|

|

|

|

|||||

|

|

Dollar Tree, Inc. DLTR has been making smart moves to enrich shoppers’ experience. The company’s progress on optimizing its store portfolio through store openings, renovations, re-banners and closings bodes well.

Recently, DLTR entered a definitive agreement to sell its Family Dollar business to Brigade and Macellum for $1.007 billion, subject to adjustments for working capital and net debt. The transaction, expected to close in 90 days, is contingent upon customary closing conditions, including U.S. antitrust approval. Hence, Dollar Tree has classified Family Dollar as held for sale, reporting its results as discontinued operations in its financial statements.

Dollar Tree’s 3.0 multi-price strategy has been working excellently. The 3.0 stores are new or converted, offering expanded multi-price assortments. In the most recent quarter, the company opened 33 Dollar Tree stores, bringing fiscal 2024 store openings to 525. At the end of fiscal 2024, it had approximately 2,900 Dollar Tree 3.0 multi-price format stores, including 2,600 conversions and 300 new stores.

The company remains pleased with the expanded assortments’ performance in 3.0 stores. Its in-line 3.0 stores recorded a 220-basis-point (bps) comp lift compared with the other formats, comprising a 40-bps lift in consumables and a 290-bps lift in discretionary. 3.0 stores also recorded a 20-bps traffic lift and a 200-bps ticket lift. By fiscal 2025, management targets roughly 5,200 3.0 stores, consisting of 2,000 new conversions and 300 new stores.

Other formats are 2.0, which have a smaller multi-price assortment focused on a single aisle, and 1.0 stores, where more than 95% of the items are priced at $1.25. Dollar Tree’s restructuring and expansion initiatives, which are quite evident from steady store openings and improvement of distribution centers, are likely to drive revenues. Such initiatives are also boosting comps and profitability.

In addition, the company has been working on expanding the assortment, offering shoppers a broad range of choices across a variety of categories, comprising food and snacks, beverages, pet care, personal care and others.

Tough macro factors have been hurting customer sentiment and, in turn, the discretionary demand and buying behavior. Given the anticipated 2025 imports, the estimated net impact of the 10% China tariff before any mitigation efforts would be nearly $15-$20 million per month.

Dollar Tree has been struggling with higher selling, general and administrative (SG&A) expenses for a while now. Adjusted SG&A costs were 27% of sales, up 260 bps from the year-earlier quarter. The rise was driven by software impairments and the contract termination costs related to the Family Dollar sale, along with higher depreciation, stock compensation, professional fees and utility costs.

For fiscal 2025, management expects deleverage of about 50-80 bps, stemming from increased store payroll with respect to the investments in additional hours and state-mandated minimum wage rises, and management incentive compensation. Our model anticipates a rise of 50 bps in adjusted SG&A, as a percentage of sales, for fiscal 2025.

Dollar Tree has been making strategic efforts to revert to growth. Its store-related endeavors appear quite encouraging. Looking ahead, management projects robust top-line growth from the Dollar Tree banner, with sales backed by multi-price expansion, operating improvements in stores, store openings and the ramping up of its recently introduced stores, particularly the former 99 Cents Only portfolio. Management expects same-store sales growth of 3-5% for the first quarter of fiscal 2025 compared with our estimate of a 4.7% rise.

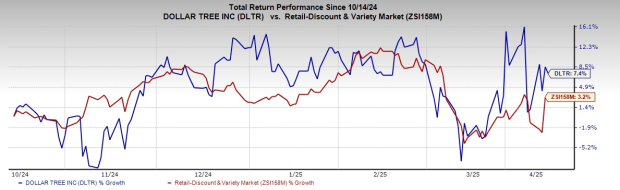

DLTR’s shares have gained 7.4% in the past six months compared with the industry’s 3.2% growth. The stock currently has a Zacks Rank #3 (Hold).

We have highlighted three better-ranked stocks, namely Gap GAP, Boot Barn BOOT and Urban Outfitters URBN.

Gap, clothing and accessories retailer, currently sports a Zacks Rank #1(Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The consensus estimate for Gap’s current financial-year sales indicates growth of 1.6% from the year-ago figure. GAP delivered an average earnings surprise of 77.5% in the trailing four quarters.

Boot Barn, a lifestyle retail chain devoted to western and work-related footwear, apparel and accessories, currently has a Zacks Rank #2 (Buy).

The Zacks Consensus Estimate for Boot Barn’s current financial-year sales indicates growth of 14.9% from the year-ago figure. The company delivered a trailing four-quarter earnings surprise of 7.2%, on average.

Urban Outfitters, a fashion lifestyle specialty retailer, currently carries a Zacks Rank of 2. URBN delivered an average earnings surprise of 28.4% in the trailing four quarters.

The consensus estimate for Urban Outfitters’ current financial-year sales indicates growth of 6.6% from the year-ago figure.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 10 hours | |

| 10 hours | |

| 11 hours | |

| 12 hours | |

| 17 hours | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite