|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

Since the original National Quantum Initiative (NQI) Act in 2018, quantum has been treated as a strategic technology alongside AI and advanced semiconductors. The FY 2025 NQI budget supplement shows federal agencies collectively investing about $1 billion a year in quantum information science, up from roughly $456 million in 2019, spread across Department of Energy (DOE), National Science Foundation (NSF), National Institute of Standards and Technology (NIST), National Aeronautics and Space Administration (NASA), Department of Defense (DOD) and the intelligence community.

The steady buildout has set the stage for the next wave of public-sector support, one that could reshape the trajectory of pure-play quantum companies heading into 2026.

Reauthorization bills now moving through Congress will scale the program for 2025–2029. On the House side, H.R. 6213 will authorize about $1.8 billion over five years, funding new DOE QIS centers, NSF research and education hubs, NIST quantum labs and NASA experiments in space-based quantum applications. In the Senate, a competing Commerce Committee bill will go further, authorizing $2.7 billion over five years and explicitly pivoting the NQI toward applied projects, new NIST and NSF quantum centers, quantum testbeds and workforce hubs, and expanded public-private partnerships designed to push laboratory breakthroughs into real-world systems.

In April 2025, DARPA selected a group of companies, including pureplay quantum computing firms like IonQ IONQ and Rigetti RGTI, for a program to test the practicality of quantum computing. For IonQ, Rigetti and D-Wave, which continued to remain loss-making, such deals tied to DARPA’s Quantum Benchmarking Initiative helped support their growth narrative. In September 2025, Rigetti announced a $5.8 million, three-year contract with the U.S. Air Force Research Lab for quantum networking, while IonQ signed an MOU with the Department of Energy on space-related quantum applications.

These are not massive amounts relative to big-tech R&D budgets, but in the context of sub-scale quantum companies, they matter. For many of these firms, a single defense award can represent a visible share of annual revenues and, more importantly, a strong signal that the government views their technology as strategically relevant.

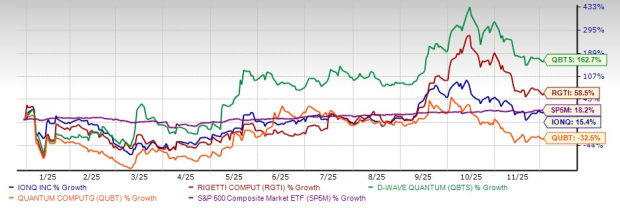

On paper, companies like IonQ, Rigetti, D-Wave QBTS, and Quantum Computing Inc. QUBT remain in early stage with low revenues, sizable operating losses and technology still far from mainstream deployment. Yet, their valuations have expanded dramatically since the 2024 lows, and much of that premium reflects expectations about government spending rather than near-term enterprise demand.

When investors see a multi-year federal reauthorization bill, a new DOD or DOE pilot, or fresh quantum subsidies from the UK, EU or Japan, they are effectively inferring that the public sector will be the anchor customer for quantum through the 2030s. This is why a $5-10 million defense deal can move a stock as much as a full year of commercial bookings.

According to reports by The Wall Street Journal (first reported) and Reuters, the Trump administration has agreed to inject up to $150 million into xLight, a startup developing free-electron lasers that could power next-generation extreme ultraviolet (EUV) lithography for advanced chips. The investment is being channeled through the CHIPS R&D office and marks the first major move under a $7.4 billion research institute originally launched during tenure of the prior administration.

xLight’s goal is to build more efficient laser sources for EUV tools, a space currently dominated by ASML in the Netherlands, potentially reshaping the strategic bottleneck in high-end semiconductor manufacturing.

While xLight is not Trump’s startup in an ownership sense, the symbolism is clear. Washington is willing to take direct, equity-like stakes in deep-tech hardware companies tied to national security and supply-chain resilience. The line between subsidy and state venture capital is blurring.

If the U.S. government is prepared to own a slice of an EUV laser startup to secure chipmaking, it is not hard to imagine future programs that look more equity-like or even revenue-guaranteed for quantum hardware companies.

For now, quantum stocks are still more story than cash flow. But the story is increasingly written on budget tables, grant calls and contract announcements, not just in lab breakthroughs.

From an analytical perspective, anyone modeling this space ahead of 2026 needs to treat policy and procurement as core inputs to valuation, not background noise. Tracking bills, defense solicitations and R&D partnerships are becoming crucial for investors in their decision-making.

Valuation frameworks should focus on government procurement, not traditional product cycles. Companies like IonQ, Rigetti, D-Wave and QUBT, all carrying a Zacks Rank #3 (Hold) now, are likely to depend on multi-year federal contracts, milestone payments and access to government testbeds long before they generate meaningful commercial revenues.

Quantum stocks should also be treated as small, long-term, policy-sensitive positions. The recent xLight example shows that Washington is willing to take equity-like stakes in critical hardware startups. That same playbook could eventually apply to quantum firms, especially those tied to defense or space projects.

For 2026, the takeaway is straightforward: investors won’t succeed by guessing when quantum technology becomes mainstream. They will succeed by watching how aggressively governments choose to fund and support these companies — because policy momentum, not product launches, will drive quantum stocks.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 49 min | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-18 | |

| Feb-18 | |

| Feb-17 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite