|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

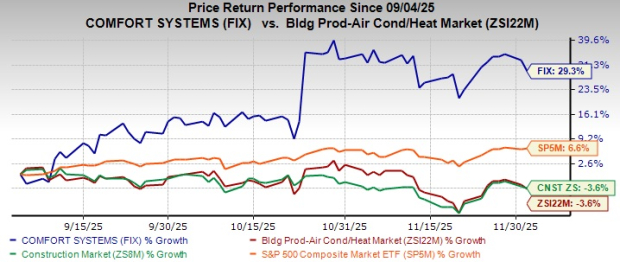

Comfort Systems USA, Inc. FIX rose 29.3% in the past three months, significantly outperforming the Zacks Building Products - Air Conditioner and Heating industry, the Construction sector and the S&P 500 Index.

The company’s prospects are gaining from increased opportunities across large-scale projects, especially for data center and chip manufacturing-related activities. Amid a favorable public spending environment, the declining Fed interest rates are proving to be an additional catalyst in fostering the upward trends. Despite an uncertain macro scenario surrounding tariffs and housing market weakness, FIX’s inorganic efforts, alongside a stable liquidity position, are backing up its prospects in the mid and long terms.

Notably, during the past three months, FIX also outperformed a few of the other market players, including EMCOR Group, Inc. EME, Trane Technologies plc TT and Carrier Global Corporation CARR. During the said time frame, EMCOR, Trance Technologies and Carrier Global tumbled 5.3%, 0.4% and 15.3%, respectively.

Let us dive into understanding the factors that are driving Comfort Systems’ momentum.

Comfort Systems' backlog is witnessing incremental growth because of broad-based strength across technology, industrial and institutional markets, with data centers emerging as the dominant engine of growth. Year-to-date, the Technology sector accounted for about 42% of revenues, up from 32% reported last year, as hyperscale and AI-driven infrastructure projects continue to scale in size and urgency. Besides, the Industrial sector’s work overall represents 65% of revenues, highlighting a robust multi-sector tailwind.

As of the third quarter of 2025, FIX’s backlog of $9.38 billion grew year over year by 65% from $5.68 billion and 15.5% sequentially. Bookings remain exceptionally strong across both traditional construction and modular operations, with modular demand being entirely sold out into early 2026, aided by new automation investments and expanded capacity. Moreover, the company’s opportunities in larger and longer-cycle projects, with a disciplined bidding approach, are paving the path for incremental growth prospects and unprecedented visibility heading into 2026.

Amid a favorable federal and state funding environment, the two back-to-back Fed rate cuts are acting as a catalyst in boosting prospects further. After a 0.25 percentage point rate cut on Sept. 17, 2025, the Federal Reserve again pulled down the interest rate by another 25 basis points on Oct. 29, moving the targeted benchmark between 3.75% and 4.00%. Currently, another rate cut is expected in December 2025, with two more by June 2026 (per Goldman Sachs chief economist Jan Hatzius). This growth optimism happens to run in favor of Comfort Systems, alongside the other market players EMCOR, Trane Technologies and Carrier Global, operating in the commercial and industrial infrastructure markets.

Notably, FIX’s management highlighted that strong pipelines in technology and promising long-term opportunities in pharma and manufacturing are its long-term growth boosters. Moreover, beyond data centers, onshoring, automation investment and manufacturing upgrades are creating sustained demand for mechanical, electrical and modular solutions.

Owing to the strong leverage from top-line growth and favorable market trends, Comfort Systems ended the third quarter of 2025 with cash and cash equivalents of $860.5 million, up from $549.9 million as of 2024. As of the first nine months of 2025, cash provided by operating activities was $717.8 million, up from $638.6 million reported in the year-ago comparable period. The company currently has sufficient liquidity to meet its short-term obligations of $4.7 million.

Apart from maintaining a stable liquidity position, FIX also ensures its shareholders are satisfied through share repurchases and dividend payments. During the first nine months of 2025, it repurchased 0.3 million shares for approximately $125.4 million under the repurchase program. Also, on Oct. 23, 2025, Comfort Systems’ board of directors hiked the quarterly dividend payment by 20% to 60 cents per share ($2.40 per share annually). The dividend is payable on Nov. 24, 2025, to shareholders as of Nov. 13.

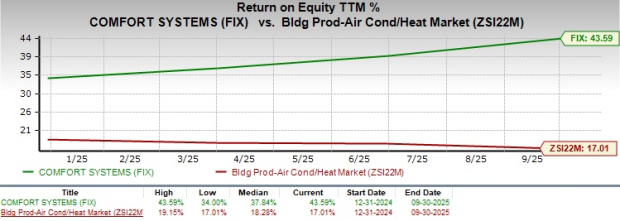

Comfort Systems’ trailing 12-month return on equity (ROE) of 43.6% significantly exceeds the industry’s average, underscoring its efficiency in generating shareholder returns.

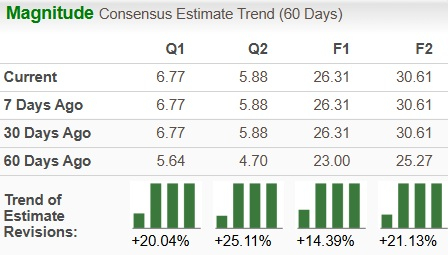

FIX’s earnings estimates for 2025 and 2026 have trended upward over the past 60 days to $26.31 and $30.61 per share, respectively. The estimated figures for 2025 and 2026 imply year-over-year growth of 80.2% and 16.4%, respectively.

The robust market fundamentals and FIX’s strategic initiatives to curb the adverse impacts of macro uncertainties are likely to have induced bullish sentiments among analysts.

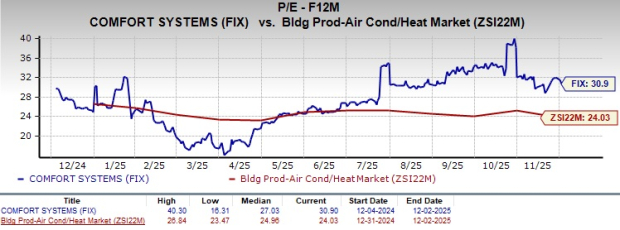

FIX stock is currently trading at a premium compared with the industry peers, with a forward 12-month price-to-earnings (P/E) ratio of 30.9, as evidenced by the chart below.

Comfort Systems continues to strengthen its investment appeal, supported by exceptional project momentum, rising demand in technology and industrial markets, and a favorable macroeconomic backdrop. The company has significantly outperformed its industry and broader market peers, driven largely by explosive growth in data center and chip-related infrastructure work. Federal and state funding tailwinds, combined with consecutive Fed rate cuts and expected further easing through 2026, are amplifying demand across commercial, industrial, and onshoring-related markets, reinforcing FIX’s multi-sector growth runway.

Although FIX stock is currently trading at a premium, the upward earnings estimate trends, with a noteworthy ROE position, point to it as a promising investment choice.

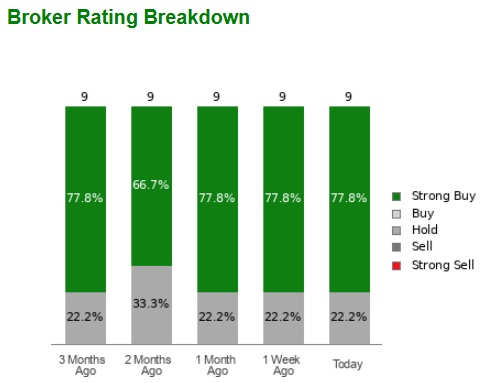

Analysts’ optimism regarding FIX stock is reflected in seven of the nine recommendations, pointing to a "Strong Buy”, representing 77.8% of all recommendations.

Summing up, a superior growth visibility, financial strength and sustained momentum make this current Zacks Rank #1 (Strong Buy) stock an appealing buy for investors now. You can see the complete list of today’s Zacks #1 Rank stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-20 | |

| Feb-20 | |

| Feb-20 |

Blue Collar AI Stock Comfort Systems Jumps On Blowout Earnings, Soaring Backlog

FIX +6.46%

Investor's Business Daily

|

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite