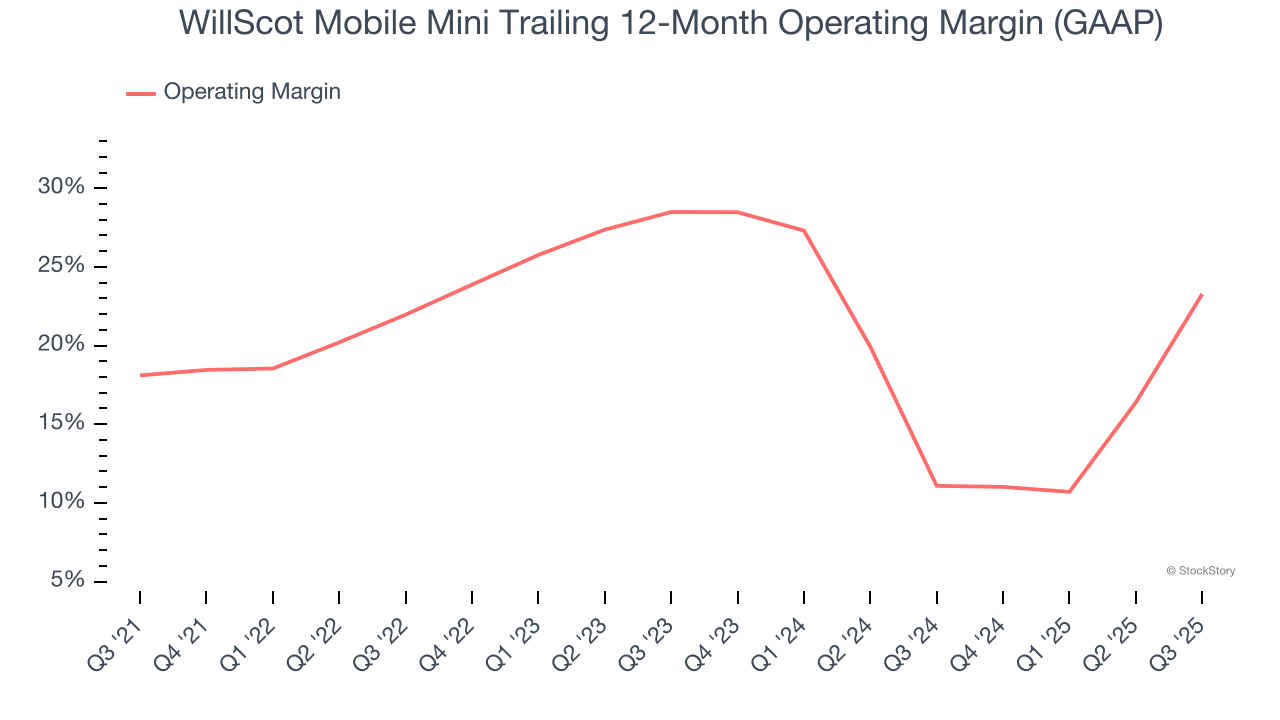

WillScot Mobile Mini has been a well-oiled machine over the last five years. It demonstrated elite profitability for an industrials business, boasting an average operating margin of 20.6%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Analyzing the trend in its profitability, WillScot Mobile Mini’s operating margin rose by 5.2 percentage points over the last five years, as its sales growth gave it immense operating leverage.

This quarter, WillScot Mobile Mini generated an operating margin profit margin of 21%, up 26.8 percentage points year on year. The increase was solid, and because its revenue and gross margin actually decreased, we can assume it was more efficient because it trimmed its operating expenses like marketing, R&D, and administrative overhead.

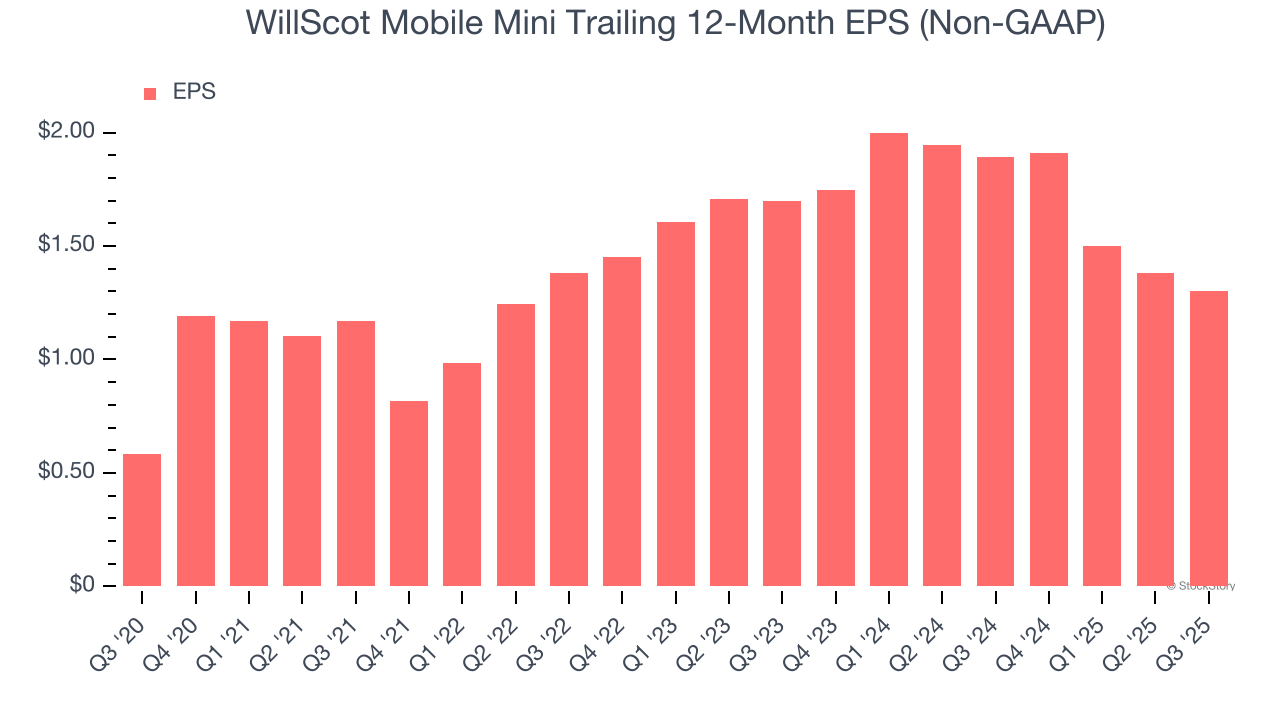

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

WillScot Mobile Mini’s EPS grew at a spectacular 17.4% compounded annual growth rate over the last five years, higher than its 13.9% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

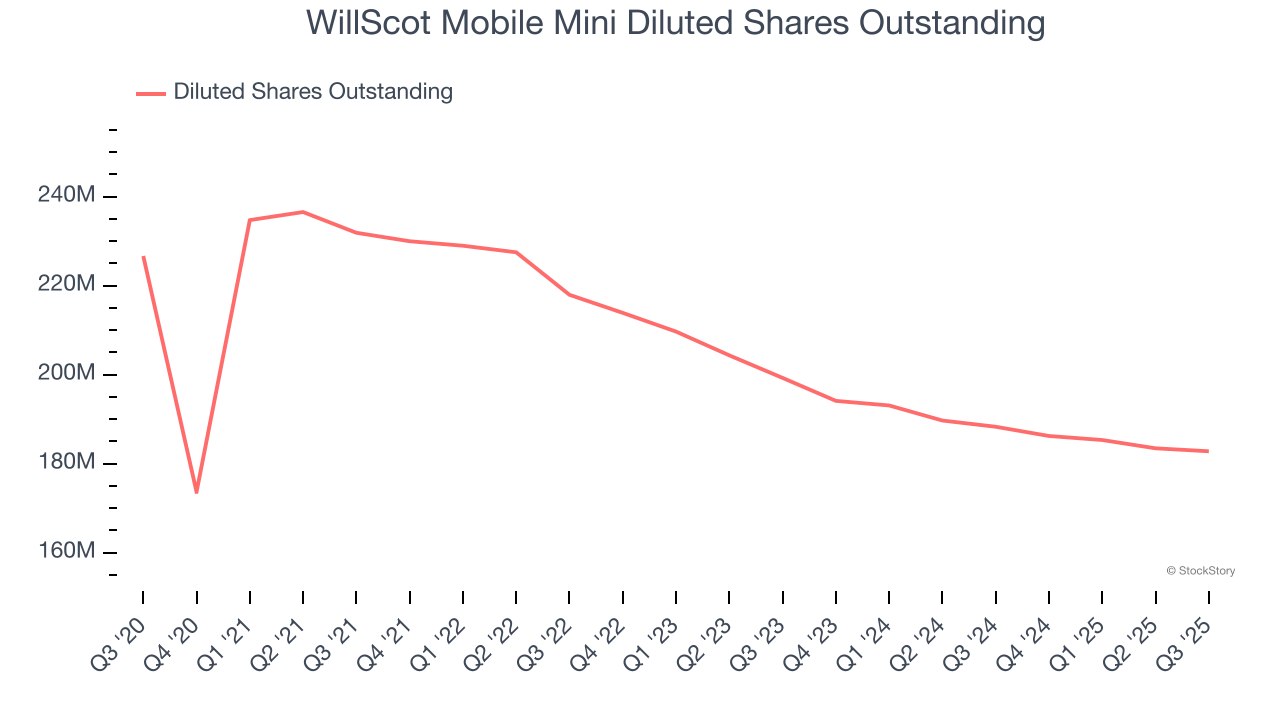

Diving into the nuances of WillScot Mobile Mini’s earnings can give us a better understanding of its performance. As we mentioned earlier, WillScot Mobile Mini’s operating margin expanded by 5.2 percentage points over the last five years. On top of that, its share count shrank by 19.4%. These are positive signs for shareholders because improving profitability and share buybacks turbocharge EPS growth relative to revenue growth.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For WillScot Mobile Mini, its two-year annual EPS declines of 12.5% mark a reversal from its (seemingly) healthy five-year trend. We hope WillScot Mobile Mini can return to earnings growth in the future.

In Q3, WillScot Mobile Mini reported adjusted EPS of $0.30, down from $0.38 in the same quarter last year. Despite falling year on year, this print beat analysts’ estimates by 3.9%. Over the next 12 months, Wall Street expects WillScot Mobile Mini’s full-year EPS of $1.30 to grow 6.6%.

It was good to see WillScot Mobile Mini beat analysts’ EPS expectations this quarter. On the other hand, its Delivery and Installation revenue missed and its revenue guidance for next quarter fell short of Wall Street’s estimates. Overall, this was a softer quarter. The stock traded down 6.6% to $18.29 immediately after reporting.

WillScot Mobile Mini didn’t show it’s best hand this quarter, but does that create an opportunity to buy the stock right now? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-17 | |

| Feb-17 | |

| Feb-13 | |

| Feb-08 | |

| Feb-05 | |

| Feb-04 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite