|

|

|

|

|||||

|

|

Quantum computing stocks have soared in recent years based on hype, and Rigetti Computing is no exception.

Quantum computing could revolutionize a host of industries, but the technology is quite a few years away from commercial viability.

Rigetti's share price is disconnected from the company's fundamentals.

In the stock market, there's a not-so-subtle difference between investing and speculating. People doing the first are usually looking at an asset and considering its fundamentals and value; those doing the second hope to capitalize on momentum and hype. And while buying speculative stocks can deliver explosive returns over the short term, usually, that strategy will eventually underperform the slower but steadier returns of well-considered investment decisions over the long term.

Rigetti Computing (NASDAQ: RGTI) might be a great example of this concept. While shares of the quantum computing start-up are still up by about 2,000% in the last 12 months, its rally has begun to crack. The stock has already dropped by about 44% from its all-time high of $56, and it may continue to give back its gains. So what do Rigetti's fundamentals tell us about when it might be a good time to buy the stock?

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Quantum computing technology can be used to create a new type of computer that can solve certain unusual types of problems that are unsolvable in any useful period of time by even the fastest classical supercomputers.

If quantum computers can be made practical, reliable, and cost effective, they could revolutionize an array of fields, from drug discovery to cryptography to materials science. They could also help businesses create trillions of dollars in shareholder value. But while quantum computing has been generating a lot of buzz recently, it is still a speculative and uncertain technology. Fundamentally, the underlying physics that makes quantum computers so powerful also makes them incredibly finicky, delicate, and millions of times more prone to errors than the chips powering whatever digital device you're reading this article on. Solving those problems will not be trivial -- nor will it be cheap.

Analysts at McKinsey & Company believe it could take until 2040 or later before one of these devices will be able to function at scale. And while industry leader Alphabet believes it can create a commercially viable quantum computer within five years, investors should take that forecast with a grain of salt. Big tech is not infallible, and management teams have an incentive to err on the side of optimism to keep shareholders happy.

In January, Nvidia CEO Jensen Huang predicted that practical quantum computing could be 20 years away. He later backpedaled from that assertion somewhat after learning that it had led to a sharp pullback in quantum computing stocks.

Yet even if quantum computing eventually has its ChatGPT moment, there is no guarantee that the early movers will rapidly become profitable from an operational perspective. Technical viability is a first step. But it could take many more years after companies reach that milestone before they are able to scale quantum computing into a sustainably profitable business model.

With commercially viable quantum computing likely over a decade away, investors should pay close attention to Rigetti Computing's less-than-encouraging operational results. With revenue of just $1.8 million, the company is nowhere close to being able to handle its massive overhead and research and development expenses, which added up to a total of $20.4 million in operating costs last quarter. Rigetti's cash burn could increase over time as it seeks to stay competitive.

To be fair, it's normal for growth-oriented companies to generate losses as they scale up their business models. But Rigetti is arguably in a "pre-growth" phase where its addressable market hasn't even fully materialized yet -- even if it has managed to secure some one-off deals in certain quarters.

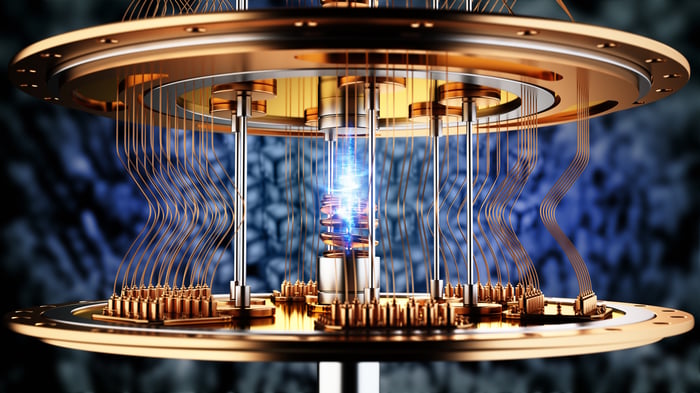

Image source: Getty Images.

Rigetti was only able to go public through a reverse merger with a special purpose acquisition company (SPAC), which allowed it to bypass the stricter requirements for an initial public offering on the Nasdaq exchange. While SPACs have given retail investors the ability to buy into the types of businesses that were previously only available to venture capitalists, these companies also carry a higher level of risk than those that came public through conventional means. And SPAC companies as a class now have a clear track record of underperforming their traditional peers.

Rigetti Computing is a speculative stock that has soared this fall. So investors should recognize that it faces significant near-term downside risks as the hype fades and people take a closer look at its actual numbers. That said, while Rigetti looks like a poor fundamental investment right now, that doesn't mean it will always be a dud.

Although we don't know precisely when quantum computing will become a commercially viable technology, Rigetti has positioned itself as an early mover in the pick-and-shovel side of the opportunity by making its own quantum chips and processors. Investors should keep the company on their watch lists in case the company's operational results improve over the next few years.

Before you buy stock in Rigetti Computing, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Rigetti Computing wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $604,044!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,220,149!*

Now, it’s worth noting Stock Advisor’s total average return is 1,064% — a market-crushing outperformance compared to 194% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of November 10, 2025

Will Ebiefung has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet. The Motley Fool has a disclosure policy.

| Feb-17 | |

| Feb-17 |

Quantum Computing Stocks: Infleqtion Pops In First Day As Public Company

RGTI

Investor's Business Daily

|

| Feb-17 | |

| Feb-17 | |

| Feb-14 | |

| Feb-14 | |

| Feb-13 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-11 | |

| Feb-11 | |

| Feb-10 | |

| Feb-10 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite