|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

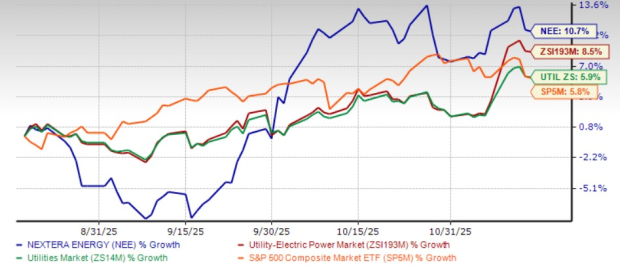

Shares of NextEra Energy NEE have gained 10.7% in the last three months compared with the Zacks Utility - Electric Power industry’s rise of 8.5%. The company has also outperformed the Zacks Utilities sector and the Zacks S&P 500 composite’s return in the same time frame.

The increase in NextEra Energy’s share price reflects its solid performance and expanding customer base, which is driving greater demand for the services. Improving economic conditions in Florida are creating fresh demand for its services. The decline in interest rates is expected to enhance the outlook for this capital-intensive business.

Should you consider adding NEE to your portfolio only based on positive price movements? Let us delve deeper and find out the factors that can help investors decide whether it is a good entry point to add NEE stock to their portfolio.

Another utility, Xcel Energy XEL, operates in the same space and has substantial clean power generation capacity and is investing to increase its clean electricity generation capacity. Xcel Energy’s shares gained 11.6% in the last month, outperforming its industry, sector and Zacks S&P 500 composite’s rally.

NextEra Energy reported third-quarter 2025 adjusted earnings of $1.13 per share, which beat the Zacks Consensus Estimate of $1.04 by nearly 8.7%. The year-over-year improvement in earnings per share was due to solid financial and operational performance at two of its businesses.

The improving Florida economy is boosting NextEra Energy’s outlook by creating fresh demand opportunities. With the need for clean electricity steadily rising, the company is well-equipped to respond through targeted investments that modernize and expand its infrastructure. Additionally, residential bills at its subsidiary, Florida Power & Light Company (“FPL”), remain well below the national average, giving NEE a competitive edge and helping draw in new customers.

FPL continues to invest heavily to deliver reliable, high-quality service, with plans to deploy nearly $43 billion from 2025 to 2029. Its long-term strategy includes adding more than 25 gigawatts (“GW”) of new generation and storage by 2034, supported by about $19.5 billion in clean-energy projects during 2025-2029. Thanks to its modernization initiatives and the nation’s largest owned and operated solar portfolio, FPL has already saved customers nearly $16 billion in fuel costs since 2001.

NextEra Energy is advancing its long-term clean energy strategy with substantial investments and a strong project pipeline. The company plans to add 36.5-46.5 GW of new renewable capacity from 2024 to 2027 and expects to invest $31.3 billion between 2025 and 2029 to expand and reinforce its operations. It currently has a robust backlog of 29.6 GW of signed contracts, underscoring solid growth visibility. In the third quarter of 2025 alone, nearly 3 GW of new renewable projects were added to this backlog. By 2027, the Energy Resources unit anticipates operating more than 70 GW of generation and storage capacity.

NextEra Energy, a capital-intensive company with a domestic focus, stands to gain from the Federal Reserve's decision to cut interest rates. The Fed has reduced the benchmark rate to 3.75-4.00% from the 5.25-5.5% range. Additional rate cuts anticipated in 2026 could further reduce the company’s capital servicing costs.

Contribution from NEE’s organic and inorganic assets results in stable free cash flow, which allows it to increase shareholders’ value through dividends and share repurchases. The current buyback authorization will enable the company to buy back 180 million shares over an unspecified period.

Courtesy of the efficient execution of plans and smart capital investment, NextEra Energy's earnings surpassed expectations in the fourth quarter. The company’s earnings surpassed expectations in each of the past four quarters, with an average surprise of 4.39%.

Another prominent utility, Duke Energy Corporation DUK, is making substantial investments to reduce emissions and add renewable and clean electricity generation assets to its portfolio. Duke Energy also reported an average earnings surprise of 5.72% in the last four quarters.

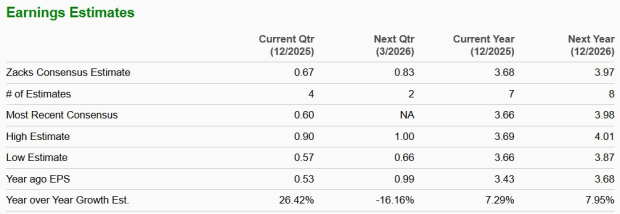

NextEra Energy expects its 2025 earnings per share in the range of $3.45-$3.70 compared with $3.43 a year ago. The Zacks Consensus Estimate for NEE’s 2025 and 2026 earnings per share indicates year-over-year growth of 7.29% and 7.95%, respectively.

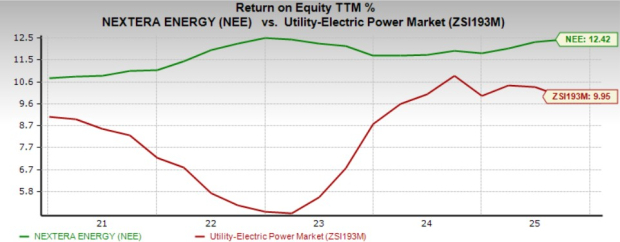

Return on Equity (“ROE”) shows how effectively a company’s management is utilizing investors’ money to generate returns. The ROE of the company is better than its industry. The current ROE of the company is 12.42% compared with its industry’s 9.95X.

NextEra Energy plans to increase the dividend rate annually by 10%, at least through 2026, from the 2024 base, subject to its board’s approval. The current annual dividend of the company is $2.27 per share, and the dividend yield of 2.7% is better than the Zacks S&P 500 composite’s yield of 1.53%. NextEra Energy has increased its dividend five times in the last five years. Check NEE’s dividend history here.

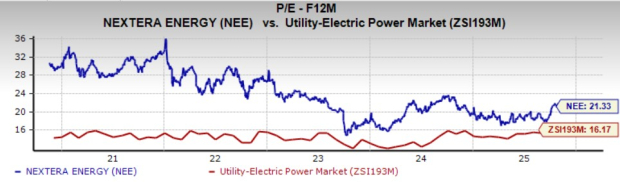

The company is currently valued at a premium compared with its industry on a forward 12-month P/E basis. NextEra Energy is currently trading at 21.33X compared with the industry average of 16.17X.

The company maintains steady performance, supported by growing demand for clean energy across its service areas. NEE’s broad presence across the United States, coupled with falling interest rates, further strengthens its outlook. The company’s efficient operations, large-scale renewable energy capabilities and strategically positioned projects continue to drive and enhance its overall performance.

Investors may consider keeping this Zacks Rank #3 (Hold) utility in their portfolios thanks to its steady return on equity, improving earnings outlook and consistent ability to deliver regular dividend payments. Due to NEE’s premium valuation, new investors may want to wait for a more attractive entry point.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-17 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite