|

|

|

|

|||||

|

|

GE Vernova Inc.’s GEV shares have risen 38.3% over the past six months, outperforming its Zacks Alternate Energy – Other industry’s growth of 29.2%. A significant advantage of the rapidly expanding AI data center construction is that these establishments need enormous amounts of electricity, which GE Vernova can supply with its turbines and grid equipment.

Other alternative energy stocks, such as Constellation Energy Corporation CEG and Crescent Energy Company CRGY, have underperformed the industry in the past six months. Shares of CEG have risen 23.3% while those of CRGY have gained 6.5% during the same time frame.

Considering GE Vernova’s outperformance, investors might be left wondering if this is a good time to add GEV stock to their portfolio. Let's examine the factors that contributed to the share price gain and assess the stock's investment prospects to make an informed decision.

GE Vernova is gaining from its focus on improving profitability in the wind division, strong performance in gas and power services, and growing demand for energy infrastructure fueled by the expansion of data centers and artificial intelligence. In November 2025, GE Vernova started operations at the Jafurah Cogeneration ISPP in Saudi Arabia. This strengthens GE Vernova's position and increases its chances of landing other significant gas-power and cogeneration projects around the world. By securing a consistent revenue stream over decades rather than just a one-time equipment sale, GE Vernova enhances business stability and accelerates returns from the initial transaction.

During the same month, GE Vernova announced that it will provide grid-stabilizing technology for Transgrid to support renewables rollout in Australia. The contract expands GE Vernova’s business into a high-growth segment like grid stability and renewables integration. It will generate recurring services, enhance its global reputation, and position it well for future growth.

In October 2025, GE Vernova announced that it will acquire the remaining 50% stake of Prolec GE, its unconsolidated joint venture with Xignux. It is expected that the acquisition will provide GE Vernova with complete control over a significant growth asset, increasing scale, margins, and alignment with trends in electrification and grid modernization while broadening its prospects for growth.

In the third quarter of 2025, GE Vernova reported strong momentum with orders worth $14.6 billion, up 55% organically. The company’s backlog increased $6.6 billion sequentially, reflecting solid growth in both equipment and long-term service contracts. Notably, Gas Power equipment backlog and slot reservation agreements expanded from 55 GW to 62 GW, signaling rising customer commitments for future turbine deliveries and strengthening revenue visibility for the coming years.

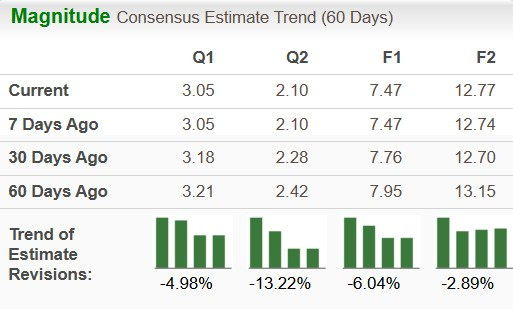

The Zacks Consensus Estimate for 2025 and 2026 earnings per share (EPS) indicates a decrease of 6.04% and 2.89%, respectively, in the past 60 days.

The Zacks Consensus Estimate for Constellation Energy’s 2025 EPS indicates an increase of 0.53% and that for 2026 EPS implies a decline of 1.54% in the past 60 days. The bottom-line estimate for Crescent Energy Company’s 2025 EPS indicates a decline of 7.19% and that for 2026 EPS implies an increase of 9.86% in the past 60 days.

GE Vernova is currently facing some difficulties, which are adversely impacting its performance. Manufacturers in a variety of industries have recently faced the global supply-chain problem, and GE Vernova is no exception.

The company relies on complex global supply networks for components used in its gas turbines, wind turbines and grid infrastructure. Specifically, it purchases nearly $20 billion in materials and components sourced from more than 100 countries. Therefore, disruptions in the availability of raw materials, along with logistical delays, have affected and may adversely impact GE Vernova’s production timelines and raise its input costs, thereby hurting its bottom line.

Offshore wind turbine installation and maintenance are vulnerable to weather delays, high winds, and difficult site access, leading to unpredictable operations and service demand. Limited suitable site availability or mismatched turbine specifications can also hinder sales and negatively impact business performance, cash flow and financial results.

The company beat on earnings in two of the trailing four quarters and missed in two, delivering an average surprise of 21.29%.

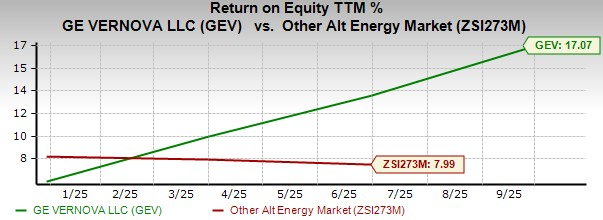

The company’s trailing 12-month return on equity of 17.07% is higher than the industry average of 7.99%. Return on equity, a profitability measure, reflects how effectively a company utilizes its shareholders’ funds to generate income.

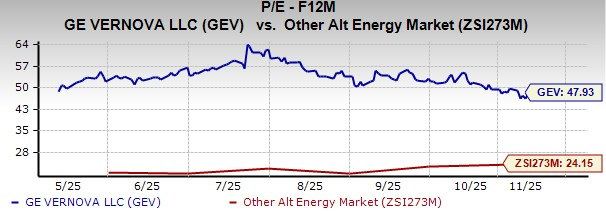

GE Vernova is currently trading at 47.93X a premium compared to its industry’s 24.15X on a forward 12-month P/E basis.

Constellation Energy is also trading at 31.61X a premium, while Crescent Energy Company is trading at 6.21X a discount compared with the industry’s P/E F 12M.

GE Vernova benefits from its diversified business across Power, Wind, and Electrification, which allows it to provide customers with a full suite of solutions, from gas and nuclear to wind energy and grid technology. Because of its flexibility, the business appeals to a broad range of customers and remains resilient to market changes.

However, considering its declining earnings estimates, and premium valuation, it is advisable to stay invested at present and new investors may look for a better entry point. GEV carries a Zacks Rank #3 (Hold) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 3 hours | |

| 3 hours | |

| 4 hours | |

| 5 hours | |

| 7 hours | |

| 7 hours | |

| 10 hours |

Nvidia Earnings, Inflation Data, State of the Union Address: What to Watch This Week

CEG

The Wall Street Journal

|

| 10 hours | |

| Feb-22 |

How Will Dow Jones Futures Open After Trump Hikes Global Tariff To 15%?

GEV

Investor's Business Daily

|

| Feb-22 | |

| Feb-22 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite