|

|

|

|

|||||

|

|

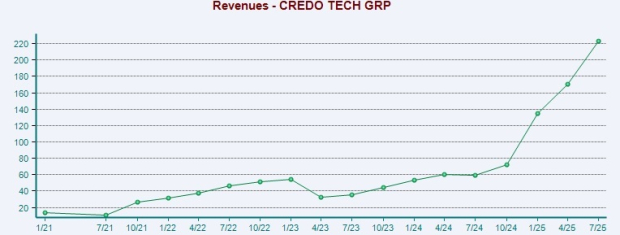

Credo Technology Group Holding Ltd (CRDO) has rallied 38% in the past three months, driven by accelerating business momentum as hyperscalers and data center operators aggressively invest in AI infrastructure. Fiscal first quarter revenues jumped 274% year over year while non-GAAP operating income was $96.2 million (compared with $2.2 million in the prior year).

The company ended the fiscal first quarter with a fortified balance sheet boasting a cash position of $479.6 million, giving it ample flexibility to invest in innovation and inorganic expansion.

The rally has outpaced the Electronic-Semiconductors and the broader Computer and Technology sector’s growth of 17.4% and 10.2%, respectively. The gains are also higher than some of its competitors, including Broadcom (AVGO), Marvell Technology (MRVL) and Astera Labs (ALAB). AVGO and MRVL have gained 15% and 17.6%, respectively, over the same time frame, while ALAB has declined 7.8%.

The big question now: Can Credo stock continue to climb higher from here, or has it already priced in much of the near-term upside?

Let us take a closer look at CRDO’s fundamentals, growth drivers, competitive advantages and potential risks, and assess whether it is wise to stay invested.

Credo’s business momentum is buoyed by its extensive clout in the Active Electrical Cables (AECs) space. AECs, which serve as power-efficient alternatives, have seen explosive adoption. These cables offer up to 1,000 times more reliability with 50% lower power consumption than optical solutions, added CRDO. In the last reported quarter, the AEC product line increased by healthy double digits sequentially. The adoption from intra-rack to rack-to-rack deployments is expected to boost further revenues from this product line.

Traction in the optical business and PCIe and Ethernet retimer businesses is another key catalyst. The company is investing heavily in both copper and optical solutions to diversify its market position. Its optical DSP segment maintained strong momentum, positioning the company to achieve a doubling of optical revenues again in the current fiscal year. CRDO added that recently launched PCIe retimer solutions were gaining “significant traction” and expects PCIe design wins in 2025 with production revenues in 2026. The PCIe-based solutions for AI scale-up networks expand CRDO’s addressable market.

Frequent product launches across segments are expected to drive top-line growth. Last week, CRDO unveiled a memory fanout gearbox called Weaver within its new product family, OmniConnect. This gearbox is designed to accelerate memory bandwidth and density, optimizing the computing efficiency of AI accelerators. The new ZeroFlap (“ZF”) optical transceiver product line is crafted to deliver superior reliability, energy efficiency and stability for AI backend networks. Supporting 400G, 800G and 1.6T speeds, the ZF optical portfolio addresses a key industry challenge, optical link flaps, where connections repeatedly drop and reconnect, disrupting network performance.

In September, the company introduced its Bluebird DSP, a high-performance, low-power solution for 1.6 Tbps optical transceivers that delivers 224 Gbps per lane PAM4 data transmission. Bluebird enables transceivers to operate under 20 watts, making them ideal for dense AI and hyperscale data centers.

CRDO recently collaborated with the Arm Total Design ecosystem to integrate its high-speed SerDes and mixed-signal DSP IP (including SerDes chiplets) with the latter’s processor technology. The integration will allow for faster and efficient design of custom silicon solutions for next-generation AI, cloud computing and hyperscale data center applications.

To gain market share, CRDO is focused on inorganic expansion. In October, Credo acquired Hyperlume, Inc., a privately held developer of miniature light-emitting diode (microLED) technology-based optical interconnects for chip-to-chip communication. With this buyout, CRDO expects to boost its next-generation connectivity solutions as AI, cloud and hyperscale data centers place unprecedented demands on data infrastructure deployments. Acquisitions like this are valuable for companies as they accelerate access to the latest technologies. These types of buyouts provide valuable tools, technologies and market access that accelerate and amplify organic growth.

Increasing market competition and macroeconomic uncertainties amid tariff troubles may impact CRDO’s growth trajectory. Credo competes with semiconductor giants like Broadcom and Marvell Technology.

While hyperscaler demand is a growth driver, it also poses risks. In the fiscal first quarter, three hyperscalers each contributed more than 10% of revenues and CRDO noted that there was a material revenue contribution from a fourth hyperscaler. Though it expects revenues from the additional hyperscaler to increase throughout fiscal 2026, with just three to four hyperscaler customers, Credo’s revenue base remains highly concentrated.

Management expects these three to four hyperscalers to surpass 10% of revenues in the upcoming quarters and fiscal year. Two additional hyperscalers are expected to commence ramping in fiscal 2026. Nonetheless, any spending slowdown or in-house component development by these clients could materially impact topline performance.

Moreover, CRDO’s bullish narrative hinges on AI investment. While these segments are currently experiencing high growth, they are also cyclically dependent on AI capex spending, which could decelerate after initial buildouts.

Management has guided for sequential revenue growth of 5% at the midpoint in the fiscal second quarter, compared with 31% sequential growth in the first quarter, indicating near-term deceleration.

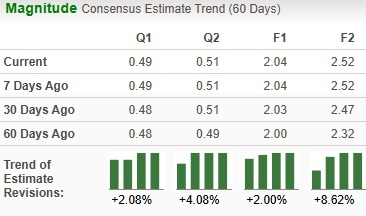

Analysts have slightly revised earnings estimates upwards over the past 60 days for the currnet year.

In terms of the forward 12-month Price/Sales ratio, CRDO is trading at 25.45, higher than the Electronic-Semiconductors sector’s multiple of 7.62. It seems that the current price has already factored in much of the anticipated AI-driven upside.

In comparison, Broadcom trades at a forward 12-month P/S multiple of 19.29, while Astera Labs and Marvell are trading at a multiple of 4.97 and 7.62, respectively.

CRDO carries a Zacks Rank #3 (Hold) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

In a market increasingly driven by AI tailwinds, CRDO stands out as a pure-play beneficiary with differentiated products, strong financials and increasing demand.

However, a sharp 38% rally, premium valuation, hyperscaler concentration risk, competitive pressures and macro uncertainties limit near-term upside potential.

Investors looking to invest are better off waiting for a favorable entry point, while investors already having a position can retain the stock given the compelling long-term fundamentals.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 hour | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite