|

|

|

|

|||||

|

|

By one estimate, the evolution of quantum computing can create $1 trillion in global economic value by 2035.

IonQ, Rigetti Computing, D-Wave Quantum, and Quantum Computing Inc. stocks have all soared on the expectation that quantum computing technology will be rapidly adopted.

Third-quarter operating results from IonQ, Rigetti, and D-Wave paint a murky picture about the growth arc for quantum computing stocks.

If you believe artificial intelligence (AI) has been the hottest trend on Wall Street in 2025, think again. While empowering software and systems with the tools to make split-second decisions is a long-term game changer, no innovation has captivated the attention and wallets of investors this year quite like the arrival of quantum computing.

Over the trailing year, as of the closing bell on Nov. 13, shares of quantum computing pure-play stocks IonQ (NYSE: IONQ), Rigetti Computing (NASDAQ: RGTI), D-Wave Quantum (NYSE: QBTS), and Quantum Computing Inc. (NASDAQ: QUBT) have respectively rallied by 97%, 1,590%, 1,420%, and 627%! Some of these gains have been life-altering for early investors.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

However, things aren't as rosy for quantum computing stocks as their scorching-hot gains would imply. While there are, indeed, catalysts fueling excitement for this technology, recently hyped events for IonQ, Rigetti Computing, and D-Wave Quantum all but confirm that their recent pullbacks are likely to accelerate.

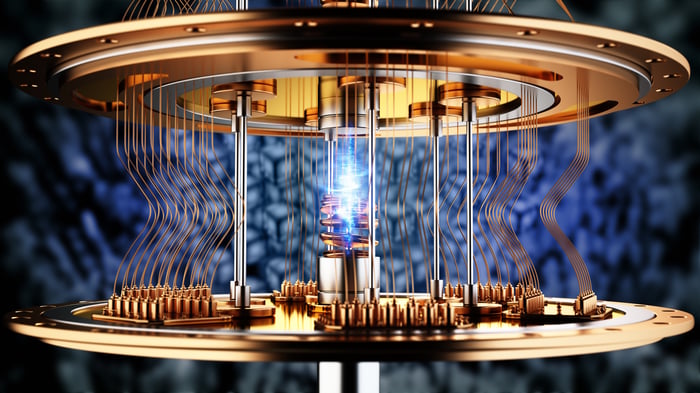

Image source: Getty Images.

In simple terms, quantum computing utilizes specialized computers and the theories of quantum mechanics to tackle highly complex problems that classical computers can't handle or wouldn't be able to calculate during our lifetime.

One of the most exciting tie-ins between quantum computing and AI is the potential for quantum computers to accelerate the learning process of AI algorithms. This can be especially valuable for training large language models, which could hypothetically occur in a fraction of the time.

But quantum computing has utility that extends well beyond the AI arena. These specialized computers can rapidly run molecular interaction simulations, helping drug developers target therapies for difficult-to-treat diseases. Quantum computers can also improve weather modeling, as well as strengthen cybersecurity platforms, among other real-world applications.

However, it's the dollar signs that are attracting investors. Boston Consulting Group believes quantum computing will create between $450 billion and $850 billion in global economic value by 2040. Meanwhile, online publication The Quantum Insider predicts that worldwide economic value creation will reach $1 trillion by 2035.

Some of this investment hype has already translated into real-world partnerships. Amazon's quantum cloud-computing service Braket, along with Microsoft's Azure Quantum service, are giving their subscribers access to IonQ's and Rigetti's quantum computers. Any time a nascent company lands a deal with one or more members of the "Magnificent Seven," Wall Street takes notice.

Unfortunately, hyped events for IonQ, Rigetti Computing, and D-Wave Quantum -- namely, their respective third-quarter operating results -- show how susceptible these stocks are to future downside.

Image source: Getty Images.

Although quantum computing stocks are still wet behind the ears, investors were hoping for substantial revenue beats for the current quarter and/or consensus-crushing guidance. What investors in IonQ, Rigetti, and D-Wave received was confirmation that the respective market caps of these companies have far exceeded their growth expectations.

Wall Street's largest pure-play stock, IonQ, actually exceeded the consensus sales estimate of analysts by an impressive 37%. The problem is that its $39.9 million in revenue for the September-ended quarter (up 222% from the prior-year period) doesn't remotely come close to justifying what had been a market cap of well in excess of $20 billion (currently $16.1 billion, as of this writing on Nov. 13).

Rigetti Computing's third-quarter operating results were considerably more disappointing than IonQ's. Total sales came in at just $1.9 million, which is down from the prior-year period, when Rigetti reported nearly $2.4 million in revenue. Keep in mind that, until recently, Rigetti had been sporting a market cap of more than $15 billion.

It's a similar story for D-Wave Quantum, which recorded approximately $3.7 million in third-quarter sales, up exactly 100% from the comparable period in 2024. Although investors actively seek out companies growing by triple digits, an annual sales run rate of $15 million pales in comparison to a company that was pacing a market cap of almost $14 billion.

While no valuation metric can concretely guarantee directional moves in stocks or the broader market, the time-tested price-to-sales (P/S) ratio has done an excellent job of forecasting the future with hyped technologies and next-big-thing trends.

Since the advent and widespread adoption of the internet three decades ago, companies on the leading edge of perceived-to-be game-changing innovations commonly peaked at P/S ratios ranging from 30 to 40. Examples include Amazon, Microsoft, and Cisco Systems prior to the bursting of the dot-com bubble.

Despite there being some wiggle room with this arbitrary P/S ratio ceiling, the point remains the same, regardless of the trend: premium valuations are unsustainable over extended periods. As of the closing bell on Nov. 13, the respective trailing-12-month P/S ratios for Wall Street's hyped quantum computing stocks are:

Even accounting for their supercharged projected sales growth in the coming years, these P/S ratios land firmly in bubble/unsustainable territory.

Since hitting their respective all-time highs in October, shares of IonQ, Rigetti, D-Wave, and Quantum Computing Inc. have plunged between 45% (for IonQ) and 59% (for Quantum Computing Inc.). Given that their operating results confirm how far above historical norms their valuations remain, investors should expect the pullback in quantum computing stocks to accelerate in the coming weeks and months.

Before you buy stock in IonQ, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and IonQ wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $599,784!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,165,716!*

Now, it’s worth noting Stock Advisor’s total average return is 1,035% — a market-crushing outperformance compared to 191% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of November 10, 2025

Sean Williams has positions in Amazon. The Motley Fool has positions in and recommends Amazon, Cisco Systems, IonQ, and Microsoft. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

| Feb-07 | |

| Feb-07 | |

| Feb-06 | |

| Feb-06 | |

| Feb-06 | |

| Feb-06 | |

| Feb-05 | |

| Feb-05 | |

| Feb-05 | |

| Feb-05 | |

| Feb-05 | |

| Feb-05 | |

| Feb-04 | |

| Feb-04 | |

| Feb-04 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite