|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

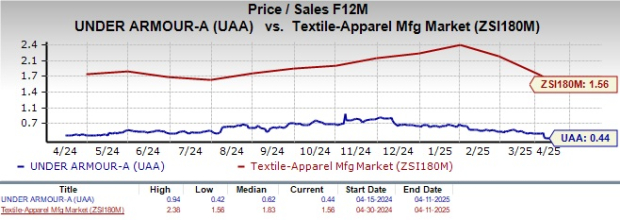

Under Armour, Inc. UAA stands out as a compelling value play within the Zacks Textile – Apparel industry. It is trading at a forward 12-month price-to-sales ratio of 0.44, down from the industry and the Consumer-Discretionary sector’s average of 1.56 and 1.78, respectively. This undervaluation highlights its potential for investors seeking attractive entry points. Moreover, Under Armour’s Value Score of A underscores its value appeal.

UAA Looks Attractive From a Valuation Standpoint

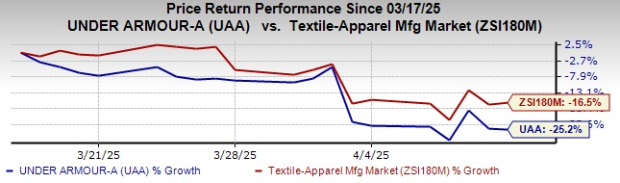

Over the past month, the company’s shares have lost 25.2%, underperforming the industry’s decline of 16.5%. While this downturn reflects ongoing market headwinds, it may present an appealing buying opportunity for investors looking to capitalize on a fundamentally strong company trading at a discount.

UAA Stock Past-Month Performance

Under Armour has taken bold steps to reshape the direct-to-consumer (“DTC”) approach, centering its focus on full-price sales and reinforcing identity as a premium athletic brand. By pulling back on promotions and discounts, the company has successfully driven up average unit prices and overall order values, boosting both profitability and brand perception. This pivot to a more value-focused model supports a healthier revenue stream and cements Under Armour’s status as a high-performance market leader.

A major win for the company has been the expansion of its loyalty program. In the third quarter of fiscal 2025, 4 million new members signed up, bringing North America’s total members to 17 million. This surge has led to stronger customer retention, higher repurchase activity and deeper brand engagement. With a growing base of loyal consumers, Under Armour is strengthening its direct connections and fostering long-term brand affinity.

A standout piece of this transformation is Under Armour’s Baltimore flagship store, which functions as a real-time innovation lab for enhancing customer experience. Insights gained from this store are applied across its 200 locations in North America and nearly 2,000 global retail stores, ensuring consistent and improved consumer interactions. This hands-on retail strategy is proving instrumental in building lasting consumer relationships, all while setting the stage for sustainable growth.

Under Armour is strengthening its premium positioning through product innovation and elevated offerings. New releases like the Fox 1 basketball shoe with Flow technology and the UA Icon Heavyweight Hoodie have resonated with younger consumers, driving strong sell-through and margin improvements. This shift toward high-performance, high-value products is helping the brand move away from discount-driven sales and build greater pricing power.

At the same time, the company is revamping its marketing strategy under brand president Eric Liedtke, focusing on grassroots programs, influencer partnerships and culturally relevant campaigns, such as UA Next and viral moments with Notre Dame Football. On the global front, Under Armour is expanding in key international markets, with targeted efforts in EMEA and APAC to drive localized growth. These combined efforts are setting the stage for stronger brand equity, increased consumer engagement and long-term global profitability.

Under Armour has made notable progress in improving margins, achieving a 240-basis-point increase in gross margin during its fiscal third quarter, reaching 47.5%. This improvement is largely attributed to reduced promotional activity, lower product and freight costs and favorable currency exchange rates.

On the last earnings call, Under Armour has updated its guidance for fiscal 2025 with a cautiously optimistic outlook. The company anticipates a low-single-digit percentage decline in adjusted selling, general and administrative expenses, an improvement from its previous estimate of a low to mid-single-digit decrease. The company also raised its adjusted operating income forecast to a range of $185 million to $195 million, up from the earlier projection of $165 million to $185 million.

In addition, Under Armour has increased its adjusted earnings per share guidance to 28-30 cents compared with the prior estimate of 24-27 cents. This revised outlook highlights the company’s commitment to disciplined cost control, enhanced operational efficiency and targeted growth strategies aimed at delivering long-term shareholder value.

Under Armour presents a strong opportunity for investors looking at undervalued potential in the athletic apparel market. The company is enhancing its premium brand image through a refined DTC strategy, focusing on higher-priced products and reducing reliance on discounts. UAA’s growing customer loyalty base and innovative retail experiences are strengthening brand engagement, while global expansion and an updated marketing strategy are boosting its worldwide presence. With improving margins and a positive outlook on operational efficiency, Under Armour is positioning itself for long-term value and sustained growth. The company currently carries a Zacks Rank #2 (Buy).

Some other top-ranked stocks are The Gap, Inc. GAP, Stitch Fix SFIX and Gildan Activewear Inc. GIL.

The Gap is a premier international specialty retailer offering a diverse range of clothing, accessories and personal care products. It sports a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for The Gap’s fiscal 2025 earnings and revenues indicates growth of 7.7% and 1.6%, respectively, from fiscal 2024 reported levels. GAP delivered a trailing four-quarter average earnings surprise of 77.5%.

Stitch Fix delivers customized shipments of apparel, shoes and accessories for women, men and kids. It currently has a Zacks Rank of 2.

The Zacks Consensus Estimate for Stitch Fix’s fiscal 2025 earnings implies growth of 64.7% from the year-ago actuals. SFIX delivered a trailing four-quarter average earnings surprise of 48.9%.

Gildan Activewear is a manufacturer and marketer of premium quality branded basic activewear. It carries a Zacks Rank #2 at present.

The Zacks Consensus Estimate for Gildan Activewear’s current financial year earnings and revenues implies growth of 16% and 4.4%, respectively, from the year-ago actuals. GIL delivered a trailing four-quarter average earnings surprise of 5.3%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-20 | |

| Feb-20 | |

| Feb-18 | |

| Feb-18 | |

| Feb-15 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-11 | |

| Feb-11 | |

| Feb-10 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite