|

|

|

|

|||||

|

|

Berkshire’s operating profits soared last quarter, although the bar was set relatively low.

That being said, its quarterly operating income is only one of three important aspects of the conglomerate’s consistent success.

Don’t be surprised to see another strong quarter with Q4’s results to be released in February, likely capping off a record-breaking year.

Most investors are so curious about the stocks that Warren Buffett's Berkshire Hathaway (NYSE: BRK.A) (NYSE: BRK.B) owns that it's easy to forget it's not a mutual fund, but rather, a conglomerate of several privately owned businesses that also happens to hold a bunch of individual equities.

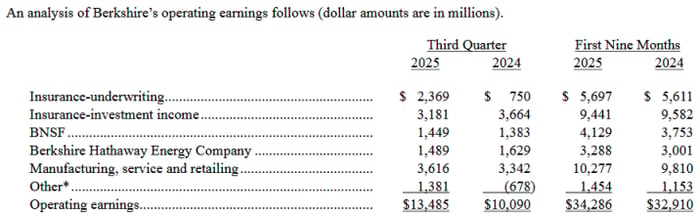

We were reminded of this reality this past weekend, however, when Berkshire posted third-quarter results that very plainly lay out its operating profits for the quarter in question. It booked a total of $13.49 billion in operating income for the three-month stretch, up 34% from the year-earlier comparison of $10.09 billion. Nice!

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

It's a number that requires some additional insight though, just to keep things in the proper perspective.

Image source: The Motley Fool.

Yes, the most-watched aspect of Berkshire Hathaway's is arguably the stock-picking that Buffett and his lieutenants do with the company's cash. There's far more to the company, however.

Indeed, the conglomerate's stock holdings are a relatively small part of the total business. Given the company's current market cap of just a little over $1.0 trillion, its privately owned entities like Fruit of the Loom, Duracell, insurer Geico, Shaw flooring, and Clayton Homes (just to name a few of its 68 wholly owned companies) are collectively worth more than Berkshire's current stock holdings.

And these businesses produce a fair amount of reliable, recurring cash flow. They're largely seen as cash cows, supporting Berkshire Hathaway's other ventures like its insurance operations and the purchase of publicly traded companies. These entities collectively contributed $13.5 billion to the company's bottom line during the third quarter of this year, on revenue of just under $95 billion.

Now here's the rest of the story.

Just to be clear, Berkshire Hathway's operating earnings only reflect the operating profit of the company's wholly owned enterprises like the aforementioned Geico, or its railroad BNSF. Gains or losses -- realized or unrealized -- on its stock holdings don't add or subtract from the number.

The conglomerate still discloses this information, however. While it's a bit difficult to ferret out between all of its sales, purchases, and its payoffs for simply remaining patient, the quarterly report notes that Berkshire Hathaway experienced $9.2 billion in total investment gains for the three months ending in September, offsetting losses suffered earlier in the year to bring its year-to-date investment gains up to $3.3 billion.

The 34% year-over-year improvement in operating profits is enormous to be sure. Just remember that it's a comparison to a particularly disappointing third quarter of 2024, when operating earnings fell 7% year over year thanks to a couple of catastrophic losses that weren't offset by windfall gains.

In other words, the bar was set fairly low.

Also know that a little over $700 million of the $3.4 billion swing reflects currency-exchange gains and "after-tax interest, dividend and other investment income of Berkshire Hathaway (parent company) and certain other related entities" that didn't actually come from any of the conglomerate's privately owned companies, but is still booked as operating income.

Beneficial accounting or not, there's no denying the number itself is still very impressive.

Largely fueled by manufacturing income along with a quick recovery of its insurance underwriting business following last year's setback, last quarter's $13.5 billion in operating income is the highest third-quarter operating income ever reported by the company, and the second-highest for any quarter. The highest was last year's fourth-quarter operating income of $14.5 billion despite the economic headwinds -- like inflation -- blowing at the time.

Image source: Berkshire Hathaway's Q3-2025 report.

Don't be surprised to see record-breaking operating income for the current quarter when those results are released in February of the coming year either. Although the economic malaise is palpable, most of Berkshire Hathaway's privately held businesses along with its publicly traded stock holdings tend to be quite resilient.

Now take a step back and look at the bigger picture. Berkshire isn't a mutual fund or a conglomerate. It's both, offering the best attributes of both entities without also being limited by the less desirable qualities of either. Unlike mutual funds and most insurers, for instance, Berkshire Hathaway isn't required to keep the majority of its assets invested in a stock market that may or may not be worth being in at any particular time. The company's got more than $380 billion in cash just waiting on the sidelines, in fact -- a tacit warning from Buffett to all investors.

And yet, the benefit of Berkshire's business structure is even more nuanced than that.

Although you have to go all the way back to 2009's letter (published in early 2010) to Berkshire shareholders to hear Buffett's complete -- and brilliant -- explanation, as he put it then:

"Insurers receive premiums upfront and pay claims later... This collect-now, pay-later model leaves us holding large sums -- money we call 'float' -- that will eventually go to others. Meanwhile, we get to invest this float for Berkshire's benefit... If premiums exceed the total of expenses and eventual losses, we register an underwriting profit that adds to the investment income produced from the float. This combination allows us to enjoy the use of free money -- and, better yet, get paid for holding it."

This the overlooked beauty of Berkshire's unrestricted structure. The "float" can be used in a range of ways, from buying publicly traded stocks to wholly owned companies to partial stakes in privately held enterprises, all of which contribute to the bottom line one way or another. And Buffett has masterfully used this flexibility and subsequent cash flow to produce a long-term market-beating performance.

Incoming CEO Greg Abel is likely to do the same, by the way, having learned how to manage it since becoming part of the Berkshire family back in 1999 when the conglomerate acquired a controlling stake in MidAmerican Energy where Abel was serving as an executive.

Before you buy stock in Berkshire Hathaway, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Berkshire Hathaway wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $595,194!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,153,334!*

Now, it’s worth noting Stock Advisor’s total average return is 1,036% — a market-crushing outperformance compared to 191% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of November 3, 2025

James Brumley has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Berkshire Hathaway. The Motley Fool has a disclosure policy.

| 6 hours | |

| 7 hours |

Stock Market Week: Reaction To Iran, Berkshire Earnings, Apple Event

BRK-B

Investor's Business Daily

|

| 7 hours |

Stock Market Week: Reaction To Iran, Berkshire Earnings, Apple Event

BRK-A

Investor's Business Daily

|

| 8 hours | |

| 9 hours | |

| 9 hours | |

| 9 hours | |

| 10 hours | |

| 11 hours |

Warren Buffett's successor Greg Abel publishes his first letter to Berkshire Hathaway shareholders

BRK-A

Associated Press Finance

|

| 11 hours | |

| 18 hours | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-26 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite