|

|

|

|

|||||

|

|

U.S. stock markets have been witnessing an astonishing rally since the beginning of 2023 barring some minor fluctuations. Wall Street’s most observed benchmark — the S&P 500 Index — has advanced 16.7% year to date.

Although the rally has been primarily driven by the global boom in artificial intelligence (AI) technology, several non-tech behemoths have popped this year, aside from technology bigwigs. Investment in these stocks with a favorable Zacks Rank should be fruitful in 2026.

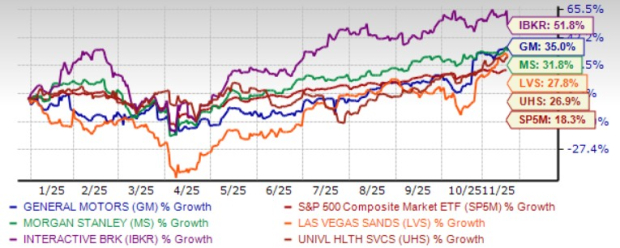

Five such stocks are — General Motors Co. GM, Morgan Stanley MS, Interactive Brokers Group Inc. IBKR, Las Vegas Sands Corp. LVS and Universal Health Services Inc. UHS. Each of our picks currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The chart below shows the price performance of our five picks year to date.

General Motors remains the top-selling U.S. automaker with a 17% market share, driven by strong demand for its Chevrolet, GMC, Buick, and Cadillac brands. GM’s U.S. manufacturing expansion and China restructuring—where sales rose 10% year over year in the last reported quarter — support long-term growth.

GM’s software and services arm is becoming a key profit engine, with $2 billion in revenue year to date and 11 million OnStar subscribers. Strong liquidity of $35.7 billion and robust buybacks boosts investor confidence. Additionally, the Auto Tariff Offset Process should increase GM’s domestic cost competitiveness. Backed by strong brands, operational recovery in China, and software-led diversification, GM appears well-positioned for sustained earnings growth and shareholder value creation.

General Motors has an expected revenue and earnings growth rate of -0.7% and 7.9%, respectively, for next year. The Zacks Consensus Estimate for next year’s earnings has improved 10.8% over the last 30 days.

Morgan Stanley’s focus on wealth and asset management operations along with its strategic alliances and acquisitions will aid the top line. The deal to buy EquityZen will help MS tap the rapidly growing private markets landscape. The performance of the investment banking (IB) business will continue to be driven by a strong pipeline. We project MS’ total revenues and IB fees to increase 11.7% and 12.8% in 2025, respectively.

On the other hand, while MS’ trading revenues have been increasing, growth in the same might become challenging in the future because of the volatile nature of the business. Yet, MS’ efficient capital distributions reflect a solid balance sheet.

Morgan Stanley has an expected revenue and earnings growth rate of 4.1% and 5.8%, respectively, for next year. The Zacks Consensus Estimate for next year’s earnings has improved 3.7% over the last 30 days.

Interactive Brokers Group’s efforts to develop proprietary software, lower compensation expenses relative to net revenues, enhance its emerging market customers and global footprint, along with relatively high rates, are expected to continue aiding revenues.

IBKR’s third-quarter 2025 results reflected solid revenue growth and lower expenses. IBKR’s efforts to develop proprietary software and enhance its emerging market customers and global footprint, along with relatively high rates and lower compensation expenses relative to net revenues, are expected to support its top-line growth. IBKR’s initiatives to expand its product suite and the reach of its services will bolster its market share.

Interactive Brokers Group has an expected revenue and earnings growth rate of 5.3% and 7.8%, respectively, for next year. The Zacks Consensus Estimate for next year’s earnings has improved 1.4% in the last seven days.

Las Vegas Sands reported third-quarter 2025 results, with earnings and revenues beating the Zacks Consensus Estimate. Both metrics increased on a year-over-year basis by 77.3% and 24.2%, respectively. LVS is benefiting from strong travel demand and improved operating conditions in Macao and Singapore.

LVS reported solid progress on its strategic goals and continued to focus on driving growth in both regions through the ongoing capital investments. In Singapore, strong performance at Marina Bay Sands was supported by new suite offerings and rising travel across Asia. LVS remains focused on expanding non-gaming opportunities in Macao.

Las Vegas Sands has an expected revenue and earnings growth rate of 5.1% and 7.3%, respectively, for next year. The Zacks Consensus Estimate for next year’s earnings has improved 10.1% over the last 30 days.

Universal Health Services continues to benefit from its expansion efforts in both the Acute Care and Behavioral Health segments, with increased licensed bed capacity driving patient volumes and revenue growth. UHS’ net revenues increased 9.9% year over year in the first nine months of 2025. UHS expects net revenues between $17.306 billion and $17.445 billion in 2025.

Acute Care unit's revenues rose 11.5% year over year in the first nine months of 2025. UHS remains committed to shareholder returns, repurchasing $565.8 million in shares in the first nine months of 2025 and maintaining consistent dividends. In October, management authorized a $1.5 billion increase to its share repurchase program.

Universal Health Services has an expected revenue and earnings growth rate of 5% and 7.7%, respectively, for next year. The Zacks Consensus Estimate for next year’s earnings has improved 0.1% over the last seven days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 hour | |

| 1 hour | |

| 2 hours | |

| 6 hours | |

| 7 hours | |

| 7 hours | |

| 8 hours | |

| 8 hours | |

| 8 hours | |

| 9 hours | |

| 9 hours | |

| 9 hours | |

| 9 hours | |

| 10 hours | |

| 10 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite