|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

CoreWeave, Inc. (CRWV), one of the fastest-growing players in the AI infrastructure space, saw its shares slide following the third-quarter 2025 results, as investors reacted to concerns over delays, rising capital expenditures and a reduction in guidance. Its shares slid 16.3% in the last session, taking the decline to 37.6% in the past month, underperforming the Zacks Internet-Software Market’s loss of 6.8%.

The key question for investors: With CRWV stock down, is this dip a buying opportunity or a warning sign? Let’s take a deeper look at the recent numbers, management commentary and forward outlook points to ascertain the best course of action.

Revenues in the third quarter were a record $1.4 billion, which beat the Zacks Consensus Estimate by 6.8% and jumped 134% year over year. The top-line performance was driven by surging demand for AI compute capacity.

Revenue backlog (inclusive of remaining performance obligation and other amounts the company estimates will be recognized as revenues in future periods under committed customer contracts) was $55.6 billion. The revenue backlog nearly doubled quarter over quarter.

Total operating expenses were $1.3 billion compared with $466.8 million in the year-ago quarter.

Operating income was $51.9 million compared with $117.1 million in the prior-year quarter. Adjusted operating income was $217.2 million, up 74% year over year, while adjusted operating margin was 16%, down from 21%.

As of Sept. 30, 2025, CRWV had $3 billion in cash, cash equivalents and restricted cash.

Amid intense competition, pressures like heavy capex, rising interest costs and delays have kept investors on tenterhooks, leading to a sharp fall post-earnings announcement. CoreWeave faces tough competition in the AI cloud infrastructure space, which boasts behemoths like Amazon and Microsoft and other players like Nebius (NBIS). Nebius is another hypergrowth AI infrastructure focused company. Third quarter group revenues for Nebius surged 355% year over year to $146.1 million while the core infrastructure business (comprising 90% of total revenues) surged 400%.

Management cited delays in powered-shell delivery associated with the data center provider as affecting fourth-quarter results. CRWV expects full-year 2025 revenues to be between $5.05 billion and $5.15 billion compared with $5.15 billion to $5.35 billion projected earlier.

Adjusted operating income is forecasted to be between $690 million and $720 million compared with $800-$830 million anticipated earlier. CRWV is bringing some large-scale deployments online in the fourth quarter and this is expected to impact adjusted operating income. The metric will be affected due to the timing difference between when data center costs are first incurred and subsequent revenue recognition.

Capex is estimated to be $12 billion to $14 billion compared with $20 billion to $23 billion projected earlier. It expects to recognize the vast amount of capex for the fourth quarter in the first quarter of 2026 following delayed of powered-shell capacity. 2026 capex is expected to be in excess of double that of 2025. Higher capex can be a concern if revenues do not keep up the required pace to sustain such high capital intensity, especially in a macro environment where AI demand cycles could fluctuate due to competitive pricing and regulatory changes.

Another concern is that CoreWeave’s aggressive data center buildout is being funded in large part by debt. The company has raised a staggering $14 billion in debt and equity year to date. Interest expense surged to $311 million compared with $104 million a year ago. For 2025, it expects interest expenses to be between $1.21 billion and $1.25 billion, owing to high leverage. Higher interest expenses can exert pressure on the adjusted net income and potentially affect free cash flow generation and undermine near-term profitability. Adjusted net loss for the third quarter was $41 million against adjusted net income of $67 million a year ago.

With its GPU-based cloud services tailored specifically for AI workloads, CRWV is at the center of the AI infrastructure boom. A $55.6 billion backlog including $50 billion in RPO provide ample revenue visibility and financial predictability. Importantly, the company continues to diversify its customer base, with no single customer exceeding 35% of backlog, down from 50% from the last quarter.

CoreWeave is rapidly increasing its infrastructure footprint with eight new data centers across the United States in the third quarter. Further expansions are underway in Europe, including Scotland. CRWV highlighted that no single data center provider accounts for more than 20% of its contracted power, which adds operational resilience.

CRWV had nearly 590 megawatts (“MW”) of active power and contracted power of 2.9 gigawatts (“GW”) at the quarter-end. With more than 850 MW of active power targeted by year-end, CRWV is positioning itself as a top-tier provider capable of meeting the needs of large-scale AI training and inference workloads. With 1 GW of contracted capacity still unsold, CoreWeave is well-placed to capture future demand.

CoreWeave Inc. price-consensus-eps-surprise-chart | CoreWeave Inc. Quote

Also, the company’s focus on strengthening its storage ecosystem will drive recurring revenue streams. The new CoreWeave AI Object Storage solution offers 75% cost reduction and is witnessing increasing traction. Management noted that its entire storage platform already boasts $100 million in ARR..

The company’s partnership with NVIDIA Corporation (NVDA) is a big plus. CoreWeave is one of the first cloud providers to deploy NVIDIA’s GB200 and GB300 GPUs at scale, maintaining a technical lead. NVIDIA also has an agreement with CRWV to purchase residual unsold capacity through April 13, 2032, subject to certain conditions.

Partnerships with OpenAI and Meta Platforms (META) validate its AI infrastructure as cutting-edge and reliable. The company entered into a multi-year deal worth up to approximately $14.2 billion with META to supply cloud computing capacity. The new OpenAI expansion contract, worth $6.5 billion, involves CRWV supplying capacity for OpenAI training of its next-generation models. The total value of OpenAI contact now stands at an impressive $22.4 billion, which includes $11.9 billion agreement in March and $4 billion expansion in May.

CoreWeave also deepened ties with a leading hyperscaler, marking their sixth contract, and continued to serve as the preferred partner for innovators, such as Mizuho Bank, NASA for Jet Propulsion Laboratory, and Poolside. The launch of CoreWeave Federal opens new vertical targeting U.S. government agencies and the defense industrial base.

Further, the company is on an acquisition spree to supplement inorganic growth. CoreWeave’s recent acquisitions of OpenPipe, Marimo and Monolith enhance its technological and commercial reach.

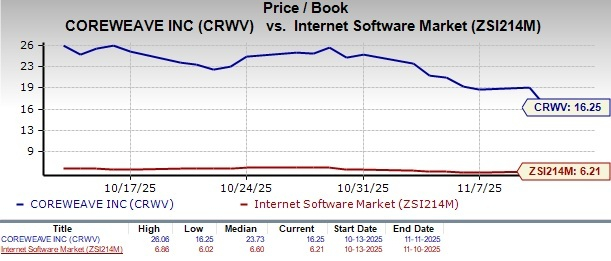

Valuation-wise, CoreWeave seems overvalued, as suggested by the Value Score of F. In terms of Price/Book, CRWV’s shares are trading at 16.25X, way higher than the Internet Software Services industry’s ratio of 6.21X.

The premium valuation is justified to an extent due to the company’s hyper revenue growth, expanding backlog and deep AI ecosystem integration.

Despite the recent selloff and concerns over aggressive capex strategy and execution risks, CoreWeave’s long-term growth story remains intact. The company’s solid backlog, customer diversification efforts, increasing footprint in the AI infrastructure space bode well, along with strategic partnerships with NVIDIA, META and OpenAI.

While near-term performance may remain pressured by capex and ballooning interest costs, these investments are setting the stage for outsized growth in the upcoming years. For now, the current dip in CRWV stock seems an attractive buying opportunity.

At present, CRWV carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 10 min |

Stock Market Today: Dow Falls On New Trump Tariffs; Novo Plunges On Drug Trial Results (Live Coverage)

NVDA

Investor's Business Daily

|

| 19 min | |

| 24 min | |

| 32 min | |

| 44 min | |

| 47 min | |

| 52 min |

AI Stocks Hit Reset. Will Nvidia, Snowflake, CoreWeave, Salesforce Earnings Decide What's Next?

CRWV NVDA

Investor's Business Daily

|

| 56 min |

Quantum Computing Stocks: Will Earnings, 2026 Outlooks Reignite Momentum?

NVDA

Investor's Business Daily

|

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 2 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite