|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

Shares of Affiliated Managers Group AMG touched a new 52-week high of $276.24 during yesterday’s trading session, before closing at $266.16. The stock has been hitting new highs since the announcement of the third-quarter 2025 results on Nov. 3.

AMG stock is up 43.9% so far this year against the industry’s decline of 16.9%. It has also performed better than its peers – Janus Henderson Group plc JHG and SEI Investments Company SEIC – in the same time frame.

YTD Price Performance

AMG’s latest quarterly performance seems to be a major factor driving investor optimism. The company’s economic earnings per share of $6.10 easily outpaced the Zacks Consensus Estimate of $5.83 and surged 26.6% year over year. Higher revenues and solid growth in assets under management (AUM) majorly support the results.

Affiliated Managers provided an upbeat fourth-quarter 2025 guidance. Management expects net income (controlling interest) to be between $189 million and $223 million. Economic earnings are expected to be between $8.10 and $9.26 per share. In the fourth quarter of 2024, the metric was $6.53.

Pivot Toward Alternative Strategies: Since 2021, Affiliated Managers has been pivoting toward private markets and liquid alternatives, fueling strong client inflows into these segments and offsetting weakness in traditional asset categories. Aligning with the strategy, this year, the company announced four new partnerships: NorthBridge Partners, Verition Fund Management, Qualitas Energy and Montefiore Investment. These new investments will likely add almost $24 billion to AUM across private markets and liquid alternatives.

Also, in October, AMG entered a partnership with Brown Brothers Harriman to expand the reach of BBH’s structured and alternative credit strategies into the U.S. wealth marketplace. Over the last two years, the company acquired minority stakes in Suma Capital, Ara Partners and Forbion Group Holding B.V.

As of Sept. 30, 2025, Alternatives constituted almost 44% of total AUM and generated approximately 55% of Affiliated Managers’ earnings. Over the next few years, the company targets to generate more than 66% of earnings from the alternatives, as it pivots the business mix toward secular growth areas with strong investor preference, positioning it to better counter volatility.

Solid Liquidity to Fund Expansion: To execute and fund its expansion plan and invest in growth opportunities, AMG has sufficient liquidity available. Since 2023, divestitures of stakes in Peppertree, Veritable LP and Baring Private Equity Asia have significantly bolstered the company’s investment capacity.

Also, in November 2025, the company offloaded its interest in Comvest Partners’ private credit business for $285 million. This move aligns with Affiliated Managers’ goal to reallocate its capital into the lucrative investment opportunities.

Management remains optimistic about finding new investment opportunities as markets face a challenging backdrop.

Rein in Outflows: Affiliated Managers’ affiliates have been reporting overall net outflows over the past years. Net client cash outflows were $13.9 billion in 2024, $29.2 billion in 2023, $33 billion in 2022, $18.5 billion in 2021, $61.8 billion in 2020 and $53.5 billion in 2019. The trend reversed in the first nine months of 2025 as the company pivoted toward alternatives. This year, the company witnessed net client cash inflows of $17 billion.

While a tough operating backdrop will likely keep investors on the sidelines in the near term, AMG’s differentiated product categories are expected to support cash flows across channels.

Revenue Growth: Affiliated Managers’ revenue growth has been challenging. Its consolidated revenues declined in the last three years due to lower asset-based fees and performance fees. The metric was relatively stable on a year-over-year basis in the first nine months of 2025, driven by the company’s focus on alternatives strategies.

The company expects performance fees in 2025 to be between $110 million and $150 million. As AMG’s efforts to evolve its revenue mix look impressive, a turnaround is likely soon. The Zacks Consensus Estimate for sales suggests 1.9% and 8% year-over-year growth for 2025 and 2026, respectively.

Sales Estimates

Solid Balance Sheet: As of Sept. 30, 2025, Affiliated Managers had total debt worth $2.37 billion and a cash and cash equivalents balance of $476.1 million. The company has a $1.25-billion senior unsecured multicurrency revolving credit facility (maturing in 2029). Further, the company has investment-grade ratings of A3 by Moody’s Investors Service and BBB+ by S&P Global Ratings.

Affiliated Managers prioritizes share repurchases over annual dividend hikes. It lowered quarterly dividends amid the COVID-19 mayhem to 1 cent per share but enhanced its share repurchase plan. The company’s board of directors authorized the repurchase of up to 5.4 million, 3.3 million and 3 million shares in July 2024, October 2023 and October 2022, respectively. As of Sept. 30, 2025, almost 3.4 million shares remained available for repurchase.

Management expects to buy back shares worth at least $500 million in 2025, up from the prior target of up to $400 million. In the first nine months of 2025, it repurchased shares worth $350 million. Given a robust capital position, the company will likely be able to sustain efficient capital distribution activities.

Expenses: Elevated operating expenses are a concern for Affiliated Managers. The company’s consolidated expenses have been witnessing a volatile trend over the past few years. Though the metric declined in 2023, it rose in 2024 and the first nine months of 2025. Overall costs are expected to remain elevated due to advertising campaigns, hiring, inflation and technology upgrades.

Intangible Assets: Affiliated Managers’ balance sheet has substantial intangible assets. These assets are subject to annual impairment reviews. As of Sept. 30, 2025, intangible assets (goodwill and acquired client relationships) of $4.23 billion constituted 47.3% of total assets. Several factors may initiate the impairment of the book value of such assets, due to which the value of these assets may have to be written down. In such a case, the company’s financials will be adversely impacted.

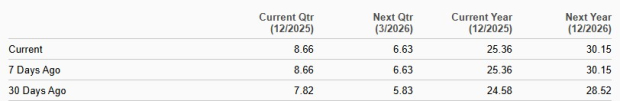

Analysts are bullish on Affiliated Managers. The Zacks Consensus Estimate for 2025 earnings implies an 18.7% rise on a year-over-year basis, while 2026 earnings are expected to grow at a rate of 18.9%. In the past 30 days, earnings estimates for 2025 and 2026 have moved upward.

Earnings Estimate Trend

Further, from a valuation standpoint, AMG trades at a 12-month trailing 12 months price-to-book (P/B) of 1.77X, above the industry average of 3.22X.

P/B

The stock is also trading at a discount to SEI Investments, while it's expensive compared with Janus Henderson. At present, SEI Investments and Janus Henderson have P/B of 4.08X and 1.37X, respectively.

Affiliated Managers’ shares have been on a powerful run of late, backed by strong fundamentals and upbeat management guidance. The company’s shift toward alternatives is improving flows, with $17 billion of net inflows this year and partnerships likely to add about $24 billion in AUM.

That said, after a 43.9% YTD surge (far outpacing peers and the broader industry decline), the risk/reward for fresh money looks less compelling at these levels. Operating expenses remain elevated and the balance sheet carries substantial intangible assets that could be vulnerable to impairment in a weaker market environment. With AMG stock already pricing in a lot of good news, a prudent stance is to hold existing positions and let the alternatives-led mix shift, improving flow profile and ongoing buybacks work over time.

Investors should avoid initiating a new position until entry points become more favorable or the company delivers additional proof of durable revenue/fee growth. At present, AMG carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-20 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-17 | |

| Feb-16 | |

| Feb-13 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite