|

|

|

|

|||||

|

|

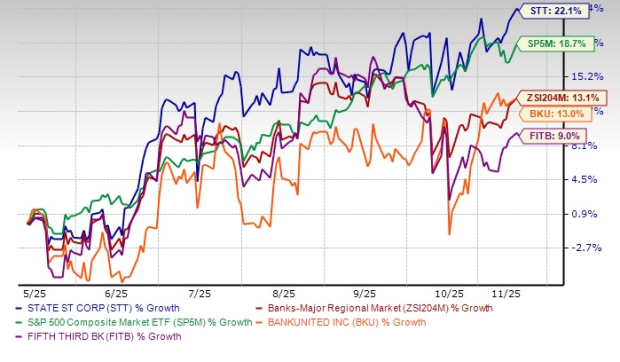

State Street Corporation STT shares touched a 52-week high of $120.81 in yesterday’s trading session to finally close at $119.43. In the past six months, STT shares have gained 22.1%, outperforming the industry’s 13.1% growth and the S&P 500 Index’s 18.7% rise. Moreover, STT’s price performance has been better than that of its peers, BankUnited, Inc. BKU and Fifth Third Bancorp FITB. The BKU stock has gained 13%, whereas shares of FITB have rallied 9% in the same time frame.

Does the State Street stock have more upside left despite touching its 52-week high? Let us find out.

Acquisitions & Restructuring Efforts: State Street has continuously been undertaking acquisitions and business restructuring efforts to expand scale. Recently, it acquired its long-standing partner, PriceStats, which is a top provider of daily global inflation data. Also, STT entered a strategic co-operation agreement with Albilad Capital to support the latter’s securities services offerings in Saudi Arabia.

Last month, it acquired global custody and related businesses outside of Japan from Mizuho Financial Group, Inc. In May 2025, STT collaborated with smallcase to cater to investors in India seeking global exposure, and in April, it partnered with Ethic Inc. to offer customized investment solutions to institutional and financial intermediary clients.

Last year, State Street joined forces with Bridgewater Associates to boost its core alternative investment strategies, partnered with Apollo Global to enhance investors' accessibility to private markets, acquired a 5% stake in Australia-based Raiz Invest Limited, partnered with Taurus and completed the buyout of CF Global Trading.

Also, as part of its global business consolidation efforts, the company announced the restructuring of the nearly 20-year-old European component of the International Financial Data Services LP joint venture (JV) arrangement in Luxembourg and Ireland, consolidated its India-based operations and assumed full ownership of its two JVs.

These efforts are expected to result in revenue and cost benefits for the company. Over the last four years (2020-2024), STT’s revenues witnessed a compound annual growth rate (CAGR) of 2.7%, with the upward trend continuing in the first nine months of 2025.

Fee Income Strength: Growth in State Street’s fee income has been impressive. While the company’s total fee revenues declined in 2022 and 2023, the metric saw a four-year (2020-2024) CAGR of 1.7%, with the uptrend continuing in the first nine months of 2025. This was mainly driven by higher client activity and significant market volatility.

Servicing assets yet to be installed were $3.5 trillion in 2021, $3.6 trillion in 2022, $2.3 trillion in 2023 and $3 trillion in 2024 across client segments and regions. As of Sept. 30, 2025, servicing assets yet to be installed were $3.6 trillion. Also, the company’s assets under custody and administration (AUC/A) and assets under management (AUM) have witnessed a four-year (ended 2024) CAGR of 4.7% and 8%, respectively. The upward momentum in both metrics continued in the first nine months of 2025.

State Street remains well-positioned for fundamental business activities, given its global exposure and a broad array of innovative products and services (including the launch of State Street Digital and State Street Alpha). The company’s business servicing wins and its inorganic growth strategy are expected to continue to aid fee revenues.

Management expects total fee revenues (excluding notable items) to increase 8.5-9% year over year in 2025.

Impressive Capital Distributions: Following the clearance of the 2025 stress test, State Street increased its quarterly dividend 11% to 84 cents per share. Before this, the company had hiked annual dividends four consecutive times by 10%.

In January 2024, the company was authorized to repurchase shares worth up to $5 billion (with no expiration date). As of Sept. 30, 2025, $2.9 billion worth of authorization remained available. Driven by a strong capital position and earnings strength, State Street is expected to sustain improved capital distributions in the future, thus enhancing shareholder value.

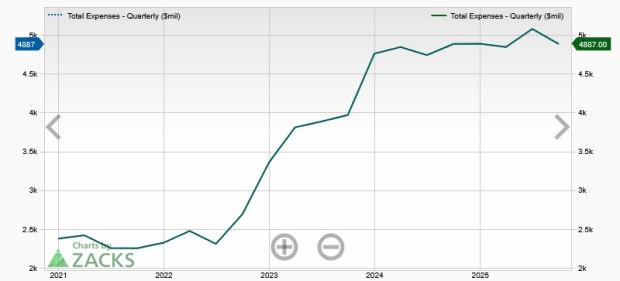

Elevated Expense Base: Despite a marginal decline in expenses in 2022 and 2024, STT’s total non-interest expenses witnessed a four-year (ended 2024) CAGR of 2.3%, with the uptrend continuing in the first nine months of 2025. Last year, the company was successful in managing expenses through high-cost location workforce reduction, business consolidation and restructuring initiatives. Over the last three years, it generated more than $1 billion of savings.

However, expenses are expected to remain elevated in the near term, owing to higher information systems and communications expenses. Also, the company’s strategic buyouts and investments in franchises will put pressure on expenses.

Fee Income Concentration: State Street’s largest revenue source is fee income, which constituted 79% of total revenues in the first nine months of 2025. Though fee income majorly supported the company’s top line in 2024 and so far in 2025, significant volatility in the capital markets is worrisome. A slowdown in capital markets activities may strain the metric’s future trajectory.

Also, concentration risk arising from higher dependence on fee-based revenues may significantly alter the company’s financial position if there is any change in individual investment preferences or regulatory amendments.

Solid business servicing wins, a global footprint, and strategic buyouts and alliances are expected to continue to support STT’s top-line growth. The company’s rising AUM balance is another positive.

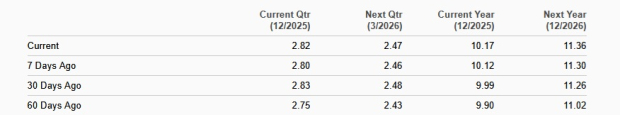

While elevated costs due to continuous investments in franchises and the company's high dependence on fee income sources are concerning, analysts seem optimistic regarding State Street’s earnings growth prospects. The Zacks Consensus Estimate for the company’s 2025 and 2026 earnings has been revised upward over the past 30 days. The 2025 earnings estimate of $10.17 indicates year-over-year growth of 17.3%. The 2026 estimate of $11.36 suggests a rise of 11.7%.

Thus, it seems like a wise idea to add the State Street stock to your portfolio now. Given the strength in its fundamentals and robust earnings growth prospects, the company is not likely to disappoint over the long term.

Currently, STT carries a Zacks Rank #2 (Buy). You can see the complete list of today's Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 5 hours | |

| Feb-25 | |

| Feb-24 | |

| Feb-23 | |

| Feb-23 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-19 | |

| Feb-19 | |

| Feb-17 | |

| Feb-17 | |

| Feb-16 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite