|

|

|

|

|||||

|

|

The artificial intelligence (AI)-driven, astonishing bull run of 2023 and 2024 has continued in 2025. The AI frenzy looks rock solid as hyperscalers are increasingly opting for data center installations to support the massive growth of cloud computing. Stock prices of several AI-centric companies have skyrocketed 300-500% during this period.

Meanwhile, market participants have other sectors to look into. Several old economy stocks from sectors such as industrials, finance, auto, materials and construction have popped year to date. Investing in these stocks with a favorable Zacks Rank should lead to profits in 2026. These old-economy stocks have transformed the ongoing rally into a broad-based one with huge opportunities for portfolio diversification.

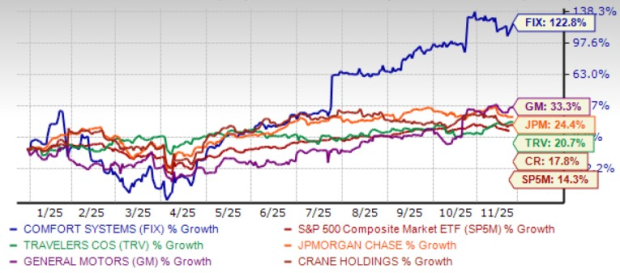

Here, we have narrowed our search to five old-economy stocks that have rallied more than 15% year to date. Yet, their current favorable Zacks Rank indicates more upside potential in 2026. These are: Comfort Systems USA Inc. FIX, The Travelers Companies Inc. TRV, General Motors Co. GM, JPMorgan Chase & Co. JPM and Crane Co. CR. Each of our picks carries either a Zacks Rank #1 (Strong Buy) or 2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The chart below shows the price performance of our five picks year to date.

Zacks Rank #1 Comfort Systems USA operates primarily in the commercial and industrial heating, ventilation and air conditioning (HVAC) markets. It performs most of its services within manufacturing plants, office buildings, retail centers, apartment complexes, and healthcare, education and government facilities.

The data center boom, driven by AI, cloud computing, and high-performance computing, is fueling demand for the specialized HVAC solutions of FIX. Cooling systems for these facilities should deliver precise and reliable performance, prompting investments in advanced technologies such as liquid cooling and modular units.

This segment is becoming a significant growth driver for FIX, offering high-margin opportunities and attracting M&A activity. HVAC firms with capabilities in precision cooling and energy-efficient infrastructure are well-positioned to capture share in this fast-expanding niche.

Comfort Systems USA has an expected revenue and earnings growth rate of 14.7% and 16.4%, respectively, for next year. The Zacks Consensus Estimate for next-year’s earnings has improved 20.1% in the last 30 days.

Zacks Rank #1 The Travelers Companies boasts a strong market presence in auto, homeowners’ insurance and commercial U.S. property-casualty insurance with solid inorganic growth. A high retention rate, a rise in new business, underwriting excellence and positive renewal premium change bodes well. TRV’s commercial businesses should perform well owing to market stability.

Given growth at profitable agencies like auto and homeowners’ business, TRV remains optimistic about the personal line of business. Strong and reliable returns from the growing fixed-income portfolio should drive net investment income. Sufficient capital boosts shareholder value. TRV aims for a mid-teens core return on equity over time.

The Travelers Companies has an expected revenue and earnings growth rate of 3.4% and 6.7%, respectively, for next year. The Zacks Consensus Estimate for next year’s earnings has improved 2% in the last 30 days.

Zacks Rank #1 General Motors remains the top-selling U.S. automaker with a 17% market share, driven by strong demand for its Chevrolet, GMC, Buick, and Cadillac brands. GM’s U.S. manufacturing expansion and China restructuring—where sales rose 10% year over year in the last reported quarter — support long-term growth.

GM’s software and services arm is becoming a key profit engine, with $2 billion in revenue year to date and 11 million OnStar subscribers. Strong liquidity of $35.7 billion and robust buybacks boosts investor confidence. Additionally, the Auto Tariff Offset Process should increase GM’s domestic cost competitiveness. Backed by strong brands, operational recovery in China, and software-led diversification, GM appears well-positioned for sustained earnings growth and shareholder value creation.

General Motors has an expected revenue and earnings growth rate of -0.8% and 11.5%, respectively, for next year. The Zacks Consensus Estimate for next year’s earnings has improved 6.5% over the last 30 days.

Zacks Rank #2 JPMorgan Chase’s business expansion initiatives, loan demand and relatively high interest rates should drive net interest income (NII) growth. We project NII to witness a CAGR of 3.3% by 2027.

While normal deal-making activity is tied to the health of the economy, JPM’s solid pipeline and leadership have generated continued growth in the investment banking business thus far.

A solid pipeline and market leadership continue to support investment banking (IB) business, though capital markets volatility and high mortgage rates will likely weigh on fee income. JPM emphasized the importance of AI in boosting efficiency and noted that its technology budget is $18 billion this year, up roughly 6% from last year.

JPMorgan Chase has an expected revenue and earnings growth rate of 3.7% and 3.7%, respectively, for next year. The Zacks Consensus Estimate for next year’s earnings has improved 0.01% in the last seven days.

Zacks Rank #2 Crane manufactures and sells engineered industrial products in the Americas, Europe, the Middle East, Asia, and Australia. CR has three segments: Aerospace & Electronics, Process Flow Technologies, and Engineered Materials.

Crane has an expected revenue and earnings growth rate of 6.1% and 9.5%, respectively, for next year. The Zacks Consensus Estimate for next year’s earnings has improved 2.5% over the last 30 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 7 hours | |

| 7 hours | |

| 8 hours | |

| 11 hours | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite