|

|

|

|

|||||

|

|

Alphabet can use the profits from its many strong, established businesses to support its quantum endeavors.

Its Willow quantum computing chip recently demonstrated a verifiable advantage over classical computers.

Quantum computing technology is still in its infancy, and there are a lot of questions about how it will progress over the next decade. Several promising pure-play companies have already gone public, but these are inherently risky investments. These companies have little in the way of revenue, and no other business lines to lean on to support the investments they're making in trying to turn their technology and ideas into reliable, commercially viable products.

As such, to continue their research and development, they must get funding from research institutions, selling debt, or issuing more shares (and diluting previous shareholders). Many of these companies may never win in the marketplace. However, if they hit it big, they could provide investors with remarkable returns.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

That high-risk, high-potential-reward investing style isn't for everyone, including me.

Instead, I prefer to invest in established tech stalwarts that are also pioneering their own quantum computing technology. My favorite quantum computing stock to buy right now is Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL), and I think it's where most investors who want exposure to the trend should be focusing as well.

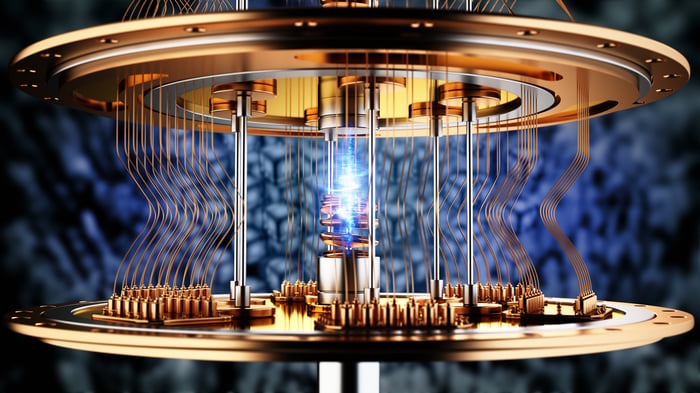

Image source: Getty Images.

Unlike the pure plays, Alphabet has massive existing businesses that it can use to fund its more speculative endeavors. Primarily, Alphabet is an advertising business, getting ad revenue from the Google Search engine and other platforms like YouTube. This is a lucrative and mature business, but it continues to grow.

In Q3, Alphabet's Google Search revenue and YouTube ad revenue both increased by 15% year over year -- a pretty good pace for two fairly mature business units. Google Cloud is also a big profit center. Its revenue was up 34%, and its operating margin improved from 17% to 23%. This shows how massive the demand is for cloud computing. That's also one of the key reasons Alphabet wants to develop a viable quantum computing solution.

Cloud computing providers largely get their parallel processing hardware from companies like Nvidia (NASDAQ: NVDA), which provides top-tier graphics processing units (GPUs) for accelerated computing applications. Alphabet also does that, but it also has its own chips that it designed in-house, called tensor processing units (TPUs). These chips are more specialized for AI workloads, which makes them more efficient and cheaper to use for those specific tasks than general-purpose GPUs.

Alphabet collaborated with application-specific chip leader Broadcom (NASDAQ: AVGO) on those TPUs. However, now Alphabet must pay Broadcom for these products, and of course, it's still buying major quantities of GPUs from Nvidia. If it can develop its next generation of computing (quantum computing) in-house, then it won't need to pay a third party for their computing units.

Bringing this in-house would provide an advantage from a margin standpoint, as well as a technological one, as clients would have to use Google Cloud if they wanted access to its version of quantum computing technology.

Alphabet's endeavors in this area have been quite impressive, as it has passed several milestones ahead of its peers.

Its most recent success came in a test in which its Willow quantum chip solved a verifiable algorithm, and did so 13,000 times faster than the best traditional supercomputer. This is a big deal because it was the first time a quantum computer had demonstrated a verifiable advantage over traditional machines.

As Alphabet continues to announce breakthroughs, investors should keep tabs on how the pure plays are doing. Several of them have announced exciting breakthroughs, too. For example, IonQ (NYSE: IONQ) raised the bar for accuracy by achieving 99.99% two-qubit gate fidelity, and Rigetti Computing (NASDAQ: RGTI) recently sold two quantum computers for real-world use. Still, Alphabet is an early leader in this industry, and it has the deep pockets to out-invest and outperform its smaller competitors from here.

With the technology still years away from commercial viability, Alphabet's cash flows give it a key edge. But even if it doesn't achieve quantum computing supremacy, it's still a strong business that investors can be excited about owning.

Before you buy stock in Alphabet, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Alphabet wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $599,784!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,165,716!*

Now, it’s worth noting Stock Advisor’s total average return is 1,035% — a market-crushing outperformance compared to 191% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of November 10, 2025

Keithen Drury has positions in Alphabet, Broadcom, and Nvidia. The Motley Fool has positions in and recommends Alphabet, IonQ, and Nvidia. The Motley Fool recommends Broadcom. The Motley Fool has a disclosure policy.

| 1 hour | |

| 1 hour | |

| 2 hours | |

| 4 hours | |

| 5 hours | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 |

Land Grab for Data Centers Is One More Obstacle to Much-Needed Housing

GOOGL GOOG

The Wall Street Journal

|

| Feb-17 | |

| Feb-17 | |

| Feb-17 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite