|

|

|

|

|||||

|

|

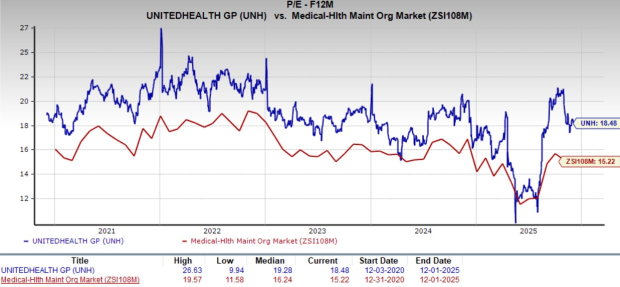

UnitedHealth Group Incorporated UNH, one of the nation’s leading healthcare plan providers, currently appears reasonably valued, trading at 18.48X forward 12-month earnings. This places the stock below its five-year median P/E of 19.28X, offering a slight discount relative to its historical norm. However, the valuation still sits above the Zacks Medical – HMOs industry average of 15.22X, signaling that investors continue to price in a premium for the company’s scale and stability. UnitedHealth also has a Value Score of A at present.

The bigger question is whether this valuation is justified given the company’s growth outlook, shifting market conditions and the decisions it is taking to manage a volatile operating backdrop. Meanwhile, competitors Humana Inc. HUM and Elevance Health, Inc. ELV trade at 19.26X and 11.86X, respectively, offering contrasting valuation setups across the sector.

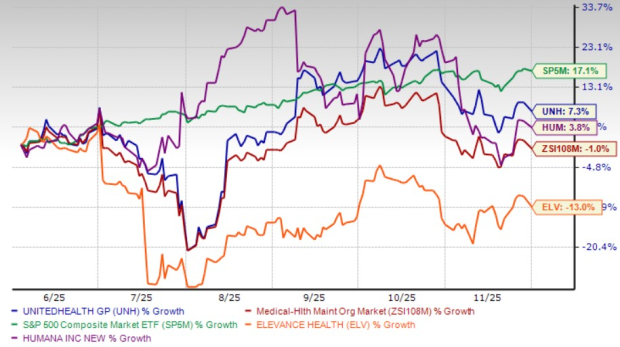

Over the past six months, UnitedHealth shares have gained 7.3%. This performance beats the broader industry’s 1% decline, underscoring the company’s relative resilience, though it trails the S&P 500’s 17.1% surge. Against its major peers, the picture remains mixed: Humana climbed 3.8%, while Elevance dropped 13%.

Despite management’s consistent reassurances, investors remain heavily focused on margin pressure. Persistent concerns surrounding elevated medical costs and reimbursement constraints continue to dominate sentiment. The key worry is whether medical expense growth will keep outpacing pricing adjustments, potentially squeezing margins further. Additionally, questions linger about the company’s ability to maintain momentum across its most important businesses, Medicare Advantage and Optum, especially as they face membership declines, regulatory scrutiny and operational complexity.

Even so, management maintains a constructive tone. The company has already repriced most of its risk-based businesses, a step expected to support margin recovery across multiple segments next year. Medicaid remains the notable exception, where unfavorable rates and ongoing cost trends will likely persist. Leadership believes tighter pricing discipline and improved cost visibility should return UnitedHealth to stronger earnings growth by 2026.

Membership trends, however, remain choppy. Medicare Advantage enrollment is expected to fall by roughly one million members next year as UnitedHealth recalibrates its plan lineup. In the commercial segment, most employer insurance businesses are being repriced for 2026, but management does not expect margins in that category to fully normalize until 2027. Enrollment under the ACA is also projected to decline sharply (around 67%) due largely to reductions in service areas where rate structures are no longer sustainable. To counter these pressures, the company is leaning more heavily on automation and machine-learning-driven tools aimed at improving operational efficiency.

Optum, UnitedHealth’s expansive healthcare services arm, is also working through disruptions. The company anticipates nearly a 10% decline in Optum Health’s value-based care membership next year due to market exits and product adjustments. Growth is expected to resume in 2027, but the near-term dip has contributed to investor unease, given Optum’s critical role in long-term profitability.

Regulatory oversight adds another source of uncertainty. The U.S. Department of Justice continues to examine UnitedHealth’s Medicare billing processes, reimbursement practices and Optum Rx’s pharmacy benefit management operations. Questions also remain surrounding the company’s handling of loans to healthcare providers in the wake of the 2024 Change Healthcare cyberattack. These ongoing inquiries increase headline risk at a time when investor confidence is waning.

To streamline operations, UnitedHealth is pressing ahead with its exit from Latin America. Per Reuters, the company recently agreed to sell its final South American operation, Banmedica, to Patria Investments for $1 billion. This move follows earlier divestitures in Brazil and Peru, marking another step in narrowing the company’s strategic focus.

The Zacks Consensus Estimate for 2025 EPS is $16.29, encouraging in light of current turbulence, though still 41.1% lower than last year. For 2026, earnings are projected to rebound to $17.59, representing an 8% improvement. Over the past month, analysts issued three upward revisions for 2025 and 2026 earnings, with only one downward revision in each period. Revenue is expected to grow 11.9% in 2025 and 2.5% in 2026. Over the last four quarters, the company missed estimates twice and beat twice, leading to an average earnings surprise of negative 2.3%.

UnitedHealth Group Incorporated price-consensus-eps-surprise-chart | UnitedHealth Group Incorporated Quote

Even with near-term turbulence, UnitedHealth remains a powerhouse in U.S. healthcare. Its unparalleled scale, deep diversification and broad customer base offer durability few peers can match. Long-term forces continue to work in its favor: rising healthcare spending, demographic aging and increasing chronic disease rates all support growth for integrated platforms like UnitedHealth.

While membership may fluctuate due to policy changes and subsidy reductions, demand for higher-margin commercial offerings is expected to strengthen. The path ahead may be uneven, but the company’s long-term foundation remains solid.

UnitedHealth’s near-term pressures, rising medical costs, regulatory scrutiny and volatile membership, justify a cautious stance, but its scale, diversified model and long-term demand drivers keep the core investment case intact. With earnings expected to stabilize and rebound in 2026, the stock offers resilience rather than rapid upside.

Given the mixed backdrop, current valuation, disciplined repricing efforts and moderate growth outlook, UnitedHealth carries a Zacks Rank #3 (Hold) at this stage. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 9 hours | |

| 10 hours | |

| 15 hours | |

| Feb-24 | |

| Feb-24 | |

| Feb-23 | |

| Feb-22 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite