|

|

|

|

|||||

|

|

The pullback across artificial intelligence stocks and the broader nuclear-heavy AI energy trade offers investors a great chance to start buying best-in-class stocks on the dip, including GE Vernova and Constellation Energy (GEV and CEG are trading roughly 20% below their highs).

The AI arms race is sending energy demand soaring because large AI data centers consume as much electricity as a midsize city. AI growth, alongside other megatrends, are projected to drive a 25% increase in U.S. electricity demand by 2030 and a 75% increase by 2050.

AI data centers crave the reliable, always-on, clean power that nuclear energy provides. This is why Mag 7 tech companies and the U.S. government are racing to make nuclear energy deals, support innovation, and, most importantly, help build new nuclear power plants after decades of neglect.

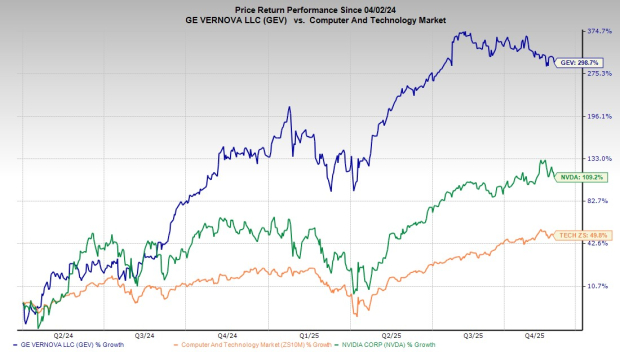

Nuclear energy stocks and ETFs have skyrocketed in 2025 and over the last few years, outpacing many of the pure-play AI stocks such as Nvidia.

Securing reliable, affordable clean energy is now one of the biggest challenges facing AI companies. At the same time, there’s no guarantee that OpenAI, which isn’t even public yet, and other AI innovators of today will become the profitable tech titans of tomorrow.

It’s time for investors to buy a few of the standout nuclear and next-gen energy stocks on the dip that will power the AI age, no matter how AI evolves.

GE Vernova Inc. GEV is one of a handful of diversified nuclear-heavy energy companies making a strong case to transform into a Wall Street titan of tomorrow. The stock has soared 300% since its spin-off from GE in April 2024, crushing Nvidia’s (NVDA) 110% and the Tech sector’s 50%. Yet investors can buy the best-in-class AI energy stock roughly 20% below its August peaks and 18% under its average Zacks price target.

GEV stock is attempting to hold its ground once again at its pre-July breakout levels. The level in blue highlighted below could mark a near-term low if the bulls fight back. Meanwhile, a pullback to GE Vernova's 200-day moving average might offer a great long-term buying opportunity.

Image Source: Zacks Investment Research

The energy company boasts that its customers generate roughly 25% of global electricity via its installed base of technologies. GE Vernova’s portfolio spans nuclear energy, natural gas, electrification, grid technologies, and beyond.

GEV is a proven energy technology manufacturing powerhouse that also pays dividends and is repurchasing stock. This helps GE Vernova stand out from the speculative nuclear and AI energy stocks like Oklo that are pre-revenue, home-run bets, while providing the same next-gen small modular reactor (SMR) upside.

The company’s BWRX-300 SMRs have a chance to be one of a few potential winners in the SMR space that many view as the future of nuclear power and possibly the entire energy sector. Mag 7 companies and Wall Street envision a future where small modular nuclear reactors are built directly at AI data centers, U.S. military bases, factories, cities, and beyond.

GEV's natural gas segment is gaining steam as tech companies and beyond try to secure as much around-the-clock power as possible. Gas and electrification will drive the stock and the company for years since next-generation SMRs won’t be deployed until the early 2030s. On top of that, its power conversion, energy storage, and grid solutions are gaining momentum as it expands its AI-boosted smart grid efforts via acquisitions.

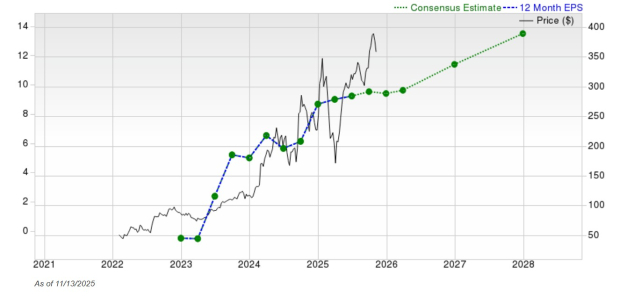

The company reaffirmed its 2025 guidance when it reported last month. It is projected to expand its adjusted EPS by 34% in FY25 and 71% in FY26 to reach $12.77 a share vs. $5.58 in 2024, based on the most recent Zacks estimates. It is expected to expand its revenue by 6.4% in 2025 and 12% in FY26 to reach nearly $42 billion.

Constellation Energy CEG is the largest U.S. nuclear power plant operator and one of the most important AI energy companies after pioneering the relationship between big tech and nuclear. CEG stock has soared over 525% since it went public in early 2022, including a 50% run in the past 12 months to beat Tech’s 28% and Nvidia’s 30%.

CEG has dropped 19% from its mid-October high. Its fall on Thursday pushed it right back to its recent lows as it attempts to hold on near its pre-DeepSeek selloff levels from January.

As is the case with GEV, a larger selloff to Constellation’s 200-day moving average might offer traders and longer-term investors an even more enticing buying opportunity.

Constellation’s $27 billion deal to buy natural gas and geothermal powerhouse Calpine is set to close in Q4.

The deal turns the nuclear energy titan into the largest clean energy firm and expands Constellation’s footprint into power-hungry, tech-heavy Texas and California. It’s poised to power large swaths of the economy and AI data centers via CEG’s established portfolio of reliable 24/7 power.

CEG already has two blockbuster 20-year nuclear power agreements with Microsoft and Meta to support their AI expansion plans. Constellation’s Mag 7 AI deals provide support for its current nuclear fleet, help it restart decommissioned nuclear reactors, and expand into SMRs.

The company already raised its dividend by 10% in 2025 and 25% in 2024 as part of a plan to consistently boost its payout to shareholders. Constellation, which already reported its Q3 results, is expected to grow its adjusted EPS by 9% in 2025 and 21% in 2026.

Constellation’s near-term trajectory is part of “visible, double-digit long-term base EPS growth backed by the Nuclear Production Tax Credit.” The chart above highlights CEG’s upbeat earnings outlook through 2027.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 16 min | |

| 24 min | |

| 1 hour |

Dow Jones Futures Fall; Nvidia Hits AI Stocks, But S&P 500 Holds Key Support

NVDA -5.46%

Investor's Business Daily

|

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 3 hours | |

| 3 hours | |

| 3 hours | |

| 3 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite