|

|

|

|

|||||

|

|

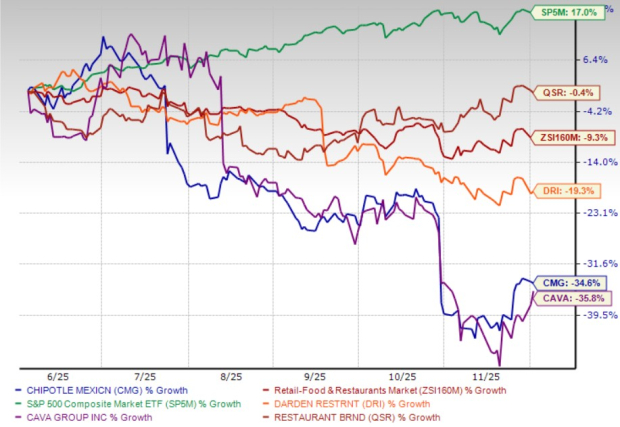

Shares of Chipotle Mexican Grill, Inc. CMG have declined 34.6% in the past six months compared with the industry’s 9.3% decrease. In the same time frame, the S&P 500 has surged 17%, highlighting just how sharply Chipotle has underperformed. The selloff reflects mounting concerns around weakening traffic trends, margin pressures and a stressed core customer base.

A combination of factors has weighed heavily on the stock in recent months. Chipotle has been hit by a broad pullback among several key consumer groups, repeated step-downs in traffic throughout the year and rising inflation that it is choosing not to fully offset with price increases. Operational inconsistencies, particularly in digital order accuracy, and elevated labor and marketing costs have further squeezed margins. Together, these pressures have raised worries about near-term earnings performance and the time it may take for traffic to stabilize and margins to recover.

Shares of other industry players like Darden Restaurants, Inc. DRI, CAVA Group, Inc. CAVA and Restaurant Brands International Inc. QSR have declined 19.3%, 35.8% and 0.4%, respectively.

One of Chipotle's biggest challenges is the broad-based decline in spending among households earning under $100,000, which accounts for about 40% of total sales. Management noted that this segment, already dealing with inflation, unemployment pressures, slower wage growth and the restart of student loan payments, has meaningfully reduced dining frequency. Chipotle is not losing these customers to rival restaurants, but to grocery and food-at-home options, which becomes especially problematic because these consumers form the backbone of its traffic base. The company also over-indexes to the 25-35 age group, another financially strained cohort, which has pulled back substantially.

The transcript reveals a consistent deterioration in underlying traffic throughout the year, with notable step-downs in February, May, August and October. While promotions, higher marketing spend and limited-time offerings helped offset some weakness, the core trajectory remained negative. This repeated softening suggests a tougher macroenvironment rather than a one-off slowdown, raising investor concerns about how long it will take for traffic to stabilize. Management’s guidance for low to mid-single-digit comp declines in the fourth quarter reinforces the near-term risk.

Chipotle faces mid-single-digit inflation due to higher beef costs and new tariffs. While many restaurant peers have pushed through aggressive pricing, Chipotle is intentionally holding back to defend its value positioning. The company expects not to fully offset inflation in 2026, which will compress restaurant-level margins. With the cost of sales expected to creep higher and marketing spend rising to 3% of sales, near-term profitability is under meaningful pressure. Management described this as a “temporary dislocation,” but investors view it as an unavoidable headwind in the upcoming quarters.

Chipotle acknowledged that not all customer experience metrics are where they need to be, especially in digital order accuracy. The company had shifted its incentive structure to emphasize on-time delivery rather than correctness, which unintentionally hurt accuracy scores. Missing items or incorrect digital orders damage repeat intent, particularly since digital represents over one-third of total sales. Management is now redesigning incentives and retraining teams, but the slip in consistency has played a role in softening customer satisfaction.

Labor costs rose due to wage inflation and lower volumes, while other operating costs jumped owing to heavier marketing investments. The company spent heavily to boost engagement and drive traffic through promotions, dips, sauces and the carne asada relaunch. These moves helped, but they also widened cost pressures at a time when comps and margins were already under strain.

Despite near-term headwinds, Chipotle continues to offer a compelling value proposition. Management reiterated that its pricing remains 20-30% below fast-casual peers, while still offering freshly prepared, high-quality meals with generous portions. Even during the slowdown, Chipotle maintained a stable wallet share, signaling consumer loyalty and brand strength. The company believes improved communication of its value — without relying on discounts — will help restore frequency as macro conditions ease.

Chipotle is leaning heavily into menu innovation to stay relevant and attract new guests. New dips and sauces like Adobo Ranch and Red Chimichurri exceeded expectations, lifting transactions and increasing trial of limited-time proteins like carne asada. Management plans to offer three to four LTO proteins in 2026, up from the historical cadence of two per year. Data shows that guests who purchase LTOs tend to return more frequently and spend more over the following year, making innovation a key lever for traffic recovery.

Digital remains a powerful growth engine. Initiatives such as Summer of Extras, Freepotle, Chipotle IQ and the new Chipotle U college rewards program boosted loyalty engagement and helped offset softness in core traffic. Management is now reimagining the rewards platform with more gamification and personalized experiences to bring inactive customers back into the funnel, a proven path to higher frequency.

Chipotle’s long-term growth runway remains intact. The brand expects to open 350-370 restaurants in 2026, expand in Europe and accelerate entry into the Middle East and Asia through partnerships. New units consistently achieve strong returns, and cannibalization remains minimal with quick recovery times. This supports Chipotle’s confidence in reaching 7,000 North American restaurants while building a broader international footprint.

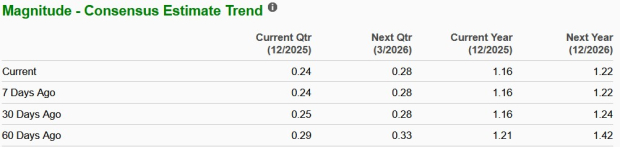

Estimates for CMG’s 2026 earnings have moved down from $1.42 to $1.22 in the past 60 days. The company’s earnings in 2026 are likely to witness year-over-year growth of 4.9%. Then again, Darden Restaurants, Restaurant Brands and CAVA’s earnings for the next year are likely to witness year-over-year increases of 7.1%, 8.5% and 11.6%, respectively.

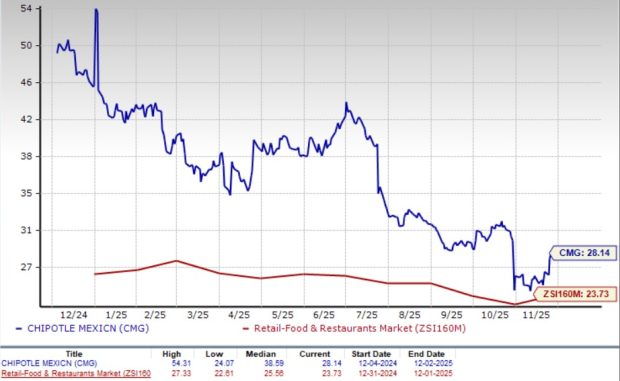

From the valuation point of view, the stock is still trading at a premium despite the recent decline. Chipotle’s forward 12-month price-to-earnings ratio stands at 28.14, higher than the industry’s 23.73 and the S&P 500's 23.41.

Chipotle’s recent performance reflects a company facing meaningful pressure across the core customer base, traffic trends and margins at a time when its valuation remains elevated relative to peers. The broad pullback among its most important consumers, combined with repeated declines in traffic and an unwillingness to fully offset inflation through pricing, suggests a tougher near-term operating backdrop.

Rising costs, operational inconsistencies and weakening customer frequency further cloud the recovery timeline. While the long-term brand story remains intact, the immediate setup points to continued earnings risk and limited support for a sustained rebound. Given these challenges and a valuation that still implies optimism, investors may be better off staying on the sidelines until there is clearer evidence of traffic stabilization, margin recovery and improved momentum in the business.

CMG currently has a Zacks Rank #5 (Strong Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 hour | |

| Feb-28 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 |

Burger King is testing AI headsets that will know if employees say 'welcome' or 'thank you'

QSR

Associated Press Finance

|

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite