|

|

|

|

|||||

|

|

Quanta Services, Inc. PWR reported third-quarter 2025 results on Oct. 30, with both earnings and revenues exceeding the Zacks Consensus Estimate by 2.5%. The company delivered another quarter of strong results, achieving double-digit growth in revenues, adjusted EBITDA and adjusted EPS compared with the prior year. Quanta also delivered strong year-over-year growth across key metrics.

Adjusted earnings per share stood at $3.33, up 22% from the prior-year quarter, while revenues of $7.6 billion increased 17.5%. Adjusted EBITDA totaled $858 million, up 26% from $682.8 million in the prior-year quarter. Growth was supported by strong activity in the Electric segment and steady demand across core infrastructure markets. Operating cash flow remained solid at $438 million in the quarter and full-year free cash flow expectations were raised to $1.5 billion at the midpoint.

Shares of Quanta have gained 35% in the year-to-date period compared with the Zacks Engineering - R and D Services industry and the S&P 500’s growth of 15% and 18.3%, respectively. PWR stock has also outperformed the broader Construction sector's 4% rise during the same period.

The stock has outperformed some other players, including Fluor Corporation FLR, KBR, Inc. KBR and AECOM ACM. In the year-to-date period, Flour and KBR have lost 12.7% and 27%, respectively, while AECOM has gained 25.3%.

Quanta’s quarterly performance continued to improve as strong project activity and stable market conditions supported the results. Let us assess what that signals for the stock after the earnings release.

PWR continued to benefit from accelerating demand across its core markets. The company highlighted strong activity in the Electric segment (which accounted for 80.9% of total revenues in the third quarter of 2025) and rising work tied to large load customers, renewable energy and new generation needs. The Electric segment delivered $6.17 billion in revenues, up 17.9% year over year.

The growth was supported by grid modernization needs, renewable energy activity and expanding demand from technology and industrial customers. The renewable energy and battery storage business also moved forward at a steady pace, with early-stage projects progressing into full work phases. These trends supported steady momentum across the business.

Looking ahead, the company expects demand across these markets to remain healthy as customers continue planning for higher power requirements. Growth in data centers, manufacturing and electrification is expected to support ongoing opportunities in grid work, renewable energy and supporting infrastructure. This broad demand backdrop positions PWR well in the current investment cycle for critical infrastructure.

Demand across PWR’s core markets remained strong, supported by active work in grid modernization, renewable energy and early-stage generation projects. The company also saw steady interest from utilities, technology customers and large load users, helping maintain a consistent flow of opportunities. In the third quarter of 2025, PWR’s backlog reached a record $39.2 billion, up from $33.96 billion a year ago, showing strong demand visibility across major end markets. Remaining performance obligations also increased, reflecting expanding activity in the Electric segment and growing needs tied to data centers, manufacturing and electrification.

Owing to solid execution and a healthy pipeline of projects, the company raised full-year revenue and free cash flow expectations. Looking ahead, multi-year programs and phased work are expected to move into full construction through 2026, providing sustained visibility and supporting growth.

PWR advanced its solutions-focused strategy by expanding its total solutions platform to address rising power generation needs. The company introduced a more integrated model that brings together engineering, technology, craft labor and supply-chain capabilities. This approach is designed to support growing electricity demand from data centers, manufacturing facilities, industrial customers and broader electrification trends.

In the third quarter of 2025, PWR also formed a joint venture with Zachry to support a major program with NiSource. The work covers generation, battery storage, transmission, substation and underground infrastructure, offering a complete project scope under a unified platform. The company stated that this model helps reduce risk for customers and strengthens project execution across large, complex programs. Looking ahead, PWR expects the expanded platform to create long-term growth opportunities as demand for reliable power and faster project delivery continues to rise.

For 2025, Quanta’s earnings estimate has remained unchanged in the past 60 days at $10.57. The estimated figures for 2025 and 2026 indicate 17.8% and 16.7% year-over-year growth, respectively.

Conversely, AECOM and KBR’s earnings in the current year are likely to witness year-over-year increases of 15.9% and 13.5%, respectively, while Fluor’s earnings are expected to decline 7.3%.

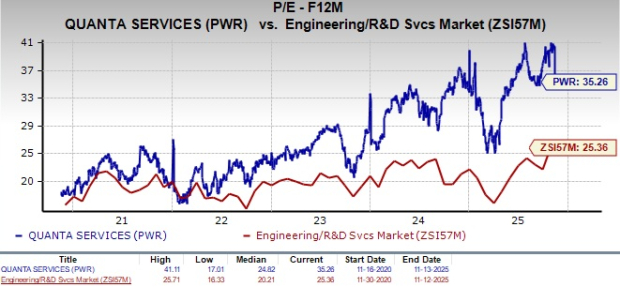

From a valuation standpoint, the company is currently trading at a premium relative to the industry and historical metrics, with its forward 12-month price-to-earnings (P/E) ratio sitting above the five-year average.

Moreover, PWR is priced higher than some of its industry peers, such as AECOM, Fluor and KBR, which trade at 23.41X, 19.52X and 10.26X, respectively.

Quanta appears well-positioned for long-term growth, supported by strong execution, steady demand across core end markets and a record backlog that offers solid visibility. The company continues to benefit from rising power needs tied to data centers, manufacturing and electrification, while the expansion of the total solutions platform further strengthens its presence in large, complex programs.

However, the stock’s premium valuation relative to peers may limit near-term upside. Broader market uncertainties and pockets of volatility across the construction and industrial landscape could also influence the pace of performance. While earnings estimates for 2025 and 2026 show healthy growth, the higher valuation multiple suggests that some of this strength is already reflected in the share price.

Given the current setup, this Zacks Rank #3 (Hold) stock is likely to maintain stable performance in the near term. Existing investors may continue to hold PWR, while new investors could wait for a more favorable entry point. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-22 | |

| Feb-22 |

How Will Dow Jones Futures Open After Trump Hikes Global Tariff To 15%?

PWR

Investor's Business Daily

|

| Feb-21 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite