|

|

|

|

|||||

|

|

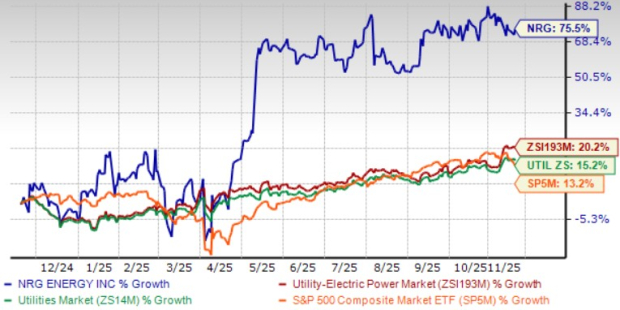

Shares of NRG Energy Inc. NRG have gained 75.5% in the last year compared with the Zacks Utility - Electric Power industry’s rise of 20.2%. The company has also outperformed the Zacks Utilities sector and the Zacks S&P 500 composite’s return in the same time frame.

NRG Energy benefits from its well-chalked-out capital investment plan to strengthen operations, strategic acquisitions, rising demand from a wide customer base and increasing demand for clean energy from the data centers developed in its service regions.

Another utility, NextEra Energy NEE, operates in the same space and has substantial clean power generation capacity and is investing to increase its clean electricity generation capacity. The company gained 9.8% in the last year, underperforming its industry.

NRG Energy is trading above its 200-day simple moving averages ("SMA"), signaling a bullish trend. NRG’s shares have gained steadily over the past 12 months after the earnings beat in the trailing four quarters.

The 200-day SMA is a key indicator for traders and analysts to identify support and resistance levels. It is considered particularly important as this is the first marker of an uptrend or downtrend of the stocks.

Should you consider adding NRG to your portfolio only based on positive price movements? Let us delve deeper and find out the factors that can help investors decide whether it is a good entry point to add NRG stock to their portfolio.

NRG Energy continues to advance its shift toward a fully integrated power provider by focusing on customer-driven strategies. Organic growth efforts and consistent delivery of high-quality services have supported strong customer retention. With a broad and diverse customer base, the company avoids dependence on a few large clients, helping stabilize billing trends and create more predictable earnings.

NRG Energy is strengthening its growth trajectory through key acquisitions. The purchases of Direct Energy and Vivint Smart Home have meaningfully expanded its operations, with acquired assets contributing positively to performance. In May 2025, the company also announced plans to acquire a major power portfolio from LS Power, which will add 18 natural gas plants totaling nearly 13 gigawatt (“GW”) and effectively double its generation capacity. This move will diversify its fleet and enhance tailored product offerings, with the deal expected to close in early 2026.

NRG has built specialized engineering, construction and offtake teams to support its customized data center strategy and secured 445 MW of high-value, long-term retail contracts. The company is pursuing additional opportunities at multiple locations and has increased its gas turbine order with GE Vernova to 2.4 GW to meet rising demand. It also signed Letters of Intent with Menlo Equities and PowLan for an initial 400 MW of supply, with the potential to scale to 6.5 GW starting in 2026.

NRG Energy has been trying to slowly lower the proportion of debt in the capital mix for a while. The company is targeting $3.7 billion debt reduction over 24-36 months from closing to maintain investment-grade credit metrics. The times interest earned ratio at the end of the third quarter of 2025 was 3.9. A times interest earned ratio of more than 1 indicates that the company is in a favorable financial position to meet interest obligations in the near future without difficulties.

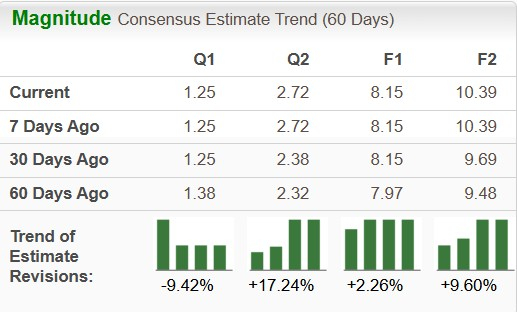

The Zacks Consensus Estimate for NRG’s 2025 and 2026 earnings per share indicates an increase of 2.26% and 9.60%, respectively, in the past 60 days.

Dominion Energy D operates in the same industry and focuses on enhancing clean energy generation. The Zacks Consensus Estimate for Dominion’s 2025 and 2026 earnings per share indicates an increase of 0.29% and 0.28%, respectively, in the past 60 days.

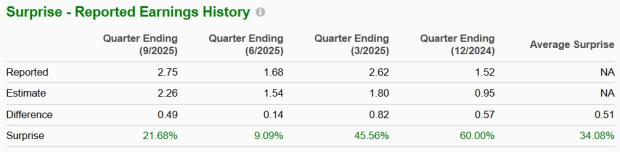

NRG Energy has been a consistent performer and it continues at a high level to meet customer and market needs amid the backdrop of increasing power demand. The company has surpassed expectations in the last four reported quarters, with an average earnings surprise of 34.08%.

Utilities are known for their regular dividend payments, and NRG Energy is no exception. NRG’s current quarterly dividend is 44 cents per share, resulting in an annualized dividend of $1.76. The company targets an annual dividend growth rate of 7-9% per share over the long term. NRG has raised its dividend five times in the past five years. More details on NRG’s dividend are available here.

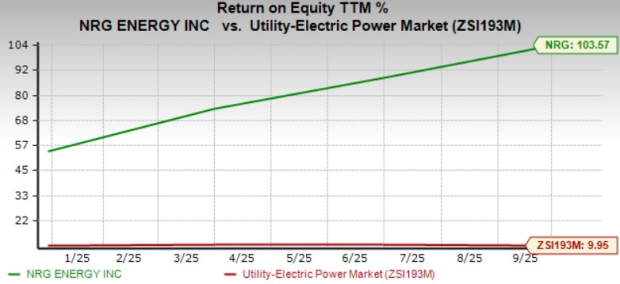

Return on equity (“ROE”) is an essential financial indicator that evaluates a company’s efficiency in generating profits from the equity invested by its shareholders. It demonstrates how well management is utilizing the capital provided to increase earnings and deliver value. The current ROE of the company indicates that it is using shareholders’ funds more efficiently than peers.

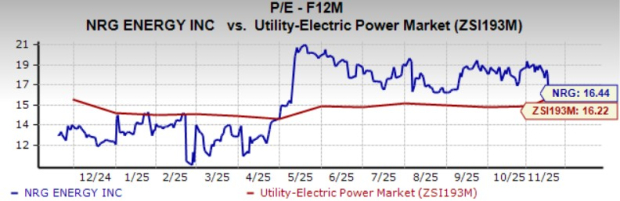

The company is currently valued at a premium compared with its industry on a forward 12-month P/E basis. NRG Energy is currently trading at 16.44X compared with the industry average of 16.22X.

NRG Energy is maintaining steady performance, supported by increasing clean-energy demand from data centers within its service regions. The company is advancing its growth through both organic initiatives and strategic acquisitions.

With improving earnings forecasts and a solid return on equity, staying invested in this Zacks Rank #3 (Hold) stock appears prudent. However, as the stock currently trades at a premium, prospective investors may want to wait for a more attractive entry point.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 34 min |

S&P 500 Nuclear Leader Constellation Energy Tops Earnings; Will Shares Continue To Rally?

NRG

Investor's Business Daily

|

| 4 hours | |

| 4 hours | |

| 5 hours | |

| 5 hours | |

| 7 hours | |

| 7 hours | |

| 8 hours | |

| 8 hours | |

| 10 hours | |

| 11 hours | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite