|

|

|

|

|||||

|

|

Merck MRK and AbbVie ABBV are leading pharmaceutical companies with strong portfolios in oncology and immunology. While AbbVie also markets products for aesthetics, neuroscience and eye care, Merck has a presence in vaccines, neuroscience diabetes, virology and animal health areas.

Oncology accounts for around 50% of Merck’s total revenues. Blockbuster PD-L1 inhibitor, Keytruda, approved for several types of cancers, alone accounts for around 50% of its pharmaceutical sales.

As regards AbbVie, its biggest segment is immunology with key drugs like Humira, Skyrizi and Rinvoq. Immunology accounts for around 50% of AbbVie’s total revenues.

Both companies are seeing consistent sales and earnings growth. Both boast robust pipelines with promising candidates in late-stage development. But which one is a better investment today? Let’s take a closer look at their fundamentals, growth prospects and challenges to make an informed choice.

AbbVie has successfully navigated the loss of exclusivity (LOE) of its blockbuster drug, Humira, which once generated more than 50% of its total revenues. It has accomplished this by launching two other successful new immunology medicines, Skyrizi and Rinvoq, which are performing extremely well, bolstered by approvals in new indications and should support top-line growth in the next few years.

AbbVie has several early/mid-stage pipeline candidates with blockbuster potential. The company expects several regulatory submissions, approvals and key data readouts in the next 12 months. AbbVie has also been on an acquisition spree in the past couple of years, which is strengthening its pipeline. It has signed several M&A deals in the immunology space, its core area, while also signing some early-stage deals in oncology and neuroscience areas.

However, the company faces some near-term headwinds like Humira’s biosimilar erosion, increasing competitive pressure on cancer drug Imbruvica and a slow market growth trend for Juvederm fillers in the United States and China due to challenging market conditions.

As of Dec. 31, 2024, AbbVie had $60.3 billion in long-term debt and short-term debt/obligations of $6.8 billion on its balance sheet. Cash and cash equivalents totaled approximately $5.6 billion. Its debt-to-capital ratio of 0.95 is much higher than the industry's average of 0.41.

Merck boasts more than six blockbuster drugs in its portfolio, with Keytruda being the key top-line driver. Keytruda has played an instrumental role in driving Merck’s steady revenue growth in the past few years. Keytruda’s sales are gaining from rapid uptake across earlier-stage indications, mainly early-stage non-small cell lung cancer. Continued strong momentum in metastatic indications is also boosting sales growth. The company expects continued growth from Keytruda, particularly in early lung cancer. Merck is also developing a subcutaneous formulation of Keytruda that can extend its patent life. Merck is working on different strategies to drive Keytruda's long-term growth.

Merck made meaningful regulatory and clinical progress in 2024 across areas like oncology (mainly Keytruda), vaccines and infectious diseases while executing strategic business moves like the acquisitions of Eyebiotech Limited and Harpoon Therapeutics.

However, sales of Gardasil, which is Merck’s second-largest product, declined in 2024 due to a weak performance in China, which resulted from sluggish demand trends amid an economic slowdown. Merck is also seeing weakness in the diabetes franchise and the generic erosion of some drugs.

Though Keytruda may be Merck’s biggest strength and a solid reason to own the stock, it can also be argued that the company is excessively dependent on the drug, and it should look for ways to diversify its product lineup.

There are rising concerns about the firm’s ability to grow its non-oncology business ahead of the upcoming LOE of Keytruda in 2028.

With a weak fourth-quarter earnings report in February, along with an unimpressive guidance for 2025, Merck began the year on a dismal note.

It exited 2024 with cash and cash equivalents of $13.7 billion against long-term debt of 34.5 billion, resulting in a debt-to-capital ratio of 0.42, which is just slightly higher than the industry's average of 0.41.

The Zacks Consensus Estimate for ABBV’s 2025 sales and EPS implies a year-over-year increase of 5.7% and 21.4%, respectively. EPS estimates for both 2025 and 2026 have risen over the past 60 days.

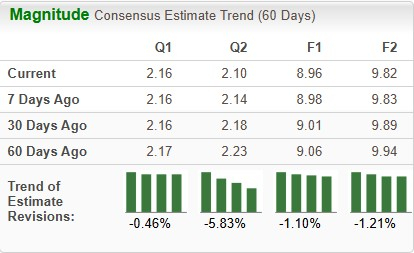

The Zacks Consensus Estimate for Merck’s 2025 sales and EPS implies a year-over-year increase of 1.3% and 17.1%, respectively. EPS estimates for both 2025 and 2026 have been trending southward over the past 60 days.

Year to date, AbbVie’s stock has declined 0.6% and Merck’s stock has plunged 19.7% compared with the industry’s decrease of 6.0%

MRK and ABBV are priced lower than the industry from a valuation standpoint. ABBV is more expensive than MRK, going by the price/earnings ratio. AbbVie’s shares currently trade at 13.71 forward earnings, higher than 8.60 for Merck.

However, both Merck and AbbVie are cheaper than other large drugmakers like Eli Lilly LLY and Novo Nordisk NVO.

AbbVie’s dividend yield of 3.75% is lower than MRK’s 4.09%.

AbbVie’s return on equity of 296.3% is significantly higher than Merck’s 44.4%

Merck and AbbVie have a Zacks Rank #3 (Hold) each, which makes choosing one stock a difficult task. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Merck has one of the world’s best-selling drugs in its portfolio, generating billions of dollars in revenues. Though Keytruda will lose patent exclusivity in 2028, its sales are expected to remain strong until then. However, the company’s problems are too many at present. Consistently declining estimates also reflect analysts’ pessimistic outlook for the stock.

On the other hand, AbbVie has faced its biggest challenge — Humira’s patent cliff — quite well and looks well-positioned for continued strong growth in the years ahead. The company saw a rapid return to sales growth in 2024 after revenues declined in 2023 due to Humira LOE, driven by its ex-Humira platform. AbbVie’s ex-Humira drugs rose around 19% (on a reported basis) in 2024, exceeding its internal expectations.

Boosted by its new product launches, AbbVie expects to return to robust mid-single-digit revenue growth in 2025 with a high single-digit CAGR through 2029, as it has no significant LOE event for the rest of this decade. Merck, in sharp contrast, faces the upcoming LOE of its biggest product, Keytruda, in a few years’ time. Though Merck’s new products, Capvaxive and Winrevair, are witnessing strong launches and have the potential to generate significant revenues over the long term, there are major doubts about the company’s ability to navigate the Keytruda LOE period successfully.

Despite its steeper valuation, AbbVie is thus a clear-cut winner due to rising estimates, stock price appreciation, a solid pipeline and the prospect of growth in 2025 sales and profits.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 2 hours | |

| 10 hours | |

| 11 hours | |

| 11 hours | |

| 11 hours | |

| 12 hours | |

| 12 hours |

Novo expands injectable Wegovy offering with European higher dose approval

NVO

Pharmaceutical Technology

|

| 13 hours | |

| 13 hours | |

| 13 hours | |

| 14 hours | |

| 15 hours | |

| 16 hours | |

| 17 hours | |

| 17 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite