|

|

|

|

|||||

|

|

Upstart Holdings UPST has been on a roller-coaster ride over the past few years, and the latest chapter has been just as dramatic. Despite reporting one of its strongest quarters in recent memory, the stock has tumbled more than 41% over the past three months. That kind of slide naturally forces investors to revisit the core question: What is really happening underneath the surface?

Part of the selloff appears tied to the broader pullback in high-growth fintech names and the market’s sensitivity to rate expectations. Yet, the drop also reflects concerns about Upstart’s lending models becoming more conservative during parts of the third quarter, temporarily limiting approval rates, something management openly discussed.

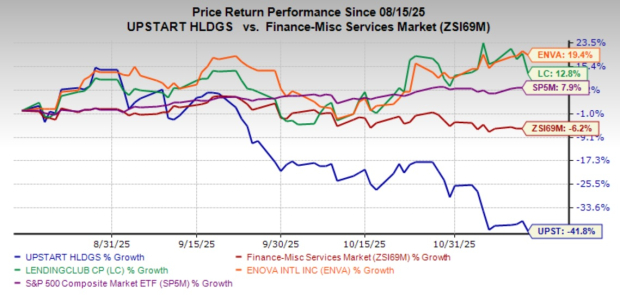

Upstart underperformed the Zacks Financial – Miscellaneous Services industry as well as the S&P 500 composite. Comparatively, its peers, LendingClub LC and Enova International ENVA, put up a better performance in terms of share price during this period.

A Quarter of Strong Growth Despite Model Conservatism

Upstart’s third-quarter performance was objectively impressive. Total revenues reached $277 million, up 71% from last year, and loan originations climbed to roughly $2.9 billion, up 80%. Management emphasized that the company’s AI-driven credit models behaved “exactly as designed,” tightening approval rates when macro signals briefly flashed caution and reverting when conditions improved.

This model responsiveness temporarily lowered Upstart’s conversion rate from 23.9% in the second quarter to 20.6% in the third quarter. That reduction explains why transaction volumes came in slightly below internal expectations, even though demand actually surged. More than 2 million loan applications were submitted on the platform, Upstart’s strongest application volume in more than three years. The gap between demand and approvals stemmed from the model adjusting to the short-lived rise in Upstart’s Macro Index during July and August.

Major Momentum in Newer Products

Another bright spot was Upstart’s diversified product engine. Auto, home equity and small-dollar loans are now scaling meaningfully, together contributing nearly 12% of total originations. Auto retail loan activity grew more than 70% sequentially. Home-equity lending also picked up, helped by automation breakthroughs that boosted instant approvals from under 1% earlier this year to about 20% in October.

Small-dollar relief loans showed rapid progress as well, with instant funding now delivering money to qualified borrowers in under two minutes. These newer businesses don’t just broaden Upstart’s reach; they also reduce reliance on personal loans and create multi-year growth levers that could expand the company’s total addressable market.

Funding Capacity Strengthens the Story

In the third quarter, the company reported its best quarter of the year for new bank and credit union partners, adding seven and reaching an all-time high in available monthly funding. On the institutional side, Upstart renewed one of its largest capital partners and maintained 100% retention of all private credit partners so far. UPST also completed a securitization in September that drew robust investor interest, with every tranche oversubscribed even after the deal was upsized and spreads tightened.

Meanwhile, the company continues to wind down the heavier balance-sheet usage that came from testing new products. Management expects several capital-partner deals to close across auto, home and small-dollar lending, which should reduce Upstart’s R&D balances and support cleaner, lighter growth into 2026.

Where the Bear Case Emerges

Despite the operational momentum, there are still notable concerns. The market remains worried about model volatility, specifically, the rapid tightening and loosening in approvals. While management noted that calibration upgrades are expected to cut conversion volatility, investors remain cautious until they see a consistent pattern.

Upstart is also carrying a larger-than-normal loan balance as it transitions new products off its books, and any delay in partner deals could stretch that period. Additionally, while the broader credit environment shows signs of improvement, uncertainty around consumer behavior, repayment speeds and interest-rate conditions could affect loan performance or investor appetite.

And finally, Upstart’s stock continues to trade with high sensitivity to macro factors, especially interest rates, which adds a layer of volatility over and above the company’s fundamentals.

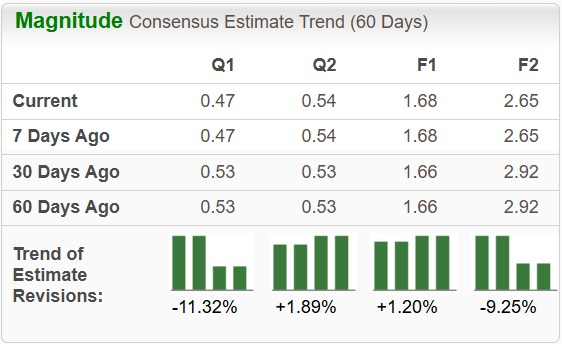

The recent estimate revision trends also echo similar sentiments. While the full-year 2025 Zacks Consensus Estimate for EPS has been revised upward, the same for 2026 has undergone downward revisions over the past month. However, both figures suggest a significant increase year over year.

From a valuation perspective, we note that Upstart shares are currently overvalued, as suggested by the Value Score of F.

In terms of forward 12-month Price/Sales (P/S), despite the share price decline, Upstart is currently trading at 3.11X, which is slightly below the industry average of 3.18X. Moreover, compared with fintech rivals, the stock trades at a premium to LendingClub and Enova International. At present, LendingClub and Enova International have P/S multiples of 1.82 and 0.88, respectively.

Upstart’s three-month slide contrasts sharply with its strong third-quarter execution. Revenues, profitability, funding stability and product expansion all point to a company that is fundamentally improving. At the same time, model-driven conservatism, balance-sheet exposure and ongoing macro sensitivity justify caution.

With both upside potential and near-term uncertainties in play, the most balanced stance for investors today is a hold. Upstart remains a promising long-term story, but the stock needs steadier macro signals and consistent model calibration before a confident buy case emerges.

Currently, Upstart carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 11 hours | |

| 11 hours | |

| 11 hours | |

| 12 hours | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-19 | |

| Feb-19 | |

| Feb-18 | |

| Feb-18 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite