|

|

|

|

|||||

|

|

The Internet Software and Services space is gathering momentum owing to robust IT spending on solutions that support hybrid operating environments. Outstanding penetration of mobile devices among users makes sense for businesses to invest heavily in web-based infrastructure, applications and security software.

Within the Technology sector, the Zacks-defined Internet Software industry is currently within the top 28% of the Zacks Industry Rank. Since the Internet Software industry is ranked in the top half of the Zacks Ranked Industries, we expect it to outperform the market over the next three to six months.

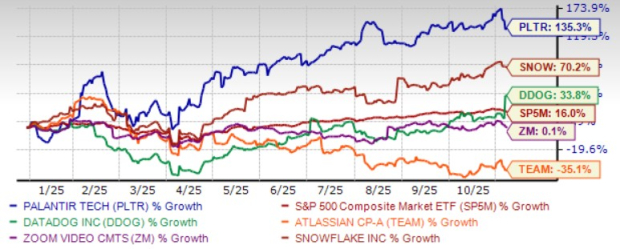

We recommend five artificial intelligence (AI)-focused stocks from this space that have strong potential for 2026. These are — Palantir Technologies Inc. PLTR, Snowflake Inc. SNOW, Datadog Inc. DDOG, Atlassian Corp. TEAM and Zoom Communications Inc. ZM. Each of our picks currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The chart below shows the price performance of our five picks year to date.

Palantir Technologies’ AI strategy is comprehensive, combining its proprietary Foundry and Gotham platforms with a solid plan to promote AI adoption across both government and commercial sectors. PLTR’s AI Platform (AIP) is the backbone of these capabilities, enabling organizations to process large datasets and derive real-time insights. This is especially valuable in sectors requiring extensive data integration, such as defense, healthcare, finance and intelligence, where operational efficiency and decision-making speed are critical.

In the government sector, PLTR is aligning its AI strategy with U.S. defense priorities. Its work in high-profile initiatives, such as the Department of Defense’s Open DAGIR project, highlight its ability to modernize military operations through AI-driven solutions where data interoperability and real-time decision-making capabilities are imperative. These capabilities solidify PLTR’s position as a key player in the defense sector.

In the commercial space, PLTR’s AIP boot camps — providing hands-on experience to over 1,000 companies — have proven instrumental in customer acquisition. Boot camps showcase the platform’s capabilities and demonstrate its adaptability across logistics, manufacturing, and supply chain management. Palantir’s core customer base comprises businesses seeking tailored AI/ML services, particularly large government and corporate clients willing to invest heavily in its systems.

AIP provides unified access to open-source, self-hosted, and commercial large language models (LLMs) that can transform structured and unstructured data into LLM-understandable objects and turn organizations' actions and processes into tools for humans and LLM-driven agents. This shift in the revenue structure has enabled PLTR to no longer depend on government defense agencies.

Palantir Technologies has an expected revenue and earnings growth rate of 41.1% and 43%, respectively, for next year. The Zacks Consensus Estimate for next year’s earnings has improved 20.9% in the last seven days.

Snowflake is positioned to benefit from accelerating demand for cloud-based data platforms. Its AI Data Cloud unifies structured and unstructured data with governance, while Snowpark and Dynamic Tables expand developer use cases and enable real-time analytics. These capabilities strengthen Snowflake’s role in helping enterprises scale workloads on cloud-native infrastructure.

The outlook for the cloud analytics market supports this trajectory. Grand View Research projects the market to expand from $35.39 billion in 2024 to $130.63 billion by 2030, reflecting a 25.5% CAGR. This expansion is expected to be driven by enterprises transitioning from legacy infrastructure and investing in scalable platforms to manage growing data volumes and real-time analytics requirements.

Snowflake’s unified architecture and consumption-based model directly align with this trend, creating opportunities for greater adoption across industries. SNOW’s platform continues to gain adoption among large enterprises across industries as these companies are leveraging the AI Data Cloud to unify workloads, improve visibility and drive more personalized customer experiences.

Increasing demand for enterprise AI solutions has been a game-changer for SNOW. The company’s expanding footprint across a plethora of end markets is noteworthy. SNOW offers verticalized AI Data Clouds across industries, including Financial Services, Healthcare, Retail, Technology, Telecom, Public Sector, manufacturing and more. The company has introduced new automotive solutions as part of its AI data cloud for manufacturing.

Snowflake has an expected revenue and earnings growth rate of 22.3% and 33.9%, respectively, for next year (ending January 2027). The Zacks Consensus Estimate for next year’s earnings has improved 4% in the last 60 days.

Datadog is benefiting from new customer additions and increased adoption of its cloud-based monitoring and analytics platform, driven by accelerated digital transformation and cloud migration across organizations.

At DASH 2025, DDOG unveiled an extraordinary portfolio of over 125 new products, capabilities, and features, demonstrating unmatched innovation velocity in the observability and monitoring space. Key launches included three specialized AI agents, advanced log management solutions like Archive Search and CloudPrem, and the Internal Developer Portal built on live observability data.

DDOG also introduced groundbreaking AI observability tools including AI Agent Monitoring and LLM Experiments, alongside breakthrough research with Toto time series models. This comprehensive innovation pipeline strengthens customer engagement, drives platform adoption, and establishes significant competitive moats against emerging competitors.

DDOG’s observability and security platforms are increasingly being adopted to monitor and optimize AI-powered applications, resulting in increasing data volumes and broader product usage. As more organizations integrate large-scale AI models into production, DDOG’s integrated monitoring capabilities and recently launched AI-focused solutions strengthened customer adoption trends and multi-product usage.

Datadog has an expected revenue and earnings growth rate of 19% and 15.4%, respectively, for next year. The Zacks Consensus Estimate for next year’s earnings has improved 0.9% in the last seven days.

Atlassian has been benefiting from the rising demand for remote working tools amid the hybrid work trend and accelerated digital transformation. TEAM’s AI-powered capabilities are seeing rapid adoption, with over 1 million monthly active users engaging with Atlassian Intelligence features, marking a 25X year-over-year increase in AI interactions.

Atlassian’s AI-powered Rovo platform and automation tools are driving significant growth in premium and enterprise editions, demonstrating high demand for AI-enhanced workflows. Investments in multi-model AI strategies and advanced search capabilities further differentiate TEAM’s offerings in an increasingly competitive landscape.

TEAM’s latest focus on adding generative AI features to some of its collaboration software is likely to drive the top line over the long run. The company has collaborated with OpenAI to enhance the capabilities of its Confluence, Jira Service Management and other programs with generative AI features. TEAM is offering generative AI-enabled features under the Atlassian Intelligence brand, which is designed to help employees be more efficient while users remain in control of data.

Atlassian has an expected revenue and earnings growth rate of 20.8% and 27.7%, respectively, for the current year (ending June 2026). The Zacks Consensus Estimate for the current year’s earnings has improved 0.6% in the last seven days.

Zoom Communications is gaining significant traction from the hybrid working wave, which has accelerated the need for digital transformation among enterprises. The launch of AI-driven solutions like Zoom Doc and Zoom AI Companion holds promise, particularly AI Companion's remarkable 4x user growth.

ZM’s AI Companion achieved extraordinary adoption with monthly active users growing fourfold year-over-year and 40% quarter-over-quarter growth in fiscal 2026. The platform integrates with 16 third-party applications including ServiceNow, Jira, and Asana, transforming from a passive meeting assistant to an autonomous task executor through agentic AI capabilities.

ZM’s Custom AI Companion add-on enables organizations to tailor AI functionality with custom meeting templates, industry-specific vocabularies, and personalized digital coaching. This AI-first strategy positions ZM ahead of competitors, with customers reporting significant operational efficiencies including a 40% reduction in manual contact center labor, creating substantial value beyond traditional video conferencing.

Zoom Communications has an expected revenue and earnings growth rate of 3% and 0.1%, respectively, for next year (ending January 2027). The Zacks Consensus Estimate for next year’s earnings has improved 3.9% in the last 60 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 hour | |

| 2 hours | |

| 2 hours | |

| 3 hours | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 |

Stock Market Today: Dow, Nasdaq Eke Out Gains; Gold, Silver Names Slide (Live Coverage)

PLTR

Investor's Business Daily

|

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite