|

|

|

|

|||||

|

|

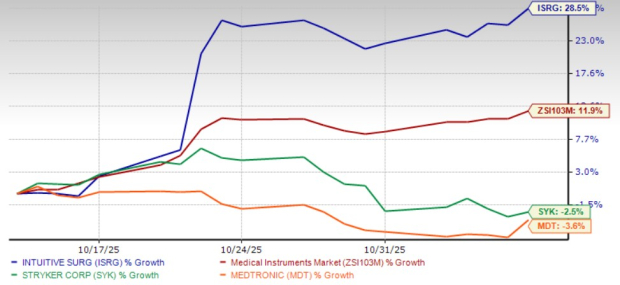

Intuitive Surgical’s ISRG shares have surged 28.5% over the past month, following a robust third-quarter performance that showcased 20% global procedure growth and accelerating adoption of its new da Vinci 5 system. Strong utilization gains, expanding international demand, and rapid growth in the Ion and SP platforms underscored investor optimism about sustained momentum. Management’s raised full-year procedure guidance further boosted confidence.

However, analysts remain cautious about potential margin pressures, competition in China, and the ongoing GLP-1–related drag on bariatric procedures, which could temper profitability even as long-term growth prospects remain compelling.

ISRG has significantly outperformed its peers, including Stryker SYK and Medtronic MDT, over the past month. Shares of Stryker and Medtronics have lost 2.3% and 3.4%, respectively, over the past month.

1-Month Performance

Intuitive Surgical delivered another strong performance in third-quarter 2025, underscored by robust global procedure growth and higher system utilization across its robotic platforms. The da Vinci procedures expanded 19% year over year, supported by benign general surgery in the United States and double-digit growth in gynecology and colorectal procedures internationally. The Ion robotic-assisted bronchoscopy system continued its steep trajectory, with procedures up 52% and utilization up 14%.

A key driver of the quarter was the accelerating adoption of da Vinci 5 (dV5), Intuitive Surgical’s newest multiport platform. Roughly 67,000 procedures were performed using dV5 during the third quarter — up from 50,000 in the second quarter — validating the company’s design goal of greater efficiency and surgeon autonomy. U.S. utilization rose 2%, reversing the flat trend seen in the first half of 2025, while international utilization climbed 8%, aided by multi-specialty uptake in Korea, India and Taiwan.

Meanwhile, the single-port (SP) platform posted 91% procedure growth, led by Korea and early progress in Europe and Japan. The first commercial cases of the SP stapler in colorectal and thoracic surgery hint at expanding applications, while potential regulatory clearances in nipple-sparing mastectomy and other procedures could further broaden its use.

Domestically, benign general surgery, including cholecystectomy, appendectomy, and hernia repair, remains the main growth engine. After-hours and acute-care surgeries also contributed, reflecting the efficiency gains and surgeon confidence brought by dV5.

Outside the United States, benign general surgery (up 39%), colorectal (up 28%), hysterectomy (up 27%), and thoracic (up 26%) led the growth. These categories, together, now account for about 40% of Intuitive Surgical’s non-U.S. da Vinci volumes. The company’s strategy of leveraging refurbished Xi systems in cost-sensitive markets is also creating incremental greenfield opportunities, particularly in Asia and Latin America.

The Ion platform continues to gain clinical validation. Studies in Europe have shown significantly higher diagnostic yields in lung biopsy compared to conventional bronchoscopy, positioning Ion as a differentiator in early-stage lung cancer diagnosis.

Management emphasized that utilization growth is still in the early stages of the dV5 cycle. Hospitals upgrading to dV5 often redeploy older Xi units to secondary sites or ambulatory surgery centers, effectively expanding access without new capital outlays. Over time, these dynamics, combined with digital tools like Hub data analytics and AI-driven surgical insights, are expected to sustain procedural throughput and deepen customer engagement.

Going forward, Intuitive Surgical aims to drive continued adoption of focused procedures across regions, secure broader regional clearances for dV5, and deepen the integration of digital and force-feedback technologies to enhance surgical precision.

Reflecting the positive sentiment around ISRG, the Zacks Consensus Estimate for earnings per share has seen upward revisions. In the past 30 days, analysts have raised their EPS estimates for the current and next fiscal year by 5.5% to $8.61 and 4.1% to $9.55, respectively. These estimates indicate year-over-year growth rate of 17.3% and 10.9%, respectively.

Despite the operational momentum, ISRG faces several challenges that may hurt its near-term prospects.

GLP-1 drugs continue to weigh on bariatric surgery volumes, which fell at a high-single-digit rate in third-quarter. Bariatrics now represents less than 3% of da Vinci procedures, but surgeons remain uncertain when the trend will stabilize.

In China, tender delays, government budget constraints, and intensifying local competition continue to pressure both system placements and pricing. While Intuitive Surgical retains a technological edge, management acknowledged ongoing price pressure in both capital and instruments & accessories.

Finally, gross margin contraction remains a concern. Pro forma gross margin fell 90 basis points year-on-year to 68%, reflecting tariffs, facility costs, and a higher mix of lower-margin dV5 and Ion systems. Even with cost reductions and improved leverage, margins are expected to hover in the 67-67.5% range for 2025, below dV5 pre-launch levels.

Shares of Intuitive Surgical have been on a decline for the major part of 2025 before jumping following better-than-expected third-quarter results. This decline has also lowered its valuation from its 5-year high in February 2025. However, it still trades at a premium to the industry’s current valuation and well above its peers. ISRG’s shares currently trade at a forward 12-month price-to-earnings (P/E) of 59.47X, significantly higher than the industry average of 30.08X. Currently, Stryker and Medtronic trade at 24.07X and 15.78X, respectively.

Despite Intuitive Surgical’s impressive procedure growth and strong adoption of da Vinci 5, mounting challenges threaten to overshadow its momentum. Persistent GLP-1-related weakness in bariatric surgeries, intensifying Chinese competition, and ongoing gross margin erosion raise concerns about the company’s ability to sustain growth in profitability, suggesting that recent optimism in its share price may prove challenging to maintain. Moreover, ISRG’s current valuation looks lofty compared to its industry and peers. The company currently holds a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

For those already holding the stock, it’s wise to stay put, as ISRG’s fundamental strengths and growth prospects are still intact. However, new investors might want to wait for a more favorable entry point, perhaps after a market dip, to avoid overpaying for future growth.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-28 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-25 | |

| Feb-25 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite