|

|

|

|

|||||

|

|

MP Materials MP announced third-quarter 2025 results on Nov. 6, with revenues declining 15% year over year to $53.6 million, surpassing the Zacks Consensus Estimate. The company achieved record neodymium and praseodymium (NdPr) production and also logged the second-highest quarterly output of rare earth oxides (REO).

Despite the revenue dip, MP Materials reported a loss of 10 cents per share, narrower than the Zacks Consensus Estimate of a loss of 14 cents and the year-ago quarter’s loss of 12 cents. The earnings beat triggered a positive market reaction, with shares climbing 12.8% after the announcement.

MP Materials shares have moved up 275.7% year to date, outperforming the Zacks Mining - Miscellaneous industry’s growth of 23.7%. In comparison, the Zacks Basic Materials sector has gained 18.6%, while the S&P 500 has moved up 16.1%.

MP Materials has outperformed other names in the rare earths space like Lynas Rare Earths Limited LYSDY and Energy Fuels UUUU, which have advanced 205.1% and 125.4%, respectively, in the same timeframe.

Before addressing the critical question of how investors should position themselves regarding the stock, let us first review the company’s third-quarter results.

MP Materials produced 721 metric tons of NdPr, a 51% year-over-year surge as a result of ramping production of separated products. NdPr sales volumes rose 30% to 525 metric tons.

The Materials segment’s revenues declined 50% year over year to $31.6 million as a 61% increase in NdPr oxide and metal revenues (due to higher sales volumes and prices) was offset by the absence of rare earth concentrates in the quarter.

REO production was down 4% to 13,254 metric tons. There were no REO sales in the quarter compared with 9,729 MT in the year-ago quarter, reflecting the company’s decision to halt concentrated shipments to China.

The Magnetics segment generated revenues of $21.9 million in the third quarter and adjusted EBITDA of $9.48 million in the quarter. Initial commercial magnet production remains on track for year-end.

MP Material’s total revenues declined 14.9% year over year to $53.6 million.

Cost of sales declined 10.3%. Selling, general and administrative expenses were up 32% due to higher legal costs and increased employee headcount to support downstream expansion.

MP Materials witnessed an 828% surge (or $17 million) spike in Advanced projects and development expenses, which included transaction costs associated with the United States Department of War (DoW) agreements and transaction costs incurred to secure financing.

Adjusted EBITDA was a loss of $12.57 million compared with a loss of $11.2 million in the year-ago quarter, mainly dragged down by the Materials segment owing to a lack of rare earth concentrate revenues.

The company reported an adjusted loss of 10 cents per share compared with the year-ago quarter’s loss of 12 cents.

The company’s strategy of producing and selling more separated products at Mountain Pass and the ramp-up of output of magnetic precursor products are expected to lead to higher costs this year, and likely lead to a full-year loss.

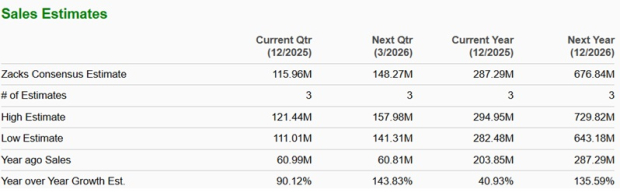

The Zacks Consensus Estimate for MP Materials’ revenues indicates a 40.9% increase year over year in 2025, and a further 135.6% in 2026.

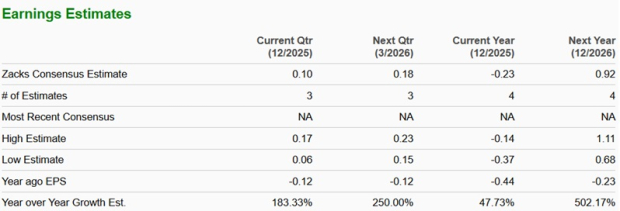

The consensus estimate for 2025 earnings is currently pegged at a loss of 23 cents per share. The consensus estimate for earnings of 92 cents per share for 2026 implies a potential turnaround.

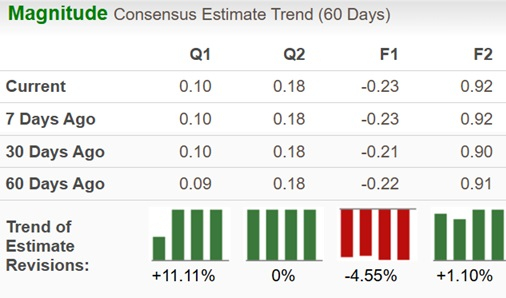

The Zacks Consensus Estimate for MP’s fiscal 2025 earnings has moved down 4.55% while the same for 2026 earnings has moved up 1.10%, over the past 60 days.

The Zacks Consensus Estimate for MP’s fiscal 2025 earnings has moved down 4.55% while the same for 2026 earnings has moved up 1.10%, over the past 60 days.

MP Materials stock is trading at a forward 12-month price/sales multiple of 16.67X, a significant premium to the industry’s 1.42X. MP’s Value Score of F suggests that the stock is not so cheap and a stretched valuation at this moment.

Meanwhile, Lynas and Energy Fuels are trading lower at 11.81X and 44.32X, respectively.

MP Materials operates the Mountain Pass Rare Earth Mine and Processing Facility, the only rare earth mining and processing site of scale in North America. These materials are essential for a wide range of existing and emerging clean-tech technologies. With China dominating the global supply, the US is increasingly prioritizing the development of domestic rare earth capabilities.

The multibillion-dollar investment package and long-term commitments from DoW provide MP Materials the opportunity to capitalize on this. MP will construct the second domestic magnet manufacturing facility (the 10X Facility), which will take total U.S. rare earth magnet manufacturing capacity to 10,000 metric tons.

MP plans to begin commissioning its new heavy rare earth separation facility at Mountain Pass by next year. The facility is designed to process approximately 3,000 MT of feedstock per year and will initially prioritize production of dysprosium (Dy) and terbium (Tb). The Dy/Tb circuit will have a nameplate capacity of 200 MT per year and support MP’s planned annual production of 10,000 MT of high-performance NdFeB magnets.

MP Materials’ unmatched positioning in the U.S. supply chain, efforts to ramp up operations and premium partnerships with Apple and the DoD indicate a robust growth runway. MP has been reporting upbeat production numbers and making investments in boosting production capacity. However, elevated costs will continue to pressure earnings, with the current year likely ending in a loss.

Investors holding MP shares should continue to do so to benefit from the solid long-term fundamentals of rare earth products. However, considering its premium valuation, the expected loss for the current year, accompanied by downward estimate revision activity, new investors can wait for a better entry point. MP Materials currently carries a Zacks Rank #3 (Hold).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 4 hours | |

| 4 hours | |

| 5 hours | |

| 5 hours | |

| 5 hours | |

| 5 hours | |

| 6 hours | |

| 6 hours | |

| 7 hours | |

| 10 hours | |

| 12 hours | |

| 12 hours | |

| 13 hours |

Rare-Earth Miner MP Materials to Invest More Than $1.25 Billion in New Texas Factory

MP

The Wall Street Journal

|

| 14 hours | |

| 14 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite