|

|

|

|

|||||

|

|

Yesterday, GE HealthCare Technologies Inc. GEHC unveiled the Genesis Radiology Workspace. It is a next-generation solution built to transform radiology workflows, deliver a unified user experience and enable radiologists to work with greater efficiency and precision.

Per GEHC, Genesis View, whose 510(k) approval is pending, sits at the heart of this innovation. It is a powerful new viewer built as a fast diagnostic, zero-footprint solution that streamlines radiology workflows to enhance patient care, while remaining fully accessible from any location.

The latest offering is expected to significantly boost GE HealthCare’s Enterprise Imaging business and strengthen its foothold in the radiology space.

Following the announcement, shares of the company gained nearly 2.2% till yesterday’s close.

Historically, the company has gained a top-line boost from its various product innovations and launches. We expect market sentiment on the stock to remain positive around this announcement, too.

GE HealthCare currently has a market capitalization of $36.51 billion. It has an earnings yield of 5.7%. In the last reported quarter, GEHC delivered an earnings surprise of 1.9%.

Per GE HealthCare, medical imaging departments are currently facing intense pressure on multiple fronts, like rising imaging volumes and growing case complexity, while staffing shortages continue to worsen. This makes the ability to interpret studies from anywhere essential for maintaining throughput and ensuring timely diagnoses. However, studies show that radiologists spend up to 64% of their time on non-interpretive tasks, such as navigating complex interfaces or waiting for images to load, which directly impacts productivity and turnaround times.

Management believes that Genesis Radiology Workspace combines cloud-native accessibility with embedded AI and advanced visualization to enable diagnostic imaging professionals to work smart, fast and from anywhere without compromising diagnostic accuracy. The solution is expected to streamline workflows, reduce cognitive burden and improve patient care.

Per a report by Data Bridge Market Research, the global radiology market was valued at $31.86 billion in 2024 and is anticipated to reach $51.55 billion by 2032 at a CAGR of 6.2%. Factors like technological advancements in imaging modalities, increasing demand for early and accurate diagnosis and the increasing adoption of advanced imaging technologies are likely to drive the market.

Given the market potential, the latest launch is expected to provide a significant boost to GE HealthCare’s business.

This month, GE HealthCare announced the submission of a 510(k) approval to the FDA seeking clearance for Photonova Spectra. It is the company’s new photon-counting computed tomography system with advanced AI algorithms.

The same month, GEHC entered into an agreement to acquire Intelerad, a renowned medical imaging software provider for the healthcare industry. This will likely create a fully-connected, cloud-first imaging ecosystem spanning high-growth outpatient and ambulatory, teleradiology and hospital settings.

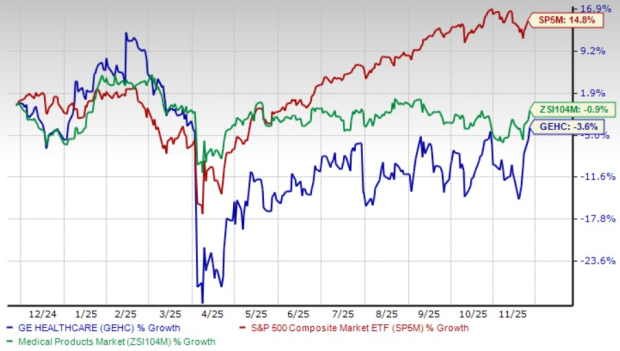

Shares of the company have lost 3.6% in the past year compared with the industry’s 0.9% decline. The S&P 500 has gained 14.8% in the same time frame.

Currently, GEHC carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader medical space are Boston Scientific Corporation BSX, Cencora, Inc. COR and IDEXX Laboratories, Inc. IDXX.

Boston Scientific, carrying a Zacks Rank #2 (Buy) at present, has an estimated long-term growth rate of 16.4%. BSX’s earnings surpassed estimates in each of the trailing four quarters, with the average surprise being 7.4%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Boston Scientific’s shares have gained 11.7% against the industry’s 0.9% decline in the past year.

Cencora, carrying a Zacks Rank of 2 at present, has an estimated long-term growth rate of 11.9%. COR’s earnings surpassed estimates in each of the trailing four quarters, with the average surprise being 5.5%.

Cencora has rallied 50.1% compared with the industry’s 1.3% gain in the past year.

IDEXX, carrying a Zacks Rank of 2 at present, has an estimated long-term growth rate of 13%. IDXX’s earnings surpassed estimates in each of the trailing four quarters, with the average surprise being 7.1%.

IDEXX’s shares have gained 81.8% compared with the industry’s 2.8% gain in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Mar-09 | |

| Mar-09 | |

| Mar-09 | |

| Mar-06 | |

| Mar-06 | |

| Mar-06 | |

| Mar-06 | |

| Mar-06 | |

| Mar-06 | |

| Mar-06 | |

| Mar-05 | |

| Mar-05 | |

| Mar-05 | |

| Mar-05 | |

| Mar-05 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite