|

|

|

|

|||||

|

|

Post Holdings, Inc. (POST) reported fourth-quarter fiscal 2025 results, wherein the top line came in line with the Zacks Consensus Estimate, while the bottom line beat the same. Both metrics showed year-over-year growth.

The company posted adjusted earnings of $2.09 per share, beating the Zacks Consensus Estimate of $1.92. The bottom line increased from the adjusted earnings of $1.53 recorded in the year-ago quarter.

Post Holdings, Inc. price-consensus-eps-surprise-chart | Post Holdings, Inc. Quote

Net sales reached $2,247 million, marking an 11.8% increase year over year, which includes $249.4 million from acquisitions. When excluding the acquisition impact, net sales growth in Foodservice, Refrigerated Retail and Weetabix was counterbalanced by a decline in Post Consumer Brands. The metric came in line with the Zacks Consensus Estimate.

The gross profit of $602.1 million increased 4.6% year over year, while the gross margin contracted to 26.8% from 28.6%.

Selling, general and administrative (SG&A) expenses increased 2.5% to $350.1 million. As a percentage of net sales, the metric was 15.6% compared with 17% reported in the year-ago period. SG&A expenses for the quarter included $14.4 million in integration costs primarily related to acquisitions.

The operating profit registered a decrease of 11.8% to $168.4 million. The adjusted EBITDA was $425.4 million, an increase of 22% from $348.7 million in the year-ago quarter.

Post Consumer Brands: The segment reported net sales of $1,158.8 million, up 10.6% year over year. The figure missed our estimate of $1,236 million. Results included $242.7 million attributable to 8th Avenue. Excluding this contribution, volumes declined 11.5%. Pet food volumes fell 13.2%, caused by reduced private-label and co-manufactured output, as well as distribution losses. Cereal and granola volumes decreased 8.1%, pressured by overall category weakness and the lapping of elevated promotional activity in the prior-year period. Segment profit declined 26.7% to $102.8 million, while adjusted EBITDA increased 2.1% to $208 million.

Weetabix: The segment delivered net sales of $145 million, up 3.6% year over year, and above our estimate of $141 million. Results included a foreign-currency tailwind of roughly 360 basis points. Volumes decreased 2.9%, reflecting the planned exit of low-performing products and softness in the cereal category, partially offset by continued growth in protein-based shakes. Segment profit rose 4.6% to $20.6 million, while adjusted EBITDA edged up 0.6% to $32.6 million.

Foodservice: The segment net sales grew 20.4% year over year to $718 million, beating our estimate of $638 million. The quarter included a $5.6 million contribution from PPI. Excluding this benefit, volumes increased 9.3%, supported by expanded distribution in egg and potato products, normalization of customer egg inventories and strength in protein-based shakes. Segment profit surged 63.7% to $128.2 million and adjusted EBITDA increased 49.9% to $161.1 million.

Refrigerated Retail: The segment posted net sales of $228.2 million, up 0.8% from the prior year and below our estimate of $233 million. Net sales included $1.1 million attributable to PPI. Excluding this contribution, volumes declined 4%, caused primarily by weakness in sausage and egg products. Segment profit rose sharply by 82.8% to $23.4 million, while adjusted EBITDA grew 44.3% to $45.6 million.

Post Holdings ended the quarter with cash and cash equivalents of $176.7 million, long-term debt of $7,421.7 million and total shareholders’ equity of $3,763.8 million.

In the fourth quarter of fiscal 2025, Post Holdings repurchased 2.5 million shares of its common stock for $273.8 million. In fiscal 2025, it repurchased a total of 6.4 million shares for $708.5 million. Following quarter-end, the company repurchased an additional 1 million shares for $105.5 million through Nov. 19, 2025. As of that date, Post Holdings had $282.6 million remaining under its share repurchase authorization.

Post Holdings expects adjusted EBITDA in a range of $1,500-$1,540 million, inclusive of a partial year contribution from 8th Avenue’s pasta business. Capital expenditures for the fiscal year 2026 are projected to be between $350 million and $390 million, reflecting continued investment in cage-free egg facility expansion and the completion of the precooked egg facility expansion in Norwalk, Iowa, totaling $80-$90 million.

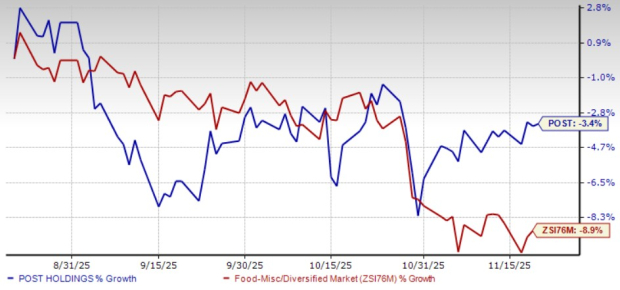

This Zacks Rank #3 (Hold) company’s shares have lost 3.4% compared with the industry’s decline of 8.9% in the past three months.

United Natural Foods, Inc. (UNFI) distributes natural, organic, specialty, produce and conventional grocery and non-food products in the United States and Canada. At present, United Natural flaunts a Zacks Rank of 1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The consensus estimate for United Natural’s current fiscal-year sales and earnings implies growth of 2.5% and 167.6%, respectively, from the year-ago figures. UNFI delivered a trailing four-quarter earnings surprise of 416.2%, on average.

Lamb Weston Holdings, Inc. (LW) engages in the production, distribution and marketing of frozen potato products in the United States, Canada, Mexico and internationally. It sports a Zacks Rank #1 at present. Lamb Weston delivered a trailing four-quarter earnings surprise of 16%, on average.

The Zacks Consensus Estimate for Lamb Weston's current fiscal-year sales indicates growth of 1.3% from the prior-year levels.

The Chefs' Warehouse, Inc. (CHEF) distributes specialty food and center-of-the-plate products in the United States, the Middle East and Canada. It currently flaunts a Zacks Rank of 1. CHEF delivered a trailing four-quarter earnings surprise of 14.7%, on average.

The Zacks Consensus Estimate for The Chefs' Warehouse’s current fiscal-year sales and earnings indicates growth of 8.1% and 29.3%, respectively, from the prior-year levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-23 | |

| Feb-21 | |

| Feb-17 | |

| Feb-17 | |

| Feb-16 | |

| Feb-15 | |

| Feb-13 | |

| Feb-12 | |

| Feb-11 | |

| Feb-11 | |

| Feb-11 | |

| Feb-11 | |

| Feb-11 | |

| Feb-11 | |

| Feb-11 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite