|

|

|

|

|||||

|

|

Huntington Bancshares Incorporated HBAN has strategically broadened its footprint and capabilities through a series of acquisitions over the past several years. These moves signal a clear commitment to accelerating growth, strengthening competitive positioning, and enhancing long-term profitability.

In October 2025, Huntington acquired Veritex Holdings, accelerating its organic growth in Texas and expanding its presence in Dallas/Fort Worth and Houston. The combined company now includes Veritex’s 31 Texas branches and will operate more than 1,000 locations overall, with nearly $223 billion in assets, $176 billion in deposits, and $148 billion in loans. The acquisition is expected to deliver about $20 million in core pre-provision net revenue (PPNR) benefits — roughly 1 cent of earnings per share in the fourth quarter of 2025, along with a 1-point improvement in the efficiency ratio and a 30-basis-point lift in return on tangible common equity (ROTCE) for 2025, with further upside anticipated from revenue synergies.

In the same month, Huntington entered into a definitive agreement to acquire Cadence Bank to expand its southern U.S. presence. The deal, subject to regulatory and shareholder approvals, is anticipated to close in the first quarter of 2026 and is expected to be 10% accretive to Huntington’s earnings per share, mildly dilutive to regulatory capital at close, and 7% dilutive to tangible book value per share, with an earn-back period of about three years, including merger expenses. With more than 390 new locations across Texas and the broader South, the acquisition enhances Huntington’s scale and market penetration. The combined institution will rank fifth in deposit market share in both Dallas and Houston, eighth across Texas, and enter the top 10 in Alabama and Arkansas.

Earlier, in 2022, the company acquired Capstone Partners. (which enhanced the complementary capabilities of the capital markets business) and Torana (to enhance digital capabilities and enterprise payments strategy). In 2021, it completed the merger with TCF Financial to become one of the top 25 U.S. bank holding companies. The acquisition strengthened Huntington’s position in existing markets, established its presence in new markets, and combined complementary businesses, which will further enable it to realize meaningful revenue synergies and fuel growth.

Huntington’s series of disciplined, strategically aligned acquisitions demonstrates a long-term growth strategy centered on scale, market expansion, and enhanced capabilities. With each deal, the company has broadened its geographic footprint, strengthened competitive positioning, and created opportunities for cost efficiencies and revenue acceleration. If integration milestones are met and projected synergies are realized, these inorganic initiatives are well-positioned to drive sustainable earnings growth and enhance Huntington’s profitability. The company expects to achieve a PPNR compounded annual growth rate of 6-9% and envisions a 16-17% ROTCE by 2027.

In November 2025, State Street Corp. STT acquired its long-standing partner, PriceStats, a top provider of daily global inflation data generated from digitally collected prices on millions of consumer products.

This aligns with State Street’s efforts to deepen its presence through buyouts and collaborations. In October 2025, STT acquired global custody and related businesses outside of Japan from Mizuho Financial Group, Inc. In May 2025, State Street collaborated with smallcase to cater to investors in India seeking global exposure.

In October 2025, Fifth Third Bancorp FITB agreed to acquire Comerica Incorporated in an all-stock transaction valued at $10.9 billion. The transaction is projected to close at the end of the first quarter of 2026.

The impending acquisition serves as a strategic acceleration of FITB’s long-term growth plan, enhancing scale, profitability and geographic reach. By integrating Fifth Third’s retail and digital banking platforms with Comerica’s strong middle-market expertise and attractive regional footprint, the merger enhances Fifth Third’s presence across high-growth markets.

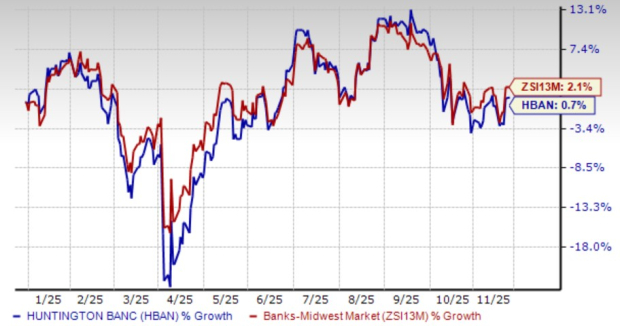

Shares of Huntington have gained 0.7% year to date compared with the industry’s growth of 2.1%.

Price Performance

From a valuation standpoint, HBAN trades at a forward price-to-earnings (P/E) ratio of 9.47X, below the industry’s average of 9.69X.

Price-to-Earnings F12M

The Zacks Consensus Estimate for HBAN’s 2025 and 2026 earnings implies a year-over-year rise of 20.9% and 13.1%, respectively. The consensus estimate for 2025 has remained unchanged, while the same for 2026 has been revised upward over the past 30 days.

Estimate Revision Trend

HBAN stock currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-18 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-16 | |

| Feb-16 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-11 | |

| Feb-11 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite