|

|

|

|

|||||

|

|

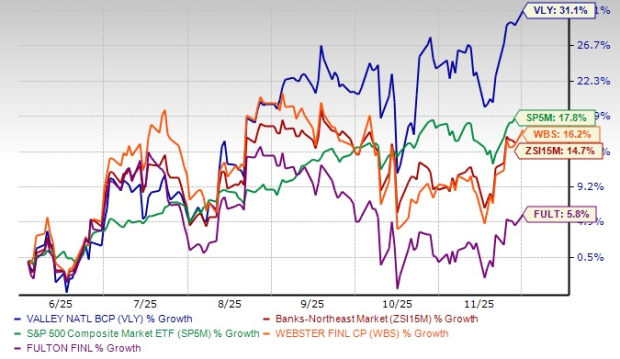

As optimism grows over additional interest rate cuts before the end of 2025, Valley National Bancorp VLY shares touched a 52-week high of $11.65 in yesterday’s trading session to finally close at $11.48. In the past six months, VLY shares have gained 31.1%, outperforming the industry’s 14.7% growth and the S&P 500 Index’s 17.8% rise.

Moreover, VLY’s price performance has been better than that of its peers, Fulton Financial Corporation FULT and Webster Financial Corporation WBS. The FULT stock has gained 5.8%, whereas WBS shares have rallied 16.2% in the same time frame.

Does the Valley National stock have more upside left despite touching its 52-week high? Let us find out.

Robust Organic Growth: Valley National’s organic growth trajectory looks impressive. Driven by a continued rise in loan balances, its net revenues witnessed a compound annual growth rate (CAGR) of 10.7% over the last five years (2019-2024), with the uptrend continuing in the first nine months of 2025.

Moreover, the company has been undertaking measures to strengthen fee income sources. It plans to leverage the investments made in treasury solutions, foreign exchange (FX) and syndication platform to drive fee income.

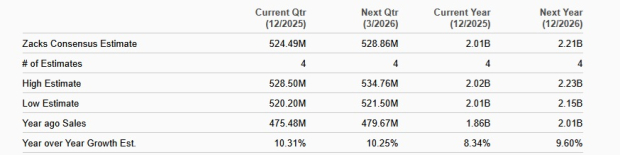

VLY’s efforts to bolster fee income and decent loan demand will likely continue to support top-line expansion. The Zacks Consensus Estimate for VLY’s 2025 and 2026 revenues is pegged at $2.01 billion and $2.21 billion, which indicate year-over-year growth rates of 8.3% and 9.6%, respectively.

Inorganic Expansion Initiatives: Given a solid balance sheet position, Valley National is well-positioned to grow on the back of acquisitions. In 2022, the company acquired Bank Leumi Le-Israel B.M.’s U.S. banking arm, while in 2021, it acquired Westchester Bank and Arizona-based advisory firm Dudley Ventures.

These and several past acquisitions are expected to be earnings accretive and help Valley National diversify revenues and footprint. Management is open to further opportunistic buyouts if that “accelerates strategic initiatives.”

Improving Margins: Although the Federal Reserve has started the rate cut cycle this year, Valley National’s net interest margin (NIM) is likely to keep improving amid gradually stabilizing deposit costs. Though the company’s NIM on a tax-equivalent basis declined in 2023 and 2024 due to higher funding costs, the metric increased in 2020, 2021, 2022 and the first nine months of 2025.

Management believes that “the current interest rate backdrop, combined with anticipated fixed rate asset repricing remains supportive of further NIM expansion in 2026.” The company is on track to achieve more than 3.1% NIM target in the fourth quarter of 2025.

Impressive Capital Distributions: Supported by a robust balance sheet, Valley National announced a dividend for the first time in 2018. Since then, the company has maintained a quarterly dividend payment of 11 cents per share.

The company also has a share repurchase program in place. In February 2024, it announced a new repurchase plan with an authorization of up to 25 million shares. The plan became effective on April 26, 2024, and will expire on April 26, 2026. As of Sept. 30, 2025, 23.2 million shares were available for repurchase. Given a strong capital position, the company is expected to keep boosting shareholder value through sustainable capital distribution activities.

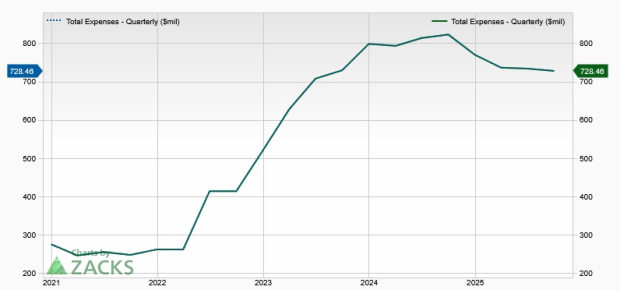

Elevated Expense Base: Over the last five years (2019-2024), the company’s expenses witnessed a CAGR of 11.9%, with the uptrend continuing in the first nine months of 2025. The rise has been mainly due to higher salary and employee benefits, and occupancy expenses.

Valley National’s non-interest expenses are expected to remain elevated in the near term as the company continues to expand through acquisitions and invest in revenue growth areas.

Risky Loan Exposure: A major part of Valley National’s loan portfolio comprises commercial real estate (CRE) and residential mortgage loans. As of Sept. 30, 2025, the company’s exposure to CRE and residential mortgage loans was 58.2% and 11.8% of total loans, respectively.

The rapidly changing macroeconomic environment has been putting a strain on commercial lending and leading to a rise in delinquencies. The company built huge reserves in 2024 to mitigate risks related to the non-performance of these loan portfolios. However, in December 2024, the company sold net CRE loans worth $925 million to Brookfield Asset Management.

Valley National continues to be highly selective on new CRE loan originations to lower “loan concentrations within the non-owner occupied and multifamily loan categories.” Despite these efforts to manage the CRE loan portfolio prudently, massive exposure to this loan category is worrisome and may hurt the company’s financials if the economic situation worsens.

Decent loan demand, opportunistic buyouts and efforts to bolster fee income (through steady investments) are expected to continue to aid the company’s top line. Given a decent liquidity position and earnings strength, VLY will be able to enhance shareholder value through efficient capital distributions.

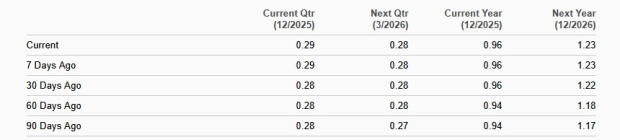

While a significant CRE loan exposure and elevated expenses remain concerning, analysts seem optimistic regarding the company’s earnings growth prospects. The Zacks Consensus Estimate for VLY’s 2025 and 2026 earnings has been revised upward over the past 60 days. The 2025 earnings estimate of 96 cents indicates year-over-year growth of 54.8%. The 2026 earnings estimate of $1.23 suggests a rise of 28.1%.

Thus, it seems like a wise idea to add the Valley National stock to your portfolio now. Given the strength in its fundamentals and robust earnings growth prospects, the company is not likely to disappoint over the long term.

Currently, VLY carries a Zacks Rank #2 (Buy). You can see the complete list of today's Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 3 hours | |

| Feb-25 | |

| Feb-25 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-23 | |

| Feb-23 | |

| Feb-22 | |

| Feb-19 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-17 | |

| Feb-16 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite