|

|

|

|

|||||

|

|

Quantum computing pure-play stocks IonQ, Rigetti Computing, D-Wave Quantum, and Quantum Computing Inc. have respectively skyrocketed up to 829% over the trailing year.

Although quantum computers offer exciting real-world applications, the technology still needs plenty of time to mature and evolve.

Several headwinds point to the quantum computing bubble popping in 2026.

Over the last three years, the ebbs and flows of Wall Street have been driven by the artificial intelligence (AI) revolution. Providing software and systems with the tools to make split-second decisions and become more proficient at their assigned tasks over time represents a technological leap forward. But AI is, arguably, not Wall Street's biggest potential bubble.

Over the trailing year, as of the closing bell on Nov. 26, shares of quantum computing stocks IonQ (NYSE: IONQ), Rigetti Computing (NASDAQ: RGTI), D-Wave Quantum (NYSE: QBTS), and Quantum Computing Inc. (NASDAQ: QUBT) had respectively rallied by as much as 829%!

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

Quantum computing burst onto the stage in 2025, and for some early investors, it delivered life-altering returns. But in 2026, the table is set for the quantum computing bubble to burst.

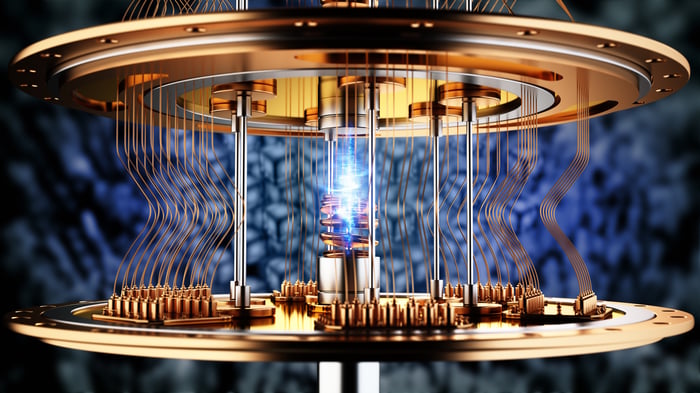

Image source: Getty Images.

Broken down to the basics, quantum computing involves the use of specialized computers that are capable of rapid, simultaneous calculations, which are considerably faster than the world's quickest supercomputers.

On paper, there's a laundry list of real-world applications for quantum computers. Some of the practical examples include:

According to the analysts at Boston Consulting Group, quantum computing is expected to create $450 billion to $850 billion in global economic value by 2040. If this wide-ranging estimate is in the ballpark, it suggests plenty of companies can benefit.

The early stage commercialization of quantum computers has also fueled investor excitement this year. For example, Amazon's quantum cloud-computing service (Braket) and Microsoft's Azure Quantum service have both given their subscribers access to IonQ's and Rigetti's quantum computers. This real-world application enables subscribers to run simulations, as well as test their quantum hardware.

Investors have likely been mesmerized by the potential for sustained triple-digit sales growth for these four pure-play stocks, too. Between 2025 and 2027, Wall Street's consensus calls for:

But while this technology offers considerable long-term potential, it's going to need time to mature and develop.

Image source: Getty Images.

Although history can't guarantee what's to come for individual stocks and the broader market, it has a habit of accurately forecasting the future more often than not. When it comes to game-changing technologies, historical precedent has had a flawless track record over the last three decades.

Specifically, investors tend to overshoot when it comes to the adoption rate, utility, and early stage optimization of hyped innovations and new technologies. The lofty expectations set by investors are eventually not met, leading to the bursting of next-big-thing bubbles.

As previously mentioned, quantum computing is still in its very early stages of commercialization. By some analysts' estimates, the technology remains years away from being a practical solution to problem-solving when compared to classical computers. All technologies need ample time to mature, and quantum computing is highly unlikely to be an exception to this unwritten rule.

Financing the quantum computing revolution is another issue for early investors. Although IonQ recently completed a $2 billion equity offering, most quantum computing pure-play stocks are hemorrhaging cash and are expected to continue losing money for the foreseeable future. With limited access to the credit market, selling stock and diluting existing shareholders is the only reasonable way for these companies to shore up their balance sheets.

Another issue that can push quantum computing stocks over the proverbial cliff in 2026 is the realization that members of the "Magnificent Seven" could disrupt their first-mover advantage. The highly influential businesses that comprise the Magnificent Seven are usually generating more cash from their operating activities than they know what to do with -- and they're not shy about aggressively investing in next-big-thing trends.

For example, Alphabet debuted its quantum processing unit (QPU), known as Willow, in December 2024. In October, Willow ran a quantum algorithm that was 13,000 times faster than the world's quickest supercomputer. Microsoft also unveiled its own QPU, known as Majorana 1, in February. The point being that the first-mover advantages of pure-play stocks are on thin ice.

Lastly, the valuations of quantum computing pure-play stocks suggest a high probability of a bubble-bursting event. Based on their trailing-12-month sales, the respective price-to-sales (P/S) ratios for this quantum computing quartet are as follows:

Over the last three decades, companies responsible for spearheading next-big-thing technologies have commonly peaked at P/S ratios in the range of 30 to 40. Even if investors use revenue estimates for 2028 for IonQ, Rigetti, D-Wave, and Quantum Computing Inc., the projected P/S ratios for all four companies would still be well above the arbitrary line in the sand that's helped identify previous bubbles.

Although quantum computing stocks have been red hot this year, there's a very good possibility they'll be ice cold in 2026.

Before you buy stock in IonQ, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and IonQ wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $572,405!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,104,969!*

Now, it’s worth noting Stock Advisor’s total average return is 1,002% — a market-crushing outperformance compared to 193% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of November 24, 2025

Sean Williams has positions in Alphabet and Amazon. The Motley Fool has positions in and recommends Alphabet, Amazon, IonQ, and Microsoft. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

| 7 hours | |

| 13 hours | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 |

Quantum Computing Stocks: Infleqtion Pops In First Day As Public Company

QBTS -6.25% RGTI IONQ

Investor's Business Daily

|

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-16 | |

| Feb-15 | |

| Feb-14 | |

| Feb-14 | |

| Feb-14 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite