|

|

|

|

|||||

|

|

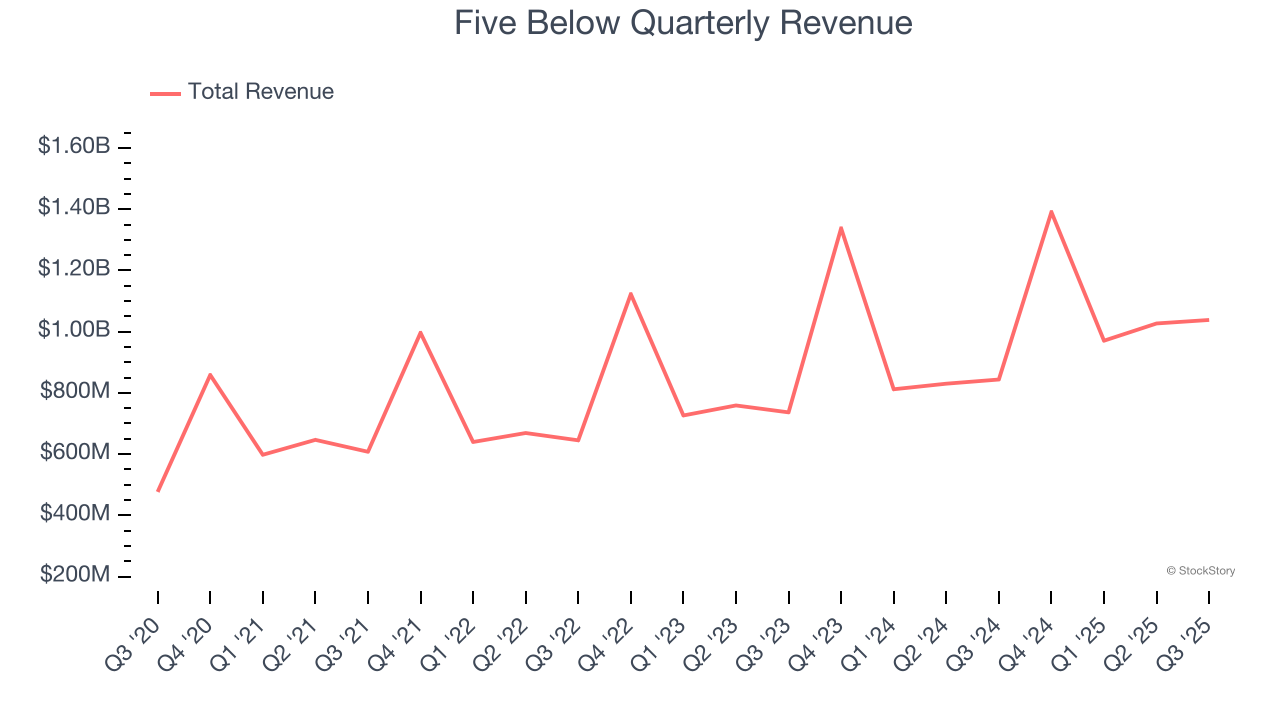

Discount retailer Five Below (NASDAQ:FIVE) beat Wall Street’s revenue expectations in Q3 CY2025, with sales up 23.1% year on year to $1.04 billion. On top of that, next quarter’s revenue guidance ($1.60 billion at the midpoint) was surprisingly good and 3.6% above what analysts were expecting. Its non-GAAP profit of $0.68 per share was significantly above analysts’ consensus estimates.

Is now the time to buy Five Below? Find out by accessing our full research report, it’s free for active Edge members.

Winnie Park, CEO of Five Below, said, "We are thrilled to report third quarter results that surpassed our expectations, marking our second consecutive quarter of over $1 billion in sales and robust double-digit same-store sales growth. This outstanding performance reflects our Crew's great execution of our customer-centric strategy: delivering trend-right merchandise at exceptional value, connecting with our customers through compelling marketing campaigns, and creating amazing shopping experiences that truly resonate.”

Often facilitating a treasure hunt shopping experience, Five Below (NASDAQ:FIVE) is an American discount retailer that sells a variety of products from mobile phone cases to candy to sports equipment for largely $5 or less.

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul.

With $4.43 billion in revenue over the past 12 months, Five Below is a small retailer, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage with suppliers. On the bright side, it can grow faster because it has more white space to build new stores.

As you can see below, Five Below’s sales grew at a solid 14.5% compounded annual growth rate over the last three years (we compare to 2019 to normalize for COVID-19 impacts) as it opened new stores and increased sales at existing, established locations.

This quarter, Five Below reported robust year-on-year revenue growth of 23.1%, and its $1.04 billion of revenue topped Wall Street estimates by 6.7%. Company management is currently guiding for a 14.7% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 8.6% over the next 12 months, a deceleration versus the last three years. Still, this projection is noteworthy and suggests the market is baking in success for its products.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

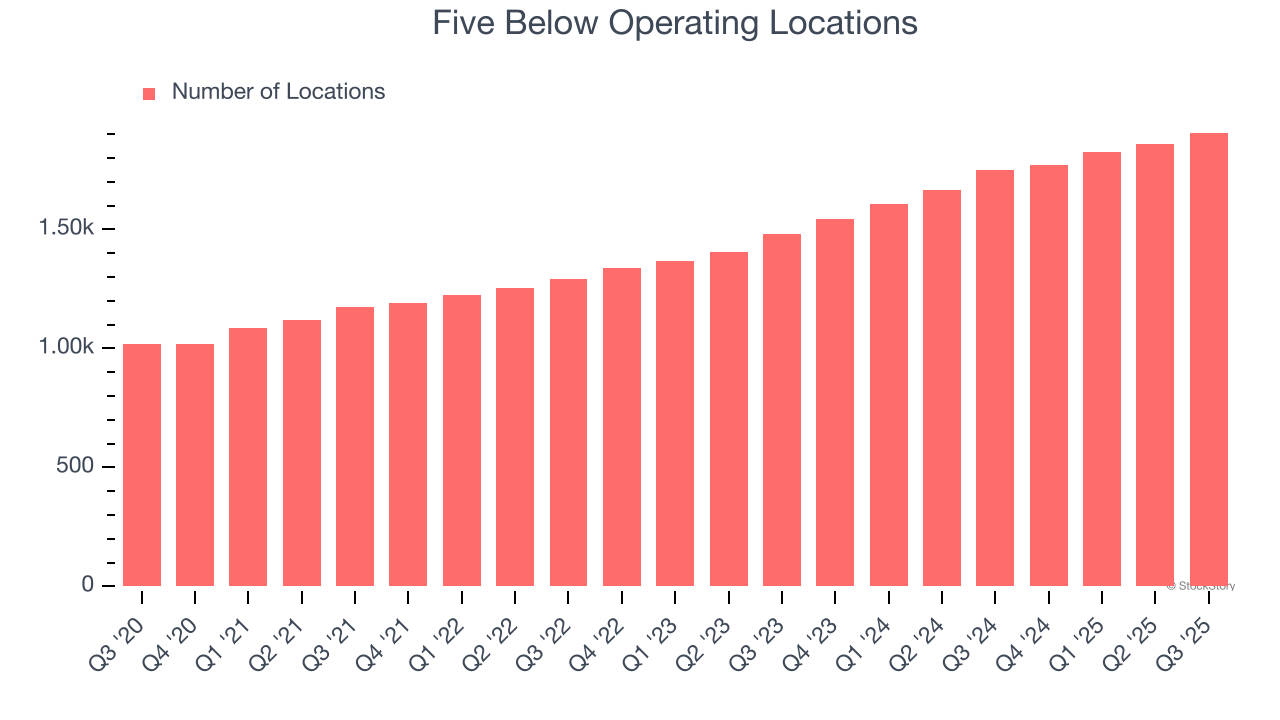

Five Below operated 1,907 locations in the latest quarter. It has opened new stores at a rapid clip over the last two years, averaging 14.8% annual growth, much faster than the broader consumer retail sector. This gives it a chance to scale into a mid-sized business over time.

When a retailer opens new stores, it usually means it’s investing for growth because demand is greater than supply, especially in areas where consumers may not have a store within reasonable driving distance.

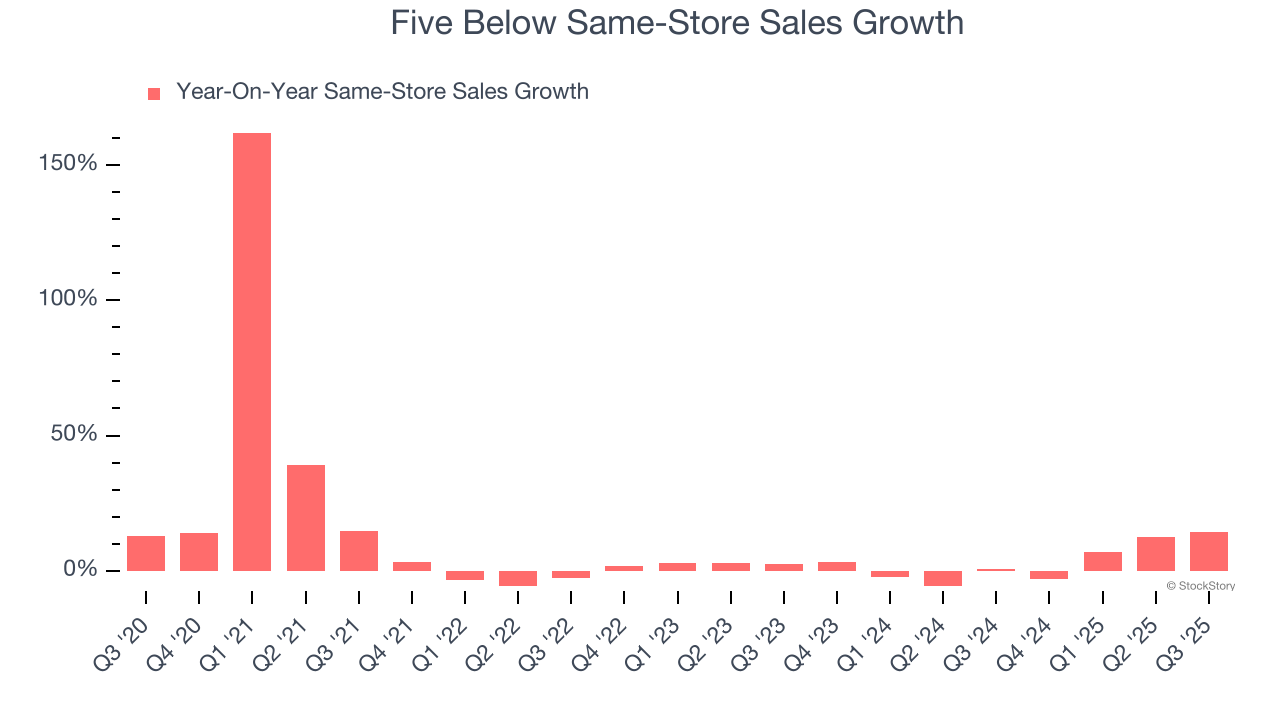

A company's store base only paints one part of the picture. When demand is high, it makes sense to open more. But when demand is low, it’s prudent to close some locations and use the money in other ways. Same-store sales is an industry measure of whether revenue is growing at those existing stores and is driven by customer visits (often called traffic) and the average spending per customer (ticket).

Five Below’s demand has been spectacular for a retailer over the last two years. On average, the company has increased its same-store sales by an impressive 3.3% per year. This performance along with its meaningful buildout of new stores suggest it’s playing some aggressive offense.

In the latest quarter, Five Below’s same-store sales rose 14.3% year on year. This growth was an acceleration from its historical levels, which is always an encouraging sign.

We were impressed by Five Below’s optimistic EPS guidance for next quarter, which blew past analysts’ expectations. We were also glad its EPS outperformed Wall Street’s estimates. Zooming out, we think this quarter featured some important positives. The stock remained flat at $164.59 immediately following the results.

Five Below had an encouraging quarter, but one earnings result doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.

| Feb-13 | |

| Feb-11 | |

| Feb-10 | |

| Feb-09 | |

| Feb-09 | |

| Feb-05 | |

| Feb-04 | |

| Feb-04 | |

| Feb-04 | |

| Feb-03 | |

| Feb-02 | |

| Feb-02 | |

| Feb-02 | |

| Jan-29 | |

| Jan-28 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite