|

|

|

|

|||||

|

|

Butterfly Network, Inc. BFLY recently introduced Compass AI, a next-generation enterprise software platform designed to streamline and scale point-of-care ultrasound (POCUS) programs across health systems. The company claims this shift can lift documentation compliance significantly and help health systems unlock more revenue from the same exam volume.

In the near term, Compass AI positions BFLY to benefit from stronger enterprise demand as health systems look for quick, revenue-enhancing solutions. The platform directly addresses long-standing workflow and compliance gaps, which could accelerate adoption and boost software-driven monetization.

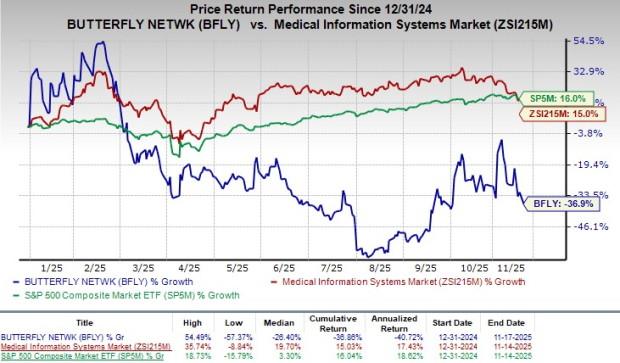

Following the announcement, the company's shares lost nearly 7% at yesterday’s closing. In the year-to-date period, shares have gained 34.7% against the industry’s 10.8% decline. The S&P 500 has gained 12.2% in the same time frame.

However, in the long run, Compass AI strengthens BFLY’s position as a core infrastructure partner for health systems, shifting the company toward a more durable, software-led revenue model. By embedding itself deeper into POCUS workflows and enterprise governance, BFLY can drive higher customer retention, expand multi-department deployments and steadily grow recurring revenue.

BFLY currently has a market capitalization of $535.5 million.

Butterfly Network’s Compass AI marks a significant upgrade to its enterprise platform, targeting longstanding workflow and documentation gaps in POCUS programs. Many health systems continue to rely on radiology-style, order-based processes that often lead to delayed documentation, missed orders and a high volume of exams going unreviewed or unreimbursed.

Traditional workflows capture only about 15% of compliant studies, leaving roughly 85% of exams unbilled. Compass AI introduces an AI-enhanced, encounter-based workflow built for POCUS, enabling documentation compliance rates of up to 94% without adding work for clinicians and helping health systems potentially generate up to five times more revenue from the same clinical load.

Compass AI brings together a full suite of AI-powered capabilities to support compliant and scalable POCUS operations. The Documentation Agent uses ambient voice dictation to complete exam notes automatically, reducing charting time by up to 25%. The QA Agent accelerates quality review through AI-based image evaluation and feedback.

The Program Dashboard tracks usage, documentation compliance, credentialing and unbilled studies, providing insights into operational performance and potential ROI. The platform also offers seamless integration with EHRs, PACS and SSO systems, ensuring studies are routed directly into the medical record and preventing lost images. Fleet Visibility enables oversight of users and devices, supporting broader governance across the health system.

With its ability to work across departments and ultrasound devices, Compass AI provides health systems with the visibility, governance and standardization needed to expand POCUS at scale. The platform supports improved documentation accuracy, stronger compliance, streamlined QA processes and enhanced revenue capture from exams that previously went unbilled. Butterfly Network confirmed that Compass AI is available starting today.

Currently, BFLY carries a Zacks Rank #3 (Hold).

Some better-ranked stocks from the broader medical space are Medpace Holdings MEDP, Intuitive Surgical ISRG and Boston Scientific BSX.

Medpace, currently sporting a Zacks Rank #1 (Strong Buy), reported a third-quarter 2025 EPS of $3.86, which surpassed the Zacks Consensus Estimate by 10.29%. Revenues of $659.9 million beat the Zacks Consensus Estimate by 3.04%. You can see the complete list of today’s Zacks #1 Rank stocks here.

MEDP has an estimated earnings growth rate of 17.1% for 2025 compared with the industry’s 16.6% growth. The company beat earnings estimates in each of the trailing four quarters, the average surprise being 14.28%.

Intuitive Surgical, carrying a Zacks Rank #2 (Buy) at present, posted a third-quarter 2025 adjusted EPS of $2.40, exceeding the Zacks Consensus Estimate by 20.6%. Revenues of $2.51 billion topped the Zacks Consensus Estimate by 3.9%.

ISRG has an estimated long-term earnings growth rate of 15.7% compared with the industry’s 11.9% growth. The company’s earnings outpaced estimates in each of the trailing four quarters, the average surprise being 16.34%.

Boston Scientific, currently carrying a Zacks Rank #2, reported a third-quarter 2025 adjusted EPS of 75 cents, which surpassed the Zacks Consensus Estimate by 5.6%. Revenues of $5.07 billion outperformed the Zacks Consensus Estimate by 1.9%.

BSX has an estimated long-term earnings growth rate of 16.4% compared with the industry’s 13.5% growth. The company’s earnings beat estimates in each of the trailing four quarters, the average surprise being 7.36%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Mar-06 | |

| Mar-06 | |

| Mar-06 | |

| Mar-06 | |

| Mar-06 | |

| Mar-06 | |

| Mar-06 | |

| Mar-05 | |

| Mar-05 | |

| Mar-05 | |

| Mar-05 | |

| Mar-05 | |

| Mar-05 | |

| Mar-05 | |

| Mar-05 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite