|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

Virtual healthcare platforms are redefining patient access to care, with Hims & Hers Health, Inc. HIMS and GoodRx Holdings, Inc. GDRX among the leaders in this digital shift. HIMS is a consumer-first, subscription telehealth platform where users discover treatments online, consult licensed providers, and receive recurring prescription and wellness products, mostly fulfilled through affiliated pharmacies in sexual health, dermatology, mental health and weight management. GDRX operates a U.S. prescription-savings marketplace that aggregates and normalizes pharmacy pricing so consumers can find low-cost options, use discount codes at retail pharmacies, and access subscriptions and telehealth, while also expanding pharma-manufacturer solutions that place affordability programs on its platform.

While Hims & Hers prioritizes a personalized, subscription-led care experience through its digital platform, GoodRx is built around prescription price transparency and driving engagement at the pharmacy counter. With both benefiting from the continued shift toward digital health and consumer-centric healthcare spending, the question remains: which stock offers the more attractive opportunity right now? Let’s take a closer look.

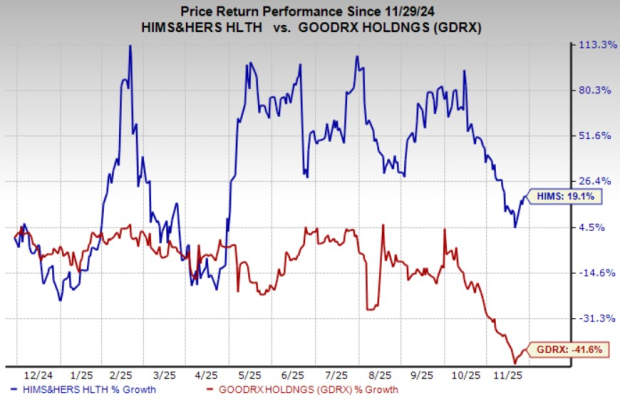

HIMS (down 9.3%) has outperformed GDRX (down 34.9%) over the past three months. In the past year, Hims & Hers has rallied 19.1% against GoodRx’s loss of 41.6%.

Meanwhile, HIMS is trading at a forward 12-month price-to-sales (P/S) ratio of 3.2X, above its median of 2.6X over the past three years. GDRX’s forward sales multiple sits at 1.2X, below its last three-year median of 2.7X. While GDRX appears cheap when compared with the Medical sector average of 2.1X, HIMS seems to be expensive. Currently, Hims & Hers and GoodRx stocks have a Value Score of D and A, respectively.

Hims & Hers is expanding into high-prevalence, recurring-care specialties that fit its subscription model. Beyond its established sexual health, dermatology and mental health roots, HIMS is expanding weight loss and diversifying in hormone-health verticals, such as low-testosterone care and menopause/perimenopause programs. These additions widen the addressable market across life stages and encourage cross-sell within an already engaged subscriber base.

Hims & Hers’ vertical integration is improving affordability, experience quality and retention. The company is deepening control over pharmacy and compounding infrastructure for personalized GLP-1 and other therapies, enabling tighter clinical oversight, more treatment options and cost efficiencies that can be passed to customers — supporting longer subscription duration and better unit economics.

Hims & Hers’ platform is evolving toward AI-enabled, proactive care. New AI-focused technology leadership signals a push to standardize clinical workflows and personalize treatment at scale, while the rollout of Labs and broader diagnostic testing shifts the relationship with customers from reactive prescribing to ongoing health management. By integrating testing insights into care pathways, HIMS can refine dosing, monitor progress more effectively and build a reinforcing data loop that strengthens personalization and supports future category launches.

GoodRx is scaling its pharma-manufacturer solutions business, which is becoming a larger growth engine. The company is expanding direct-to-consumer affordability programs with major drugmakers — such as cash-price deals for GLP-1s and specialty therapies — positioning GDRX as a key channel for brands to reach patients seeking transparent prices. Management also views the federal push toward price transparency (including TrumpRx and broader D2C policy momentum) as a structural tailwind that could accelerate these partnerships and further shift revenue mix toward higher-value manufacturer services.

GoodRx’s platform is tightening its role at the pharmacy counter and improving economics through deeper retail integration. Rollouts like RxSmartSaver at large national chains, plus e-commerce tools that streamline pickup and payment, help reduce prescription abandonment and keep GDRX embedded in the fill journey. At the same time, Community Link and direct contracting with independent pharmacies support more predictable pricing and margins for partners, reinforcing network breadth and long-term volume stability.

GoodRx is broadening into subscription-driven, condition-specific care that complements its marketplace. New offerings in hair loss, erectile dysfunction and weight-loss telehealth pair virtual consults with transparent pricing and fulfillment options, creating a more recurring relationship with consumers. These services extend GDRX beyond one-time coupon use, deepen engagement with its trusted brand and open incremental monetization paths alongside the core savings platform.

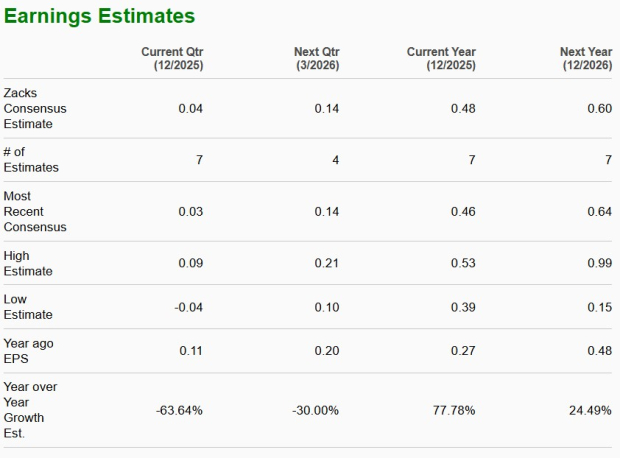

The Zacks Consensus Estimate for HIMS’ 2025 earnings per share (EPS) suggests a 77.8% improvement from 2024.

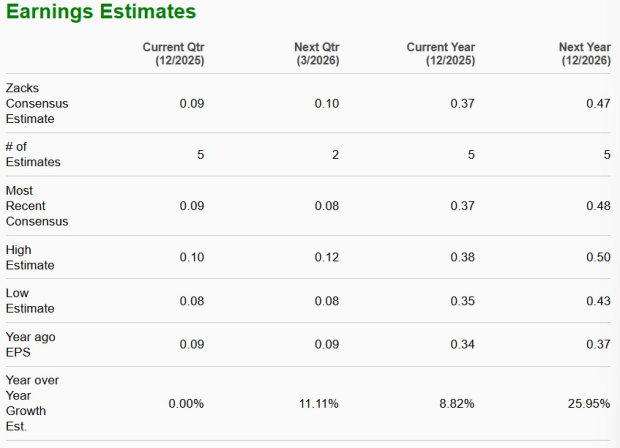

The Zacks Consensus Estimate for GDRX’s 2025 EPS implies an improvement of 8.8% from 2024.

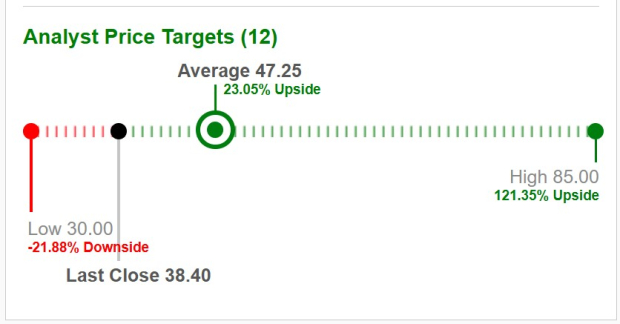

Based on short-term price targets offered by 12 analysts, the average price target for Hims & Hers is $47.25, implying an increase of 23.1% from the last close.

Based on short-term price targets offered by 14 analysts, the average price target for GoodRx is $5.14, implying an increase of 81.6% from the last close.

While both Hims & Hers and GoodRx are promising players in the consumer-focused digital healthcare space, HIMS, a Zacks Rank #3 (Hold) firm, presents a more stable and financially sound investment opportunity at this stage. With improving profitability, strong cash generation and growing subscriber engagement, HIMS is scaling a capital-efficient model — though margins may vary as it reinvests for expansion. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

GoodRx, also a Zacks Rank #3 stock, is building on its prescription-savings core by scaling pharma-manufacturer solutions and launching new affordability programs and condition-focused subscriptions. These moves diversify revenue and deepen consumer engagement. Still, GDRX is more exposed to prescription-transaction volume and retail pharmacy dynamics, which can add volatility. For investors prioritizing recurring, subscription-led care growth and tighter control over the end-to-end experience, Hims & Hers stands out as the more compelling pick at this time.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 21 min | |

| 4 hours | |

| 5 hours |

Nvidia Earnings, Inflation Date, State of the Union Address: What to Watch This Week

HIMS

The Wall Street Journal

|

| 5 hours | |

| Feb-22 | |

| Feb-21 | |

| Feb-21 | |

| Feb-21 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-19 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite