|

|

|

|

|||||

|

|

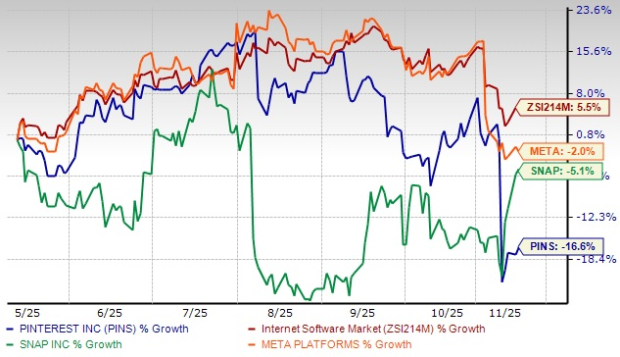

Pinterest, Inc. PINS has declined 16.6% over the past six months against the industry’s growth of 5.5%. It also lagged peers like Snap Inc. SNAP and Meta Platforms, Inc. META over this period. While Snap declined 5.1%, Meta was down 2%.

This Internet content provider that operates as a discovery platform relies heavily on advertising as its primary source of revenue. With a macro slowdown in the broader digital advertising domain, Pinterest is increasingly finding it difficult to sustain its growth momentum.

Six-Month PINS Stock Price Performance

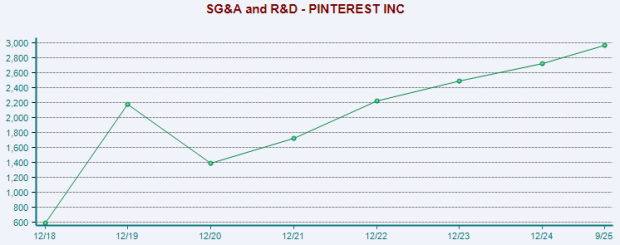

Over the years, soaring operating expenses have dented Pinterest’s profitability. The company expects to incur considerably higher operating expenses in the near term to expand operations domestically and internationally, enhance product offerings, broaden the Pinner and advertiser base, expand marketing channels, hire additional employees and develop technology. Increased infrastructure spending related to user and engagement growth is likely to result in higher cost of revenues. Total costs and expenses increased to $990.6 million in third-quarter 2025 from $904.3 million in the year-ago quarter due to headcount growth, higher R&D and increased marketing and general and administrative expenses.

In addition, Pinterest faces significant competition from larger, more established companies such as Amazon, Facebook (including Instagram), Google, Snap and Twitter. These companies provide their users with a variety of online products, services, content (including video) and advertising offerings, including web search engines, social networks and other means of discovering, using or acquiring goods and services. PINS also faces competition from smaller firms, including Allrecipes, Houzz and Tastemade, which offer users engaging content and commerce opportunities through similar technology, products and features or services.

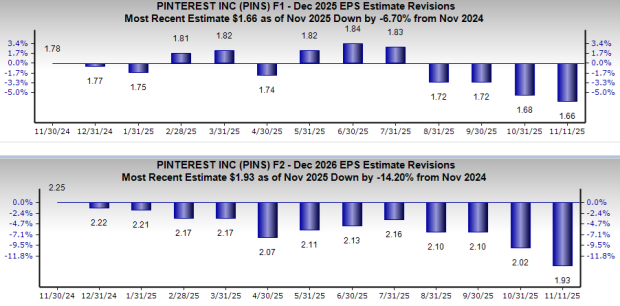

Pinterest is currently witnessing a downtrend in estimate revisions. Earnings estimates for PINS for 2025 have moved down 6.7% to $1.66 over the past year, while the same for 2026 has decreased 14.2% to $1.93. The negative estimate revision portrays bearish sentiments about the stock’s growth potential.

From a valuation standpoint, Pinterest appears to be relatively cheap compared to the industry and below its mean. Going by the price/sales ratio, the company shares currently trade at 3.92 forward sales, lower than 5.04 for the industry and the stock’s mean of 5.51.

Pinterest is taking various initiatives to bring more actionable content on the platform from a wide range of sources, such as users, creators, publishers and retailers. This has resulted in a solid improvement in engagement metrics like sessions, impressions and saves across all regions. Healthy traction in emerging verticals like men’s fashion, auto, health and travel is a tailwind. Pinterest is increasingly establishing a unique value proposition to advertisers that could provide a competitive advantage in the long haul.

The company’s focus on improving operational rigor and incorporating sophisticated AI models to enhance relevancy and personalization is likely to bring long-term benefits. Pinterest is also emphasizing building new ad tools and formats to help grow the scope of monetization on the platform. This will enable advertisers to measure the results and conversion rates, which will improve their decision-making. It has partnered with Amazon.com, Inc. AMZN to further capitalize on the commercial intent of its user base and increase shoppability on its platform.

The acquisition of the AI-powered, high-tech fashion-shopping platform, The Yes, has enabled it to create a strategic organization to help steer the evolution of its features and merchants. Pinterest and The Yes share a common vision of making it easy for customers to find products matching their tastes and styles. The combined company has been making continuous efforts to absorb creators publishing videos and live streams to make the shopping experience swift and easy for customers.

Pinterest is witnessing strong user engagement across all regions. Through third-party ad integration with Google, Pinterest aims to introduce monetization opportunities in several unmonetized international markets. It appears to be trading at a relatively cheaper level at the moment.

However, increasing competition from other video-centric consumer apps is likely to adversely impact user engagement to some extent. High operating expenses to expand operations and incorporate the latest technological innovations are expected to dent its profitability. The downtrend in estimate revisions and declining stock price performance further signifies bearish sentiments for the stock.

With a Zacks Rank #4 (Sell), Pinterest appears to be lurking in the forsaken territory, and investors could be better off if they avoid this stock. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 10 min | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 |

Mark Zuckerberg Grilled on Usage Goals and Underage Users at California Trial

META

The Wall Street Journal

|

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite