|

|

|

|

|||||

|

|

Core Laboratories Inc. CLB generates revenues by providing specialized services and products to the oil and gas industry. The company offers reservoir optimization, production enhancement and geological analysis services to help energy companies maximize the productivity and efficiency of their exploration and production operations. Core Labs’ primary revenue streams come from its laboratory services, equipment sales and data analytics, which assist clients in making more informed decisions about their subsurface assets. It also supplies proprietary technologies and expertise for reservoir management, particularly in areas like reservoir fluids, rock properties and enhanced oil recovery.

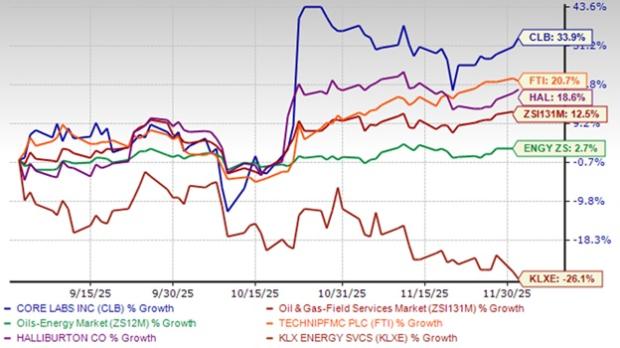

Based on the three-month share price’s chart, CLB has outperformed both its Field Services sub-industry and the broader oil and energy sector. CLB's share price gained 33.9%, which significantly surpassed the broader Oil & Energy Market, which had a modest gain of 2.7%. Among its competitors, TechnipFMC plc FTI saw a notable gain of 20.7% and Halliburton HAL experienced an 18.6% increase. In contrast, KLX Energy (KLXE saw a sharp decline of 26.1% and the Oil & Gas Field Services sub-industry (ZS131M) grew by 12.5%.

Overall, CLB stood out with the highest growth rate, demonstrating strong outperformance compared with both the industry peers and the broader market.

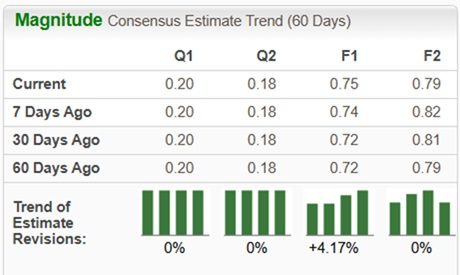

Over the past 60 days, the Zacks Consensus Estimate for CLB’s earnings per share has remained unchanged for the first quarter and the second quarter, while the estimates for the next fiscal year (F1) have increased 4.17% and the estimates for the following fiscal year (F2) have remained unchanged.

With the stock attracting attention due to its solid performance, many investors are eager to understand the factors behind the company’s success and whether it is a good time to invest. Let’s take a closer look at the key drivers behind the stock’s movement and evaluate any potential risks involved.

Alignment With Long-Term Industry Investment Trends: The company's services are directly aligned with the International Energy Agency's (“IEA”) conclusion that significant annual investment in oil and gas resource development is required for years to come to offset accelerating natural decline rates in existing fields. Core Lab's Reservoir Description and Production Enhancement technologies are essential for optimizing existing reservoirs and developing new fields, positioning it as a critical service provider in a multi-year investment cycle.

Successful Strategic Acquisition With an Earn-Out Structure: The acquisition of Solintec in Brazil, completed in third-quarter 2025, expands Core Lab's in-country capabilities along the strategic South Atlantic Margin. The deal structure includes an earn-out feature, tying a portion of the purchase price to Solintec's future performance. This aligns incentives, reduces upfront risk and demonstrates Core Lab's disciplined capital approach to entering new geographic markets with existing client relationships.

Attractive Return on Invested Capital: CLB reported a return on invested capital (“ROIC”) of 9.7% for third-quarter 2025, which management compares favorably against its peer group. The board and executive team focus on strategies to maximize ROIC, believing it has a high correlation with total shareholder return. This metric demonstrates the company's efficiency in deploying capital to generate profits.

Focus on High-Value, Long-Cycle International Projects: CLB is seeing steady activity in committed long-cycle projects in deepwater and other international regions. These large-scale projects, due to their extended planning horizons, are less sensitive to near-term commodity price fluctuations, providing a more predictable and stable revenue stream compared with short-cycle U.S. onshore work.

Resilience to Tariff Headwinds: Management believes proposed tariff measures would not apply to more than 75% of the company's revenues, which come from services not subject to tariffs. Of the remaining product sales, about half are consumed domestically in the United States and would also not be impacted by export tariffs. This limited exposure provides a layer of insulation against potential trade policy disruptions.

Modest Revenue Growth Trajectory: For the third quarter of 2025, revenues of $134.5 million were essentially flat (0.1% increase) compared with the same quarter last year. While sequential growth is positive, the lack of meaningful year-over-year top-line growth suggests the company is operating in a mature, low-growth environment, which may limit significant earnings expansion in the near term.

Vulnerability to Geopolitical and Macroeconomic Volatility: The ongoing geopolitical uncertainty and macroeconomic pressures could significantly impact Core Lab's performance. TechnipFMC, Halliburton and KLX Energy are all exposed to these same risks, particularly in volatile regions like the Middle East and Latin America. Core Lab’s focus on international markets makes it vulnerable to the same geopolitical factors that have affected these companies in the past, such as sanctions or shifts in global oil production strategies.

Inherent Risks of Forward-Looking Growth Assumptions: Like Halliburton and TechnipFMC, Core Lab’s growth assumptions are based on optimistic projections from industry organizations like the IEA and OPEC+. However, if these projections prove overly optimistic, Core Lab’s expected growth could face similar challenges experienced by KLX Energy during market downturns. The risks of relying too heavily on forecasts without flexibility for rapid market changes are clear in these companies' past performance during economic slowdowns.

Weakness and Seasonal Decline in U.S. Onshore Market: The U.S. frac spread count is trending lower, and the company anticipates the typical year-end seasonal decline in U.S. onshore completion activity. Product sales, which are more tied to North America, were down 6% year over year in third-quarter 2025. This core market softness pressures the Production Enhancement segment, which is projected to see a slight sequential revenue decline in fourth-quarter 2025.

Concentration in the Cyclical Oil & Gas Service Sector: Core Lab’s exposure to the cyclical nature of the oil and gas service sector mirrors that of Halliburton and TechnipFMC, whose fortunes are directly tied to the capital expenditure cycles of the oil and gas industry. KLX Energy, like Core Lab, faces the risk of reduced demand during periods of low commodity prices, reflecting the broader vulnerability of companies heavily concentrated in this volatile sector.

CLB benefits from its alignment with long-term industry trends, a successful acquisition of Solintec and strong ROIC, reflecting its efficiency in capital deployment. Additionally, Core Lab’s focus on high-value international projects and resilience to tariff risks further strengthens its investment case.

However, challenges include modest revenue growth, vulnerability to geopolitical and macroeconomic volatility, and the risks inherent in its reliance on optimistic energy demand projections. A soft U.S. onshore market and exposure to cyclical oil and gas sector fluctuations further complicate its outlook. Given this mix of strengths and potential challenges, investors should wait for a more opportune entry point instead of adding this Zacks Rank #3 (Hold) stock to their portfolios.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 8 hours | |

| 9 hours | |

| 9 hours | |

| 12 hours | |

| 12 hours | |

| 12 hours | |

| Mar-08 | |

| Mar-06 | |

| Mar-06 | |

| Mar-06 | |

| Mar-06 | |

| Mar-06 | |

| Mar-06 | |

| Mar-06 | |

| Mar-06 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite