|

|

|

|

|||||

|

|

Lumen Technologies, Inc. LUMN has teamed up with Meter to introduce a streamlined, end-to-end networking solution designed for the AI-driven enterprise. The new Lumen x Meter offering brings together Lumen’s high-performance Wide Area Network (WAN) and Meter’s intelligent Local Area Network (LAN) platform, creating a unified, software-defined experience that simplifies enterprise connectivity from edge to cloud.

The integrated Lumen x Meter WAN-to-LAN solution is available via Meter Connect, giving enterprises a faster, simpler and smarter path to deploy AI-ready connectivity wherever they operate.

Through Meter Connect’s single procurement workflow, enterprises can purchase the integrated WAN-to-LAN offering, enabling faster deployment, unified visibility and lower total cost of ownership. The solution will soon be available through the Microsoft Marketplace as well, giving customers a simplified, compliant path to leverage their existing Azure commitments and incentives.

Management highlighted the significance of the collaboration, calling it a major step toward delivering secure, effortless and AI-ready connectivity. By converging WAN and LAN into one cohesive platform, Lumen and Meter are not just connecting networks, they are connecting business outcomes and removing operational complexity so enterprises can scale with confidence.

The Lumen x Meter solution also represents a key advancement within Lumen’s Connected Ecosystem, an initiative focused on enabling smarter, faster cloud, data center and infrastructure services that tightly interlink customers, partners and platforms. The combined offering delivers integrated connectivity, unified visibility and simplified operations across customer environments.

Key benefits include faster site activation than traditional provisioning processes, comprehensive WAN and LAN insights through the Meter Dashboard’s single interface and streamlined procurement powered by AI-driven workflows. Joint customers such as Brex and Bridgewater are already seeing value through improved end-to-end visibility and a more seamless digital experience.

Lumen Technologies, Inc. price-consensus-chart | Lumen Technologies, Inc. Quote

The partnership is also geared toward modern IT operations, helping organizations reduce deployment friction, gain real-time network insights and optimize performance across distributed environments. Lumen and Meter are working on deeper integrations that will introduce advanced WAN insights and automation into Meter Command, enabling natural language control and full-stack visibility. These capabilities will be further strengthened by Lumen’s APIs and its Lumen Connect digital platform, which supports scalable Network-as-a-Service (NaaS) offerings through a flexible consumption model.

Lumen remains focused on “cloudifying” telecom and driving the adoption of its network-as-a-service or NaaS solutions like Lumen Ethernet On-Demand and Lumen IP-VPN (Internet Protocol Virtual Private Network) On-Demand. Lumen’s strong network capabilities and integrated hosting and network solutions are likely to promote growth in the cloud business. Its managed and cloud services are key differentiators from other players in the market. Lumen highlighted that it has surpassed 1,500 customers for the NaaS platform, while active customers were up 32% sequentially.

The company recently unveiled Internet on Demand, or IoD Offnet, and expects this solution to boost market reach by 100x. Lumen also noted that its connected ecosystem strategy was “off to a great start” with recent deals with Palantir, Commvault and QTS. Management expects digital capabilities, including NaaS, Edge Solutions, Security and the Connected Ecosystem, to deliver between $500 million and $600 million of incremental revenues exiting 2028. Also, Lumen remains on track to achieve $350 million of run-rate cost benefit in 2025. It continues to expect $1 billion of run-rate cost benefit exiting 2027.

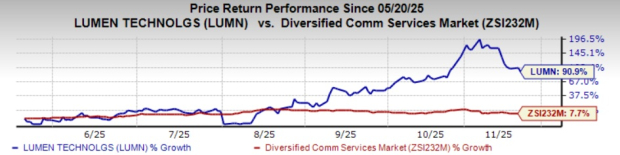

Currently, LUMN carries a Zacks Rank #2 (Buy). In the past six months, shares have surged 90.9% compared with the Zacks Diversified Communication Services industry’s growth of 7.7%.

Some other top-ranked stocks from the broader technology space are Telefonica, S.A. TEF, American States Water Company AWR and Southwest Gas Holdings, Inc. SWX. TEF, AWR and SWX carry a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

Telefonica’s earnings beat the Zacks Consensus Estimate in one of the trailing four quarters while in line in two and missing in one, with the average surprise being 1.98%. In the last reported quarter, TEF delivered an earnings surprise of 22.2%. Its shares have declined 7.9% in the past year.

American States Water earnings beat the consensus estimate in two of the trailing four quarters while in line in one and missing in one, with the average surprise being 3.63%. AWR’s long-term earnings growth rate is 5.7%. Its shares have decreased 8.8% in the past six months.

Southwest Gas Holdings’ earnings beat the Zacks Consensus Estimate in each of the trailing four quarters, with the average surprise being 4.05%. SWX’s long-term earnings growth rate is 9.7%. SWX’s shares have inched up 4.2% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Mar-05 | |

| Mar-05 | |

| Mar-05 | |

| Mar-02 | |

| Feb-28 | |

| Feb-27 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite