|

|

|

|

|||||

|

|

ASML Holding N.V. ASML is slated to report its first-quarter 2025 results on April 16.

Stay up-to-date with all quarterly releases: See Zacks Earnings Calendar.

ASML expects revenues between €7.5 billion and €8 billion. The Zacks Consensus Estimate is pegged at $8.08 billion, indicating an increase of 40.7% from the year-ago quarter’s level.

The Zacks Consensus Estimate for earnings is pegged at $6.12 per share, up 81.1% from the year-ago quarter’s earnings of $3.38. The estimate has been revised upward by 10 cents over the past 60 days.

ASML Holding has an impressive earnings surprise history. The company’s earnings outpaced the Zacks Consensus Estimate in each of the trailing four quarters, the average beat being 10.8%.

ASML Holding N.V. price-eps-surprise | ASML Holding N.V. Quote

Our proven model predicts an earnings beat for ASML Holding this earnings season. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat, which is the case here.

Earnings ESP: Earnings ESP, which represents the difference between the Most Accurate Estimate ($6.40 per share) and the Zacks Consensus Estimate ($6.12 per share), is +4.58%. You can uncover the best stocks to buy or sell before they are reported with our Earnings ESP Filter.

Zacks Rank: ASML carries a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

The semiconductor sector is riding a wave of resurgence, fueled by surging demand and the transformative potential of AI. This positive momentum has been a boon for companies like ASML, particularly in the wafer fabrication equipment space.

ASML Holding has been at the forefront of technological innovation, benefiting significantly from the industry’s shift toward smaller, more advanced technology nodes. These nodes are essential for building cutting-edge digital infrastructures supporting AI, 5G and high-performance computing. The increasing complexity of chip designs has made ASML's state-of-the-art lithography tools indispensable to chipmakers.

In both the logic and memory markets, demand for ASML’s lithography tools continues to climb. The ongoing transition to next-generation memory technologies, such as DDR5 and high-bandwidth memory (HBM), is a tailwind for the company. With DRAM manufacturers ramping up technology upgrades, ASML Holding is likely to have witnessed strong momentum in the first quarter, driven by heightened memory demand.

ASML’s heavy investments in Extreme Ultraviolet (“EUV”) technology are also paying off. EUV lithography is critical for producing advanced chips, and the company’s service segment is benefiting from the rising demand for EUV-related services. In particular, the growing popularity of the NXE:3800 low numerical aperture (NA) machine, which can process 220 wafers per hour, is likely to have driven substantial EUV sales in the to-be-reported quarter.

Despite the strengths, macroeconomic challenges are likely to have negatively impacted ASML’s quarterly outlook. The intensifying U.S.-China trade tensions, coupled with export restrictions on advanced semiconductors and equipment to China, remain a critical headwind. Given ASML’s exposure to the Chinese market, these restrictions may have dampened the company’s overall performance.

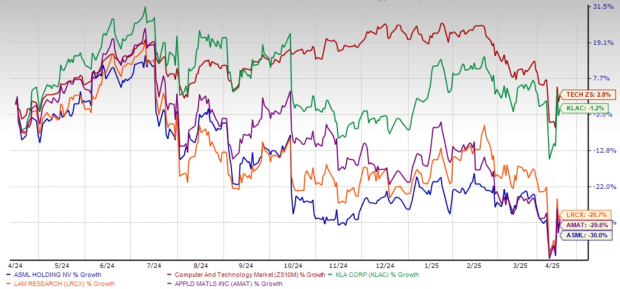

ASML Holding shares have plunged 30% over the past year, underperforming the Zacks Computer and Technology industry’s growth of 2.8%. Comparing ASML with semiconductor peers, the stock has underperformed KLA Corporation KLAC, Lam Research Corporation LRCX and Applied Materials, Inc. AMAT. Over the past year, shares of KLA Corporation, Lam Research and Applied Materials have declined 1.2%, 28.7% and 29.6%, respectively.

Now, let’s look at the value that ASML offers to its investors at the current level. Currently, ASML Holding is trading at a premium. With a forward 12-month P/E of 24.94X, ASML is trading higher than the sector’s average of 22.26X.

The stock also trades at a premium to other major semiconductor players, including KLA Corporation, Lam Research and Applied Materials. Currently, KLA Corporation, Lam Research and Applied Materials have a forward 12-month P/E ratio of 20.94, 17.93 and 15.09, respectively.

Despite short-term challenges, ASML’s technological leadership in lithography equipment makes it indispensable to the semiconductor industry. The company maintains a near-monopoly on EUV lithography, which is essential for producing advanced chips at 3nm and below. Its EUV systems are crucial for leading chipmakers such as TSMC, Samsung and Intel, positioning ASML as a key enabler of cutting-edge semiconductor manufacturing.

ASML’s High-NA EUV technology represents the next frontier in chip manufacturing. Designed for sub-2nm nodes, these advanced systems will be critical for the industry’s future. While the adoption of High-NA EUV has been slower than expected, the long-term potential remains enormous. As chipmakers ramp up production of smaller, more powerful chips, ASML’s High-NA EUV tools will play a pivotal role, driving sustained demand.

The company’s technological superiority ensures high barriers to entry, giving it a competitive moat. With EUV technology being essential for advanced semiconductor fabrication, ASML’s dominance remains intact, supporting its long-term growth outlook.

ASML Holding’s dominance in EUV and High-NA EUV technology, along with solid revenue visibility, makes it well-positioned for future growth. With rising demand for advanced nodes, AI chips and high-bandwidth memory, ASML’s lithography tools will remain mission-critical, making the stock worth buying.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 4 hours | |

| 5 hours | |

| 7 hours | |

| 10 hours | |

| 11 hours | |

| 11 hours | |

| 11 hours | |

| 12 hours | |

| 12 hours | |

| 13 hours | |

| 13 hours | |

| 14 hours | |

| 14 hours | |

| 18 hours | |

| 22 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite