|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

Investors have been looking to newer, smaller companies within the technology sector for AI-related investment opportunities.

But this particular company continues to report solid double-digit growth, and is expected to continue doing so for at least several more years.

There's good reason to expect the market to renew its former appreciation for this company's upside in the very near future.

The so-called "Magnificent Seven" stocks are still riding their ways to record highs ... well, most of them anyway. A couple of them have stumbled following the recent releases of their quarterly results.

These pullbacks aren't warnings, though, as much as they're buying opportunities for true long-term investors who can look past the short-term noise. And of those two "Magnificent Seven" names, one is a compelling prospect worth stepping into before the end of this month. That's Microsoft (NASDAQ: MSFT), which is still down more than 7% from its late-October peak. This may be all the discount you're going to get for a while.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

Image source: Getty Images.

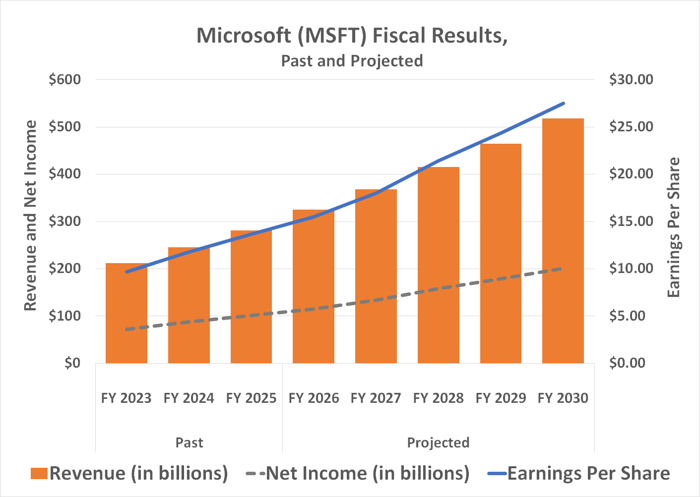

Microsoft is, of course, the world's best-known personal productivity software and operating system outfit. Indeed, StatCounter says the company's Windows operating system is installed on 66% of the planet's computers. Meanwhile, numbers from Synergy Research Group indicate Microsoft also controls about one-fifth of the world's cloud computing market. Last fiscal year, it turned $282 billion worth of revenue into net income of $102 billion, extending well-established growth trends for both metrics.

Its recently released fiscal first-quarter numbers, for the period ended Sept. 30, came in better than expected, too. The top line of $77.7 billion topped estimates of $75.4 billion, while earnings of $4.13 per share -- or $3.72 when reflecting the cost of a significant equity investment -- both still beat consensus estimates of $3.67 as well. Except, guidance offered for the quarter currently underway ultimately disappointed. The company only anticipates revenue of about $80 billion versus analysts' average estimate of $80.2 billion, explaining at least some of the stock's post-earnings pullback.

Perhaps the market's biggest worry, however, is the fact that it also shelled out $3.1 billion to add to its existing equity stake in OpenAI, even though Microsoft also acknowledges OpenAI is a competitor within the artificial intelligence (AI) space. Investors aren't quite sure how to interpret the ever-deepening relationship with a "frenemy." So, they're doing the cautious thing -- they're backing away from the stock just a bit until they gain a better understanding of Microsoft's place within the AI realm.

But, what if the stock's post-earnings setback was going to happen regardless, and the uncertainty stemming from the software giant's AI ambitions was simply the excuse needed to make it happen?

That may well be the case. And if it is, the reset it was supposed to facilitate for the stock has arguably already run its course, making shares a buy at their present price.

Microsoft doesn't have a growth problem. Last quarter's top line was up 17% year over year on a constant-currency basis, pumping up net income to the tune of 12%. At the midpoint of its guidance for the fiscal second quarter now underway, sales should be up 15%, while analysts are calling for a 23% year-over-year improvement in per-share profits, a growth pace that's expected to last at least a few more years as the AI revolution continues to unfurl.

Data source: Morningstar. Chart by author.

So then why has the stock underperformed not just since late last month, but since last year? Mizuho analyst Jordan Klein arguably answered the question best by noting after shares slumped in response to the company's fiscal first-quarter earnings that investors are now looking for smaller "AI winners that seem to want to outperform off either better fundamentals or hype around expected capex boosts" from companies like Microsoft.

In other words, Microsoft is old news, particularly now that it's spending so heavily to remain competitive on the artificial intelligence front with no assurance that it will actually remain competitive.

That may not be a realistic view of Microsoft's foreseeable future, though. See, the company's current choke point isn't a lack of demand, but rather a lack of capacity. As Klein went on to explain, Microsoft is "quickly expanding capacity to boost AI [revenue] and manage a mountain of AI bookings."

The rest of the analyst community sees it, too. Although most investors are clearly rattled by the software giant's AI data center outlays, analysts with Wells Fargo, Morgan Stanley, and several others raised their price targets on this ticker following last month's release of its Q1 report. Even Guggenheim's long-skeptical analyst John DiFucci is now on board, upgrading his firm's stance on Microsoft stock from neutral to buy on the company's artificial intelligence growth prospects. DiFucci notes that Microsoft's existing reach within the operating system and personal productivity space provides it with a unique advantage when it comes to monetizing its AI technology.

All told, the analysts' consensus price target of $634.66 is 26% above Microsoft's current stock price. That's not a bad way to start out a new trade.

Is it possible that investors as a whole are right and the analyst community is wrong? Sure, anything's possible.

But what's most likely here is that -- as Mizuho's Klein explained -- investors are just looking for more exciting AI growth stories than the one Microsoft is currently able to deliver. It happens. In the end, though, powerhouses like Microsoft tend to (very effectively) remind the market that they became massive companies for a reason, and can buy whatever technology, competitive advantage, or growth they need to with their enormous profits. It's only a matter of time.

Just don't tarry if you want in. Microsoft's stock has been lagging since late last year. Investors are likely to get this reminder sooner rather than later, once they start realizing how far away many of the young AI companies they love are from any real profitability.

Before you buy stock in Microsoft, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Microsoft wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $624,230!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,187,967!*

Now, it’s worth noting Stock Advisor’s total average return is 1,069% — a market-crushing outperformance compared to 195% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of November 10, 2025

Wells Fargo is an advertising partner of Motley Fool Money. James Brumley has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Microsoft. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

| 29 min | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 3 hours | |

| 3 hours | |

| 3 hours | |

| 3 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite