|

|

|

|

|||||

|

|

The Goldman Sachs Group, Inc.’s GS shares have jumped 43.6% year to date, outperforming the industry's 34.3% rise. Its peers, JPMorgan JPM and Morgan Stanley’s MS shares rose 34.5% and 36.1%, respectively, over the same time frame.

Price Performance

With such strong momentum, investors are now wondering whether to hold on to the stock for now or cash out the profit. Let us delve deeper and analyze what is driving growth and whether there is more scope to grow.

GS’s investment banking (IB) business continues to build on its momentum in 2025, buoyed by a resurgence in global dealmaking activity. The bank reported IB fees of $6.8 billion, up 19% year over year in the first nine months of 2025, driven by higher advisory revenues, signifying a substantial rise in merger and acquisition (M&A) volume. In the third quarter alone, Goldman’s IB revenues jumped 42.5% year over year.

The rebound stems from a friendlier rate environment, revived private equity transactions and the reopening of capital markets. Notably, GS ended the third quarter as the leader in both announced and completed M&A. The company advised on more than $1 trillion in announced M&A volumes in the first nine months of 2025. Management indicated that 2026 is expected to be an even stronger year for M&A activity, barring any major macroeconomic shocks. The company’s backlog across IB is now at its highest level in the past three years.

Overall, the combination of favorable macro conditions, strong client pipelines and sustained leadership in M&A advisory positions Goldman well to extend its dealmaking dominance.

The company’s streamlining efforts have been underway for some time as it retreats from the underperforming consumer banking ventures. GS is exiting its non-core consumer banking business and sharpening its focus on Global Banking and Markets, and asset and wealth management (AWM) divisions.

In sync with its restructuring efforts, in October 2024, Goldman finalized a deal to transfer its GM credit card business to Barclays. In 2024, Goldman completed the sale of GreenSky. In 2023, it sold substantially all of Marcus’s loan portfolio, part of its broader retreat from consumer banking.

The benefits of business restructuring began to show in the numbers. The Global Banking and Markets segment’s net revenues rose 17% year over year in the first nine months of 2025, while the AWM division’s net revenues rose 4% year over year, reflecting growing fee income and strength in private credit. In alternatives, Goldman raised a record $33 billion in the quarter. As a result, the company expects to raise $100 billion in alternatives this year, substantially exceeding its prior full-year fundraising expectations.

Goldman plans to ramp up its lending services to private equity and asset managers, and aims to expand internationally, which will likely support its growth over the long run. The company's Asset Management unit intends to expand its private credit portfolio to $300 billion by 2029. After strengthening U.S. operations, the company will expand into Europe, the U.K. and Asia.

In sync with this, in October 2025, GS agreed to acquire Industry Ventures to expand its exposure to the innovation economy and solidify its position in the global alternatives market. In September 2025, Goldman partnered with T. Rowe Price in a $1-billion deal to co-develop retirement and wealth products. Later, the firms expanded the partnership to roll out alternative investment offerings for wealthy clients in 2025 and retirement savers in 2026.

In January 2025, the company also launched initiatives to grow private credit and other asset classes, including forming the Capital Solutions Group and expanding its alternatives team.

Given such efforts, management expects to witness high-single-digit annual growth in private banking and lending revenues over time.

GS maintains a fortress balance sheet, with the Tier 1 capital ratios well above regulatory requirements. This financial strength allows it to return capital to shareholders aggressively through buybacks and a healthy dividend yield.

As of Sept. 30, 2025, cash and cash equivalents were $169 billion, and near-term borrowings were $73 billion. Given its strong liquidity, the company rewards its shareholders handsomely.

Post-clearing the 2025 Fed stress test, the company increased the quarterly dividend 33.3% to $4 per common share. In the past five years, the company has hiked dividends five times, with an annualized growth rate of 22%. Currently, its payout ratio sits at 33% of earnings.

JPMorgan raised its dividends six times over the past five years with a payout ratio of 28%. Morgan Stanley has raised its dividends five times over the past five years, with a payout ratio is 41%.

Additionally, Goldman has a share repurchase plan in place. In the first quarter of 2025, the board approved a share repurchase program of up to $40 billion of common stock. At the end of the third quarter, the company had $38.6 billion worth of shares available under authorization.

GS’s ongoing growth initiatives, consistent capital returns, and a steadily improving AWM business provide a strong foundation for long-term financial performance. The rebound in M&A activity and a healthy deal pipeline continue to underpin the firm’s IB momentum, while its robust liquidity profile supports a sustainable and disciplined capital distribution strategy.

In pursuing growth across business segments, operational efficiency remains central to Goldman’s strategy. The company’s recent performance and forward-looking initiatives reaffirm its progress toward achieving its mid-term goals of a 14-16% return on equity and a 60% efficiency ratio.

Given favorable factors, over the past month, the Zacks Consensus Estimate for 2025 and 2026 earnings has been revised upward.

Estimate Revision Trend

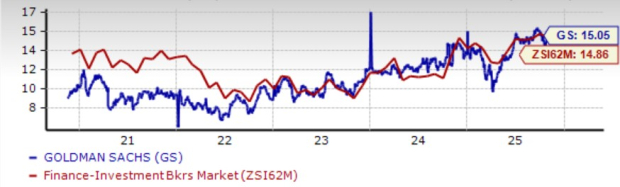

In terms of valuation, the GS stock looks expensive compared with the industry. The stock is trading at a forward price/earnings (P/E) of 15.05X above the industry average of 14.86X. The stock is trading at a discount compared with its peers, JPMorgan and Morgan Stanley, which have forward P/E multiples of 15.19X and 16.65X, respectively.

Price-to-Earnings F12M

With resilient earnings prospects and favorable momentum in dealmaking and asset management, investors may consider holding on to Goldman’s stock for now to capitalize on its sustained strength and long-term growth trajectory.

The company currently has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 hour | |

| 2 hours | |

| 2 hours | |

| 3 hours | |

| 5 hours | |

| 5 hours | |

| 6 hours | |

| 6 hours | |

| 7 hours | |

| 8 hours | |

| 8 hours | |

| 8 hours | |

| 8 hours | |

| 8 hours | |

| 9 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite