|

|

|

|

|||||

|

|

HealthEquity, Inc. HQY has been gaining from its business model and strategy. The optimism, led by a solid second-quarter fiscal 2025 performance and strength in Health Savings Accounts (HSAs), is expected to contribute further. However, data security threats are major concerns.

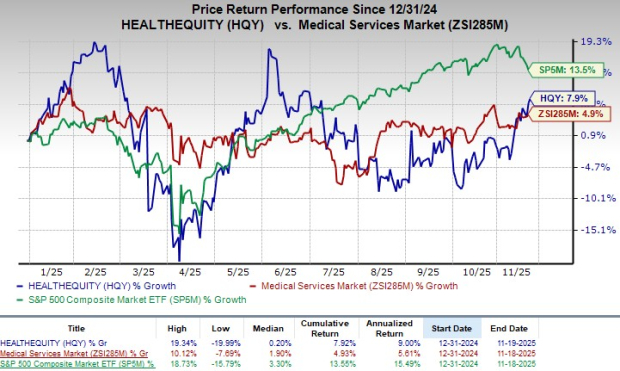

In the past six months, the Zacks Rank #2 (Buy) company’s shares have risen 9.5% compared with 3.2% growth of the industry. The S&P 500 has increased 27.6% during the said time frame.

The renowned provider of technology-enabled services platforms for healthcare savings and spending decisions has a market capitalization of $8.85 billion. The company projects 21.7% growth over the next five years and expects to witness continued improvements in its business. HealthEquity’s earnings surpassed the Zacks Consensus Estimate in three of the trailing four quarters and missed once, the average surprise being 11.1%.

AI & Digital Innovation Drive Scalable Efficiency: HQY is making rapid progress in its AI and mobile-first transformation, already seeing tangible benefits from its AI-powered claims adjudication system, which processes reimbursements faster, cuts servicing costs, and boosts member satisfaction. The company is piloting Agentic AI in voice channels to automate interactions and reduce wait times, while the full cloud migration of its V5 platform has significantly improved response speed, stability, and reliability.

Alongside this, HQY’s secure mobile app and passkey authentication are enhancing security and engagement, with features like app-based multifactor authentication, digital wallet integration and mobile investing deepening member involvement and driving higher transaction volumes. Together, these initiatives are strengthening HQY’s efficiency, customer loyalty and long-term margin potential.

Expansion of Health Savings Accounts: HealthEquity has experienced significant growth in its HSA offerings. As of July 31, 2025, the total number of Health Savings Accounts (HSAs) for which HealthEquity served as a non-bank custodian was 10 million, up 6% year over year. HealthEquity reported 782,000 HSAs with investments as of July 31, 2025, up 10% year over year. Total accounts, as of April 30, 2025, were 17.1 million. This uptick included total HSAs and 7.2 million CDBs.

Total HSA assets were $33.1 billion at the end of July 31, 2025, up 12% year over year. This included $17 billion of HSA cash and $16.1 billion of HSA investments. Deposits held on behalf of HealthEquity’s clients to facilitate the administration of its CDBs, from which the company generates custodial revenues, were $0.8 billion as of July 31, 2025.

Strong Q2 Results: HealthEquity exited second-quarter fiscal 2026 with better-than-expected results. The company witnessed solid top-line and bottom-line performances in the reported quarter. Solid growth in HSAs also drove the top line. The solid uptick in total HSA assets in the reported quarter is promising. Significant improvements in operating and gross margins also bode well.

Data Security Threats: HealthEquity deals with a high level of sensitive personal and financial data, making the security of its technology platforms critical to operations. While the company has made progress, fraud remains an ongoing cost and operational focus. In fiscal second-quarter 2026, it still reimbursed members approximately $1.2 million for fraud-related incidents, though overall fraud-related service costs declined sequentially.

Despite sequential declines in fraud incidents throughout 2025, the risk remains that any material breach could lead to loss of sensitive information, theft or loss of actual funds, litigation, indemnity obligations, and reputational harm. Such outcomes could disrupt operations and erode client confidence, adversely impacting HealthEquity’s business.

HealthEquity has been witnessing a positive estimate revision trend for fiscal 2026. Over the past 60 days, the Zacks Consensus Estimate for earnings per share (EPS) has moved 2 cents upward to $3.86.

The Zacks Consensus Estimate for third-quarter fiscal 2026 revenues is pegged at $319.9 million, implying a 6.5% rise from the year-ago reported number. The consensus mark for fiscal third-quarter EPS is pinned at 90 cents, implying a 15.4% improvement year over year.

Some other top-ranked stocks from the broader medical space are Medpace Holdings MEDP, Intuitive Surgical ISRG and Boston Scientific BSX.

Medpace, currently sporting a Zacks Rank #1 (Strong Buy), reported a third-quarter 2025 EPS of $3.86, which surpassed the Zacks Consensus Estimate by 10.29%. Revenues of $659.9 million beat the Zacks Consensus Estimate by 3.04%. You can see the complete list of today’s Zacks #1 Rank stocks here.

MEDP has an estimated earnings growth rate of 17.1% for 2025 compared with the industry’s 16.6% growth. The company beat earnings estimates in each of the trailing four quarters, the average surprise being 14.28%.

Intuitive Surgical, carrying a Zacks Rank #2 at present, posted a third-quarter 2025 adjusted EPS of $2.40, exceeding the Zacks Consensus Estimate by 20.6%. Revenues of $2.51 billion topped the Zacks Consensus Estimate by 3.9%.

ISRG has an estimated long-term earnings growth rate of 15.7% compared with the industry’s 11.9% growth. The company’s earnings outpaced estimates in each of the trailing four quarters, the average surprise being 16.34%.

Boston Scientific, currently carrying a Zacks Rank #2, reported a third-quarter 2025 adjusted EPS of 75 cents, which surpassed the Zacks Consensus Estimate by 5.6%. Revenues of $5.07 billion outperformed the Zacks Consensus Estimate by 1.9%.

BSX has an estimated long-term earnings growth rate of 16.4% compared with the industry’s 13.5% growth. The company’s earnings beat estimates in each of the trailing four quarters, the average surprise being 7.36%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 14 hours | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite