|

|

|

|

|||||

|

|

Wix.com Ltd (WIX) reported non-GAAP earnings per share (EPS) of $1.68 for third-quarter 2025, exceeding the Zacks Consensus Estimate of 39 cents. The company had reported EPS of $1.50 in the year-ago quarter.

Quarterly revenues increased 14% year over year to $505.2 million, beating the Zacks Consensus Estimate of $502.65 million. The top line exceeded management’s guidance ($498-$504 million). The company not only exceeded expectations across multiple revenue streams but also raised its full-year bookings and revenue outlook, driven largely by accelerating adoption of Base44. With Base44, Wix is expanding this mission into the realm of natural language application development.

Base44 emerged as a key growth engine for the quarter, with market share increasing from low single digits to more than 10% since June, and top-line growth exceeding expectations. The business is on track to reach at least $50 million in ARR by the year's end. Management noted that strong customer traction supports increased marketing investments, and Wix expects Base44 to deliver long-term margins similar to its core business in 2026 as well.

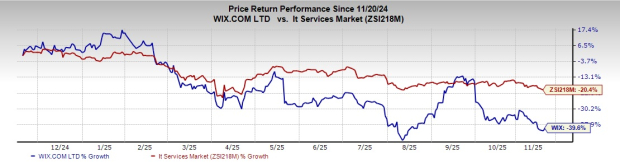

WIX's shares have declined 39.6% compared with the Zacks Computer-IT Services’ fall of 20.4% in the past year.

Creative Subscriptions’ revenues (70.5% of total revenues) increased 12% year over year to $356.2 million. In the third quarter, Creative Subscriptions' annualized recurring revenues were $1.5 billion, up 11% year over year.

Business Solutions’ revenues (29.5% of total revenues) rose 18% to $149 million. Transaction revenues totaled $65.3 million, up 20%.

Bookings of $514.5 million improved 14% year over year. Creative Subscriptions’ bookings increased 12% to $366.4 million. Business Solutions’ bookings rose 20% to $148.2 million. Strong performance in both Creative Subscriptions and Business Solutions drove the upside. New cohort bookings stayed strong, reflecting solid demand and healthy fundamentals. This ongoing momentum highlights Wix’s strength and the growing importance of its platform for small businesses and creators today.

Wix.com Ltd. price-consensus-eps-surprise-chart | Wix.com Ltd. Quote

Partners revenues in the third quarter were $192.1 million, up 24% year over year.

Region-wise, North America, Europe, Asia and others, and Latin America contributed 61%, 25%, 11% and 4% to third-quarter 2025 revenues, up 13%,14%,11% and 8% year over year, respectively.

At the end of Sept. 30, 2025, registered users were 299 million.

Non-GAAP gross margin was 69% flat year over year. Creative Subscriptions segment achieved a non-GAAP gross margin of 84% and the Business Solutions segment 34%.

Wix reported a non-GAAP operating income of $89.9 million compared with $88.4 million in the year-ago quarter.

As of Sept. 30, 2025, Wix had cash and cash equivalents of $889.6 million compared with $693 million as of June 30, 2025.

Cash flow from operations amounted to $128.7 million compared with $129.8 million in the year-ago quarter.

Capital expenditures totaled $1.4 million. Free cash flow was $127.3 million.

The company also executed $175 million in share repurchases, boosting long-term performance and valuation.

For 2025, bookings are now expected to reach $2,060–2,078 million (up 13–14%) compared with previous projections of $2,040–2,075 million (11–13%). The revision is driven primarily by Base44 outperformance and sustained cohort strength.

Wix tweaked its full-year revenue outlook to $1,990–2,000 million (up 13–14%) from $1,975–2,000 million (12–14%), with the slight shift driven by more customers choosing multi-year plans that delay revenue recognition but enhance long-term stability.

Wix now expects a non-GAAP gross margin of 68–69%, slightly lower due to higher AI costs driven by stronger-than-expected demand and growing Base44 usage. It is increasing branding and marketing investments to capture strong Base44 demand, supported by better-than-expected top-line performance. As a result, it now expects non-GAAP operating expenses to be about 50% of full-year revenue, up from the prior view of 49%.

With higher bookings, increased operating expenses and ongoing working-capital benefits, Wix now expects to generate about $600 million in free cash flow in 2025, around 30% of revenue. Prior estimate was $595-$610 million, implying 30-31% of revenues.

Management anticipates total revenues for the fourth quarter of 2025 to be between $521 million and $531 million, implying a year-over-year increase of 13–15%.

Currently, Wix carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

CDW Corporation (CDW) reported third-quarter 2025 non-GAAP EPS of $2.71, surpassing the Zacks Consensus Estimate of $2.53. Also, the bottom line increased 3% year over year. The company’s revenues increased 4% year-over-year to $5.74 billion. On a constant currency (cc) basis, sales grew 3.8%, showing broad-based demand across product categories, such as notebooks/mobile devices, software, networking (netcomm) products, desktops and services, despite a slowdown in data storage and servers.

Cognizant Technology Solutions (CTSH) reported non-GAAP earnings of $1.39 per share in the third quarter of 2025, which beat the Zacks Consensus Estimate by 7.75% and increased 11.2% year over year. Revenues of $5.42 billion beat the consensus mark by 1.63%. The top line increased 7.4% year over year and 6.5% at cc. This growth was driven by strong performance in North America and organic growth across all segments. Acquisitions also contributed approximately 250 basis points to year-over-year revenue growth.

Vertiv Holdings (VRT) reported third-quarter 2025 non-GAAP earnings of $1.24 per share, beating the Zacks Consensus Estimate by 24%. The figure jumped 63.2% year over year. Net sales increased 29% year over year to $2.68 billion, surpassing the Zacks Consensus Estimate by 3.60%. Net sales on an organic basis increased 28.4% year over year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 21 min | |

| 48 min | |

| 4 hours | |

| 5 hours | |

| 5 hours | |

| 5 hours | |

| 6 hours | |

| 6 hours | |

| 7 hours |

AI Stocks Hit Reset. Will Nvidia, Snowflake, CoreWeave, Salesforce Earnings Decide What's Next?

VRT

Investor's Business Daily

|

| Feb-22 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-19 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite